Mekari Insight

- No more paperwork or long waits—remittance software lets businesses send money instantly, securely, and at lower costs worldwide.

- Not all money transfer apps are the same. Compare fees, security, and features to find the best fit for your needs.

- The right software tracks, automates, and secures your payments, helping businesses save time and money.

Sending money internationally for business purposes used to involve lengthy processes, high costs, and complex procedures. Today, thanks to innovative international money remittance software, businesses can streamline cross-border transactions with ease.

Whether it’s paying suppliers, transferring funds between global offices, or managing international payroll, these digital platforms offer secure, fast, and cost-effective solutions.

With numerous options available, choosing the right international remittance software can be challenging. Our guide compares key features and top providers to help simplify your global business payments. Read on to find your perfect solution.

What is international remittance?

International remittance refers to the process of sending money from one country to another, typically by individuals who are working or living abroad and want to support their families back home.

This transfer can be made through various channels, such as banks, online platforms, or money transfer services.

A money remittance software plays a key role in this process by providing a digital platform for sending, receiving, and tracking funds across borders in a secure, fast, and efficient manner.

It allows users to transfer money directly from one account to another, often with lower fees and quicker processing times compared to traditional methods.

International remittance software functions

International remittance software transforms global payments by offering an easy, fast, and secure way to transfer funds.

Whether you’re paying overseas vendors, managing international payroll, or sending money to family abroad, these platforms cater to your diverse needs:

- Easy transaction initiation: Send money effortlessly through web portals, intuitive mobile apps, or in-person agent locations.

- Seamless currency conversion: Automatically convert funds from your currency to the recipient’s local currency, ensuring accuracy and convenience.

- Real-time transaction tracking: Stay updated with real-time tracking to monitor the exact status and progress of your transfers, from start to finish.

- Enhanced security and compliance: Robust safety measures keep your funds secure and compliant with international financial regulations.

- Competitive rates & transparency: Clearly see fees and exchange rates upfront, ensuring you get the best value for every transfer.

Considering multiple providers? Explore our detailed comparison to find software tailored specifically to your needs.

Money remittance software at a glance

Choosing the right remittance and money transfer platform is essential for efficient, secure, and cost-effective international transactions. Here are some of the top remittance services and their key features, offering unique benefits for various user needs:

| App | Fees | Transfer Speed | Supported Countries | Security Features | Special Features |

|---|---|---|---|---|---|

| Mekari Expense | Starts from Rp50.000 | Real-time tracking of international transfers | 40+ countries in 15+ currencies | Bank-level encryption, multi-factor authentication, fraud prevention, secure integration, automatic backups | Regular updates on exchange rates, integration with accounting software, automated transaction reconciliation, efficient vendor management |

| PayPal | Fees vary based on transaction and country | Instant to a few business days | Over 200 countries | Strong buyer and seller protection policies, robust fraud prevention measures | Intuitive mobile application, integration with various online platforms |

| Remitly | Express (higher fee) or Economy (lower fee) | Express: minutes; Economy: 3-5 business days | 100+ countries | 24/7 customer support, secure transactions | Multiple delivery options: cash pickup, bank deposit, mobile wallets |

| WorldRemit | Fees vary by transfer method and destination | Instant to same-day | 130+ countries | Bank-level encryption, multi-factor authentication | Multiple payout options: bank deposit, cash pickup, mobile money |

| Xoom (by PayPal) | Fees vary based on payment method and amount | Minutes to a few days | 160+ countries | Advanced security protocols, fraud monitoring | Various payout methods: bank deposit, cash pickup, bill payment services |

| Remitbee | Low to zero fees depending on transfer amount | Minutes to 1 business day | Focused on specific corridors, particularly Canada. | Secure transactions, regulatory compliance | Competitive exchange rates, referral incentives, bill payment services |

| Ria Money Transfer | Fees vary based on amount and destination | Minutes to 3 business days | 160+ countries | Secure transactions, fraud detection systems | Extensive agent network, multiple payout options, loyalty rewards program |

| Western Union | Fees vary based on transfer details | Minutes to several days | Over 200 countries | Compliance with global regulations, fraud detection | Extensive global network, multiple payout methods, mobile app for transfers |

| MoneyGram | Fees vary based on amount and destination | Minutes to a few hours | 200+ countries | Encryption and fraud prevention measures | Multiple delivery options, online and in-person transfers, loyalty programs |

| Wise (formerly TransferWise) | Transparent fees shown upfront | 0-2 business days | 80+ countries | Two-factor authentication, secure transactions | Real exchange rates, multi-currency accounts, integration with accounting software |

