Mekari Insight

- Business travel is important and can generate real business value, but without clear policies, budgeting strategies, and oversight, even routine trips can quietly drain your operating costs.

- Optimizing travel expenses is about improving control. From per diem limits to policy enforcement and approval flows, companies that implement smarter processes are better positioned to manage travel spend proactively.

- Mekari Expense helps businesses centralize all travel and expense activities in Business Trip feature. With automated controls, claim tracking, policy-based limits, and scheduled reimbursements, companies can reduce leakage, boost compliance, and plan future trips with confidence.

Business trips are essential for closing deals, strengthening partnerships, and building team connections. But they can also become a silent drain on your budget if not managed properly.

So how do smart companies keep travel productive and cost-efficient?

Here are 10 proven ways to control business travel expenses without cutting corners, so every trip brings value, not just receipts.

Business travel cost based on data

Business travel costs vary depending on the employee’s role and awareness of travel policies. Here’s a breakdown of the average business travel costs and spending categories:

- Average trip cost: Non-senior employees spend around $1,771 per trip, while decision-makers spend more, about $1,986, due to tighter schedules and premium needs.

- Policy awareness matters: 45% of decision-makers know their policy includes medical care and insurance, compared to just 32% of other employees. This knowledge often leads to more confidence, and sometimes higher spending.

- Out-of-pocket spend: Employees typically pay $700 from their own pocket per trip, with most spent on dining (63%), followed by entertainment (57%) and tips (55%).

- Cost breakdown by category: Business trip costs are generally divided as follows:

- Accommodation: 34%

- Airfare: 27%

- Meals: 20%

- Ground transport: 19%

Accommodation remains the biggest cost driver, making it a key area for potential savings.

2 budgeting methods to control business travel expenses

Business travel is often a significant operational cost, especially for companies that rely on face-to-face meetings, conferences, or client visits.

One of the most effective ways to keep these costs in check is by applying the right budgeting method to each trip. Two common approaches are dynamic budgeting and hard cap budgeting.

1. Dynamic budgeting

This method adjusts travel budgets using real-time market data and past trip benchmarks. It’s more flexible and data-driven, allowing businesses to:

- Set realistic budgets tailored to current pricing trends

- Forecast expenses more accurately before the trip

- Customize expense policies for different types of trips

- Identify cost-saving opportunities through regular benchmarking

Although dynamic budgeting requires more effort and tools, it offers greater precision and long-term savings potential.

2. Hard cap budgeting

In contrast, hard cap budgeting sets a fixed spending limit per trip. This method is:

- Simpler to manage and enforce

- Effective in keeping average travel costs low

- Useful for promoting frugality and cost discipline

However, it can be too restrictive. The fixed cap must be reviewed frequently to stay aligned with market changes (e.g. airfare increases). Without regular updates, it can lead to unrealistic constraints that affect trip quality or employee satisfaction.

10 ways to optimize business travel cost

Business travel is one of the most unpredictable and costly areas of operational spending. Flights, hotels, meals, and ground transportation can quickly add up, especially without proper control mechanisms.

Below are 10 practical strategies to reduce unnecessary spend while still ensuring productive and comfortable trips for your team.

1. Simplify and clarify your travel policy

Cost-effective business travel starts with a clear travel policy. If employees are confused about what’s allowed and what’s not, they’re more likely to overspend or make decisions that don’t align with company goals.

A simplified policy should:

- Clearly outline what types of expenses are reimbursable

- Define spending limits per category (e.g., hotel stars, daily meal budgets)

- List preferred vendors or booking channels

- Explain how to request, approve, and report business trips

The easier it is to understand and follow the policy, the higher your compliance rate, and the lower your risk of surprise costs.

Example: Instead of saying “Choose reasonably priced accommodation,” be specific: “Book a hotel up to $100/night or equivalent 3-star rating.”

Read more: Business Trip Policy Sample & Best Compliance Tools2. Set per diem limits and travel spending caps

Giving travelers daily allowances or hard limits per expense category helps create predictability and accountability. This approach not only controls costs but also eliminates guesswork for employees.