1. Mekari Expense

Mekari Expense is a convenient and powerful app that simplifies the management of international transactions and business expenses. Designed with user-friendly features, it ensures each transaction is secure, transparent, and efficient.

Key features:

- Real-time tracking of international money transfers.

- Instant access to detailed transaction reports anytime, anywhere.

- Regular updates on exchange rates, IDR conversion rates, and transfer cut-off times.

- Easy international transfers to 40+ countries in 15+ currencies, including SGD, USD, and EUR.

- Customizable payment approval processes aligned with your company’s policies.

- Efficient vendor management with a comprehensive domestic and international vendor database.

- Automatic integration with Mekari Jurnal for seamless accounting accuracy and reduced manual input.

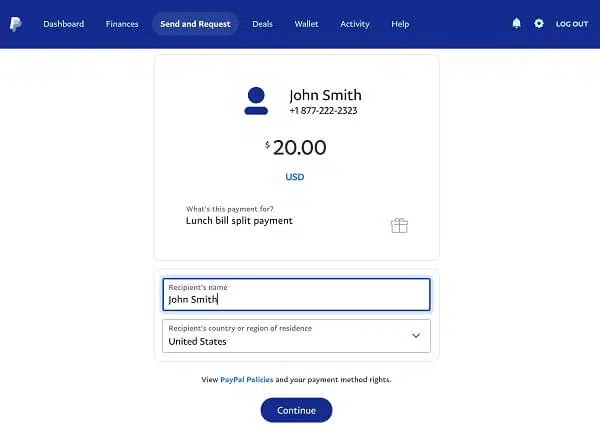

2. PayPal

PayPal is a globally recognized digital payment platform, known for its secure transactions, user-friendly experience, and extensive international reach, catering effectively to both personal and business needs.

Key features:

- Available in over 200 countries

- Strong buyer and seller protection policies

- Intuitive and user-friendly mobile application

- Robust security measures to prevent fraud

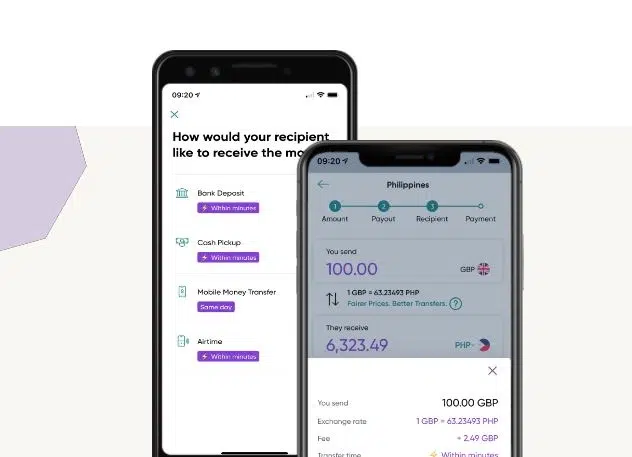

3. Remitly

Remitly specializes in providing flexible transfer solutions, ideal for users needing both speed and affordability, complemented by versatile delivery options.

Key features:

- Choose between Express (fast) or Economy (cost-effective) transfers

- Supports cash pickup, direct bank deposits, and mobile wallets

- Dedicated 24/7 customer support

- Competitive exchange rates and transparent pricing

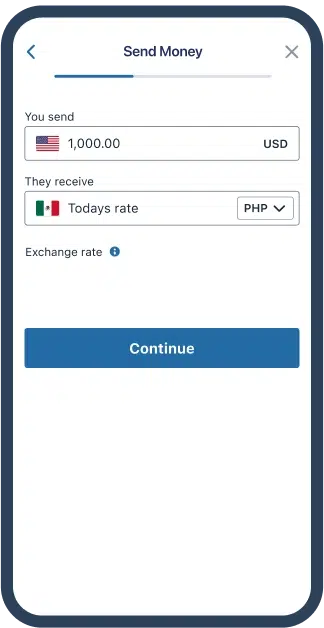

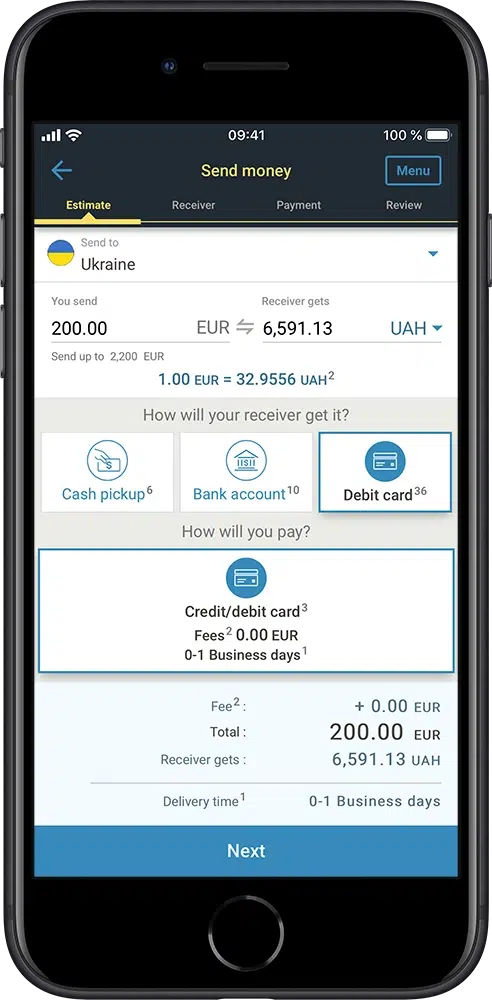

4. WorldRemit

WorldRemit is an innovative remittance service tailored to accommodate diverse recipient preferences with instant transfer capabilities, ensuring users enjoy a versatile and efficient transaction experience.

Key features:

- Multiple payout options: bank deposits, cash pickups, and mobile money

- Instant transaction capability

- Attractive and competitive exchange rates

- Simple, easy-to-use online interface

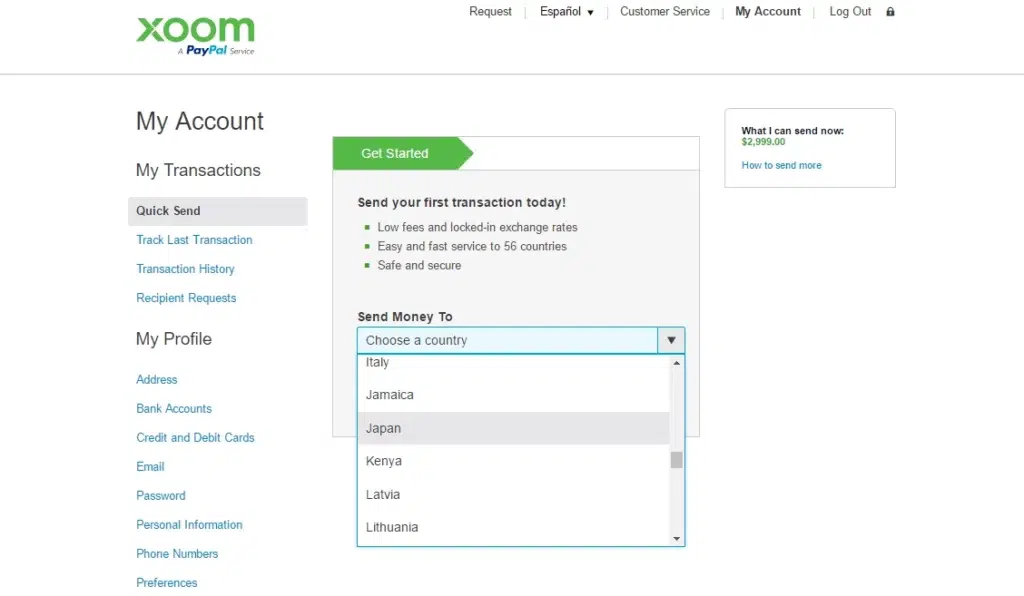

5. Xoom (by PayPal)

Xoom, powered by PayPal, focuses on rapid transfers complemented by detailed transaction tracking, perfect for users who value speed and security.

Key features:

- Swift transaction completion

- Various payout methods including home delivery and cash pickup

- Comprehensive real-time tracking of transfers

- Advanced security protocols to safeguard your transactions

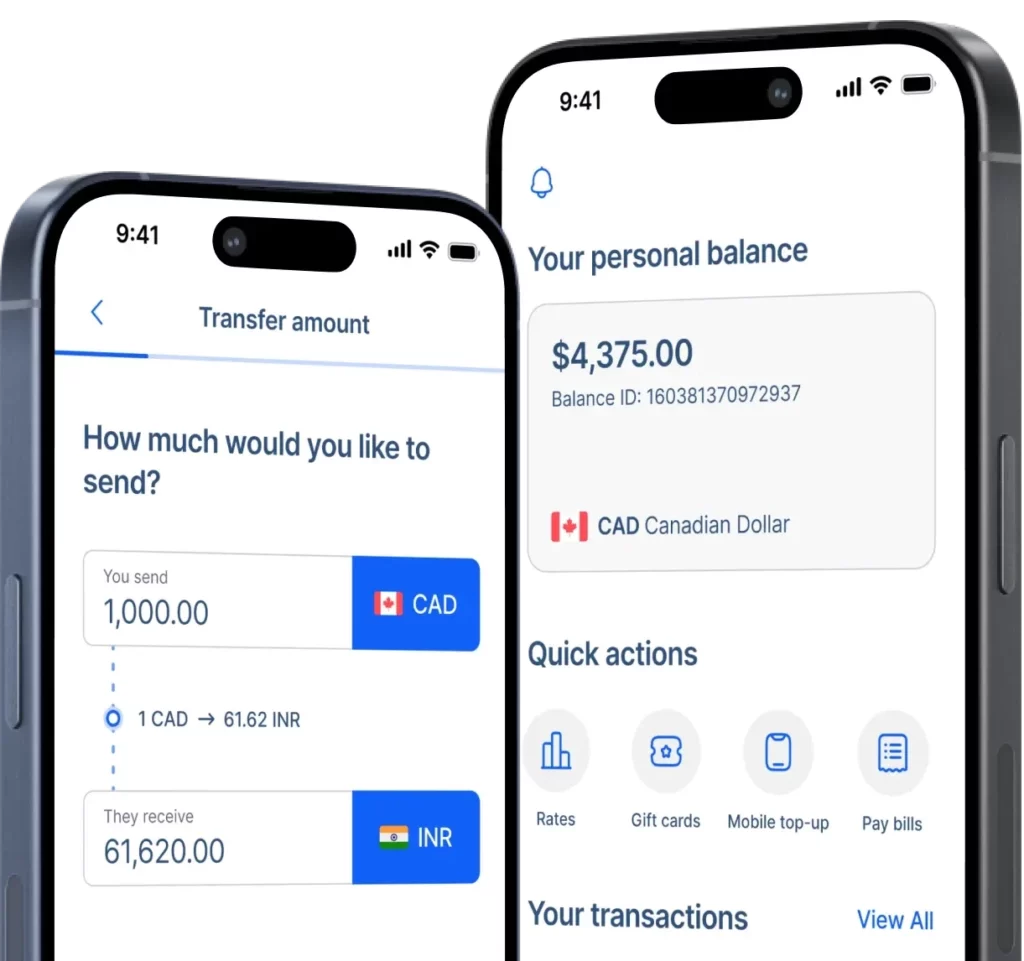

6. Remitbee

Remitbee offers an excellent balance of affordability, speed, and rewards, making it a compelling choice for frequent international money senders.