How to do it effectively:

- Set per diem rates for meals, lodging, and ground transport

- Adjust limits based on travel destination (domestic vs. international, city vs. rural)

- Use real data from previous trips or third-party benchmarks

- Integrate caps into booking or expense tools so overages trigger alerts

This method protects your budget while still giving travelers enough flexibility to make reasonable choices.

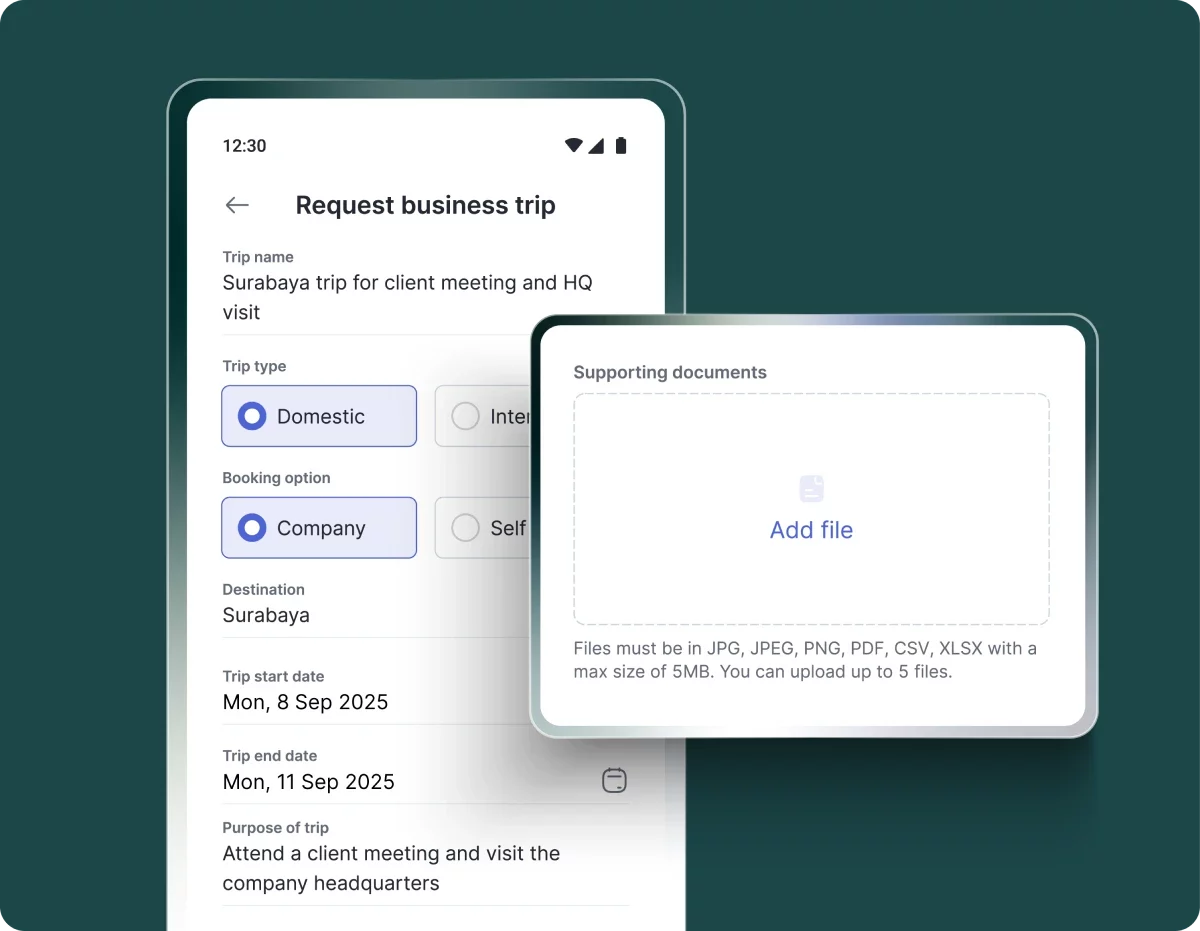

Read more: Company Expense Policy Guideline: How to Create & Start Easily3. Implement advance booking and pre-trip approval

One of the most overlooked cost-saving strategies is simply booking earlier. Last-minute bookings usually come with inflated prices and limited options.

To optimize:

- Require employees to submit trip requests at least 2 weeks in advance

- Designate approvers based on department or spend level

- Use a digital system to streamline the approval workflow and reduce delays

- Set approval thresholds (e.g., trips over $500 require manager approval)

By setting expectations and adding a layer of oversight, you reduce impulsive bookings and can better plan for cost-efficient travel.

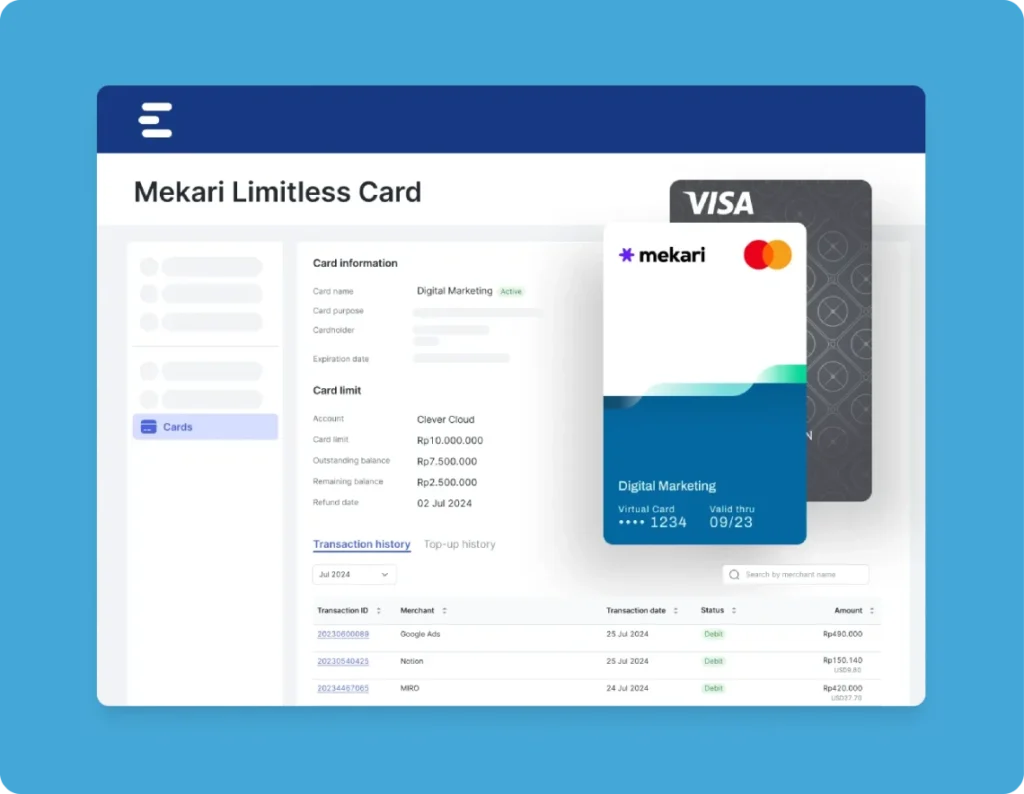

4. Use corporate cards to centralize travel spend

Corporate credit cards give finance teams better visibility into where the money is going and reduce the need for messy reimbursements.

Benefits of using corporate or virtual cards:

- Consolidated expense tracking across all trips

- Easier reconciliation with automatic transaction logging

- Customizable limits by employee, category, or vendor

- Enhanced benefits like fraud protection, lounge access, and insurance

Virtual cards are especially useful for temporary use, like a one-off hotel stay or conference fee, helping control spending without handing over full access.

Read more: Top Benefits of Business Travel Expense Card & Recommendation5. Negotiate with airlines, hotels, and car rental vendors

Even small to mid-sized businesses can leverage vendor relationships for cost savings. If your company travels regularly, even just a few times per month, you have bargaining power.

Tips for effective negotiation:

- Present your annual travel volume and projected spend

- Ask for discounted rates or corporate loyalty benefits

- Bundle services (e.g., hotel + car rental) for better deals

- Revisit contracts yearly to renegotiate based on usage

This not only reduces your per-trip cost but can also unlock perks like flexible cancellation, room upgrades, or priority service.

6. Speed up reimbursement approvals and feedback loops

Delays in expense approvals create frustration, backlog, and sometimes even discourage employees from reporting smaller claims. Worse, delayed reporting can lead to cost leakages or fraudulent claims slipping through.

To prevent this:

- Set internal deadlines for reviewing and approving reimbursements (e.g., 3–5 days)

- Automate status notifications so employees know where things stand

- Collect feedback after trips to improve future policies or vendor choices

When the reimbursement experience is fast and seamless, employees are more likely to comply with policies and report expenses accurately.

Read more: Expense Reimbursement Guide: Best Practices and Solutions7. Automate expense reporting and digitize receipt collection

Manual expense reporting is time-consuming and prone to errors. Switching to an automated system not only saves time but improves policy enforcement and accuracy.

Key steps:

- Use mobile apps that allow employees to scan and submit receipts in real-time

- Auto-categorize expenses based on vendor or amount

- Integrate with accounting software to streamline reconciliation

- Reduce manual entry and eliminate paper trails

By automating these steps, your finance team can shift focus from processing forms to analyzing and improving spend.

8. Categorize, train, and benchmark employee expense behavior

Even the best policy will fail if employees don’t understand or follow it. Training and ongoing benchmarking help build a culture of responsible spending.

Best practices:

- Offer quick policy refreshers during onboarding or before peak travel seasons

- Clearly label expense categories in your systems to reduce confusion

- Compare your company’s spend to industry standards to spot areas of overspending

- Reward teams that consistently stay within budget or optimize travel choices

Informed employees make smarter decisions, and that drives savings across the board.

9. Measure, forecast, and optimize supplier contracts and tax strategies

You can’t improve what you don’t track. Establish KPIs and forecasting tools to monitor business travel performance and identify areas for optimization.

Metrics to track:

- Average cost per trip

- Booking compliance rate

- Expense approval timelines

- Most used (and underused) vendors

Additionally, revisit supplier contracts regularly, and consult tax professionals to ensure you’re making the most of deductible expenses or allowances for business travel.

10. Use travel & expense (T&E) management software

Managing business travel manually is time-consuming and error-prone. A reliable T&E system helps you streamline the entire process, from trip planning to reimbursement, with greater control and visibility.

Look for systems that allow you to:

- Submit expense claims or cash advance requests with relevant details and supporting documents

- Break down claims into subcategories and multiple items for better accuracy

- Track claim progress through clear status stages (e.g., submitted, approved, reimbursed)

- Allow approvers to review, adjust, and leave comments when needed

- Enable communication between employees and approvers within the system

- Apply policy rules automatically, including spending limits and approval chains

- Schedule reimbursements for faster and more predictable payouts

With these features, businesses can cut administrative workload, ensure policy compliance, and gain full visibility over travel spending.

Read more: Top 5 Business Travel & Expense Management SoftwareBest travel & expense management software

To truly optimize business travel costs, having the right tools in place is just as important as having the right policy. A smart Travel & Expense (T&E) management system helps you gain real-time visibility, improve control, and manage budgets more predictably.

One solution that checks all the boxes is Mekari Expense, a spend management software with the best travel & expense management feature, built to simplify every aspect of business travel.

Why Mekari Expense stands out:

- Centralizes all travel spending in one easy-to-use platform

- Gives real-time visibility into claims, approvals, and policy compliance

- Sets clear budget controls to help avoid overspending

- Automates approval workflows for faster, error-free processing

- Reduces fraud risk by eliminating manual handling and untracked expenses

- Supports advance requests and reimbursements with flexible reporting

- Makes future planning easier with data-backed travel insights

By using Mekari Expense, companies can manage travel budgets with confidence, eliminating blind spots, enforcing policies automatically, and streamlining the entire reimbursement experience.