Key features:

- Highly competitive exchange rates

- Delivery options include instant bank deposits and mobile money transfers

- Referral incentives to reward frequent users

- Fast and reliable service

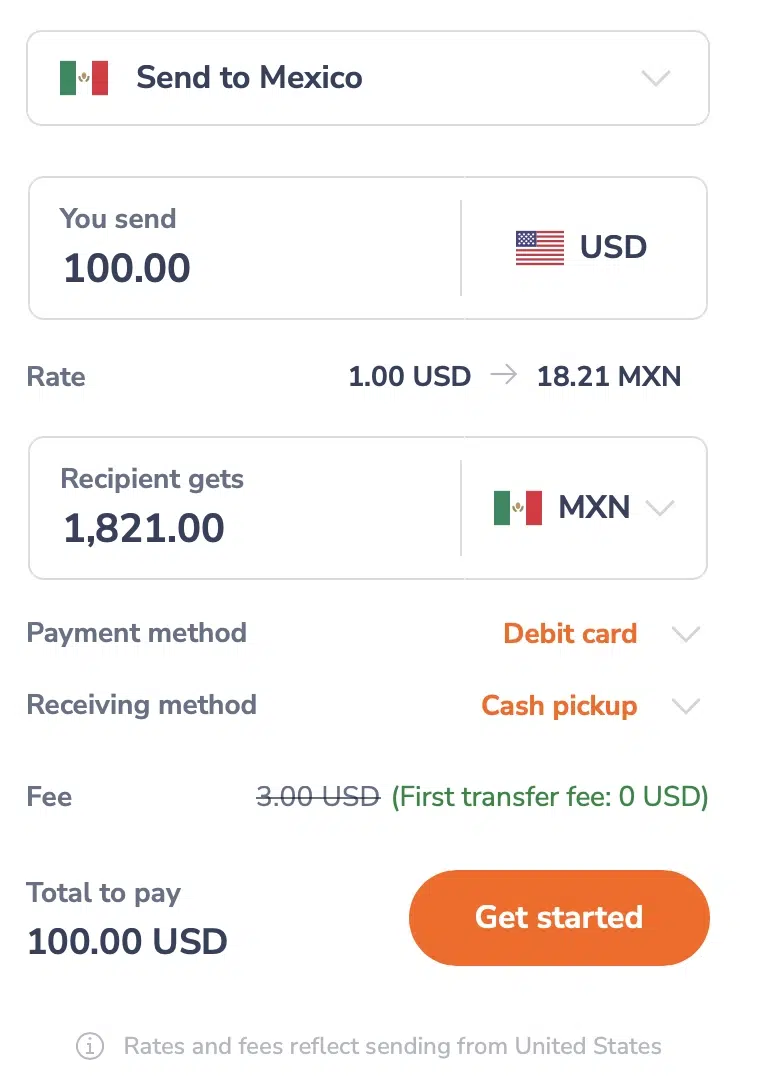

7. Ria Money Transfer

Ria Money Transfer stands out with its extensive global network, affordable rates, and loyalty incentives, catering to users looking for broad international coverage and convenience.

Key features:

- Extensive worldwide agent network

- Cost-effective fees and competitive rates

- Multiple payout choices for convenience

- Loyalty rewards program for repeat customers

8. Western Union

Western Union, renowned globally, is synonymous with secure, fast, and reliable international money transfers, boasting an extensive network of agents worldwide.

Key features:

- Extensive global network with thousands of agents

- Fast transaction processing with many instant transfer options

- Multiple payout methods, including cash pickup and mobile transfers

- User-friendly mobile and online platforms

9. MoneyGram

MoneyGram offers rapid and dependable international money transfers backed by an extensive global network and dedicated customer service.

Key features:

- Wide-ranging global presence

- Rapid transaction completion often within minutes

- Flexible delivery options including bank deposits, cash pickups, and mobile money

- Around-the-clock customer service availability

Explore these leading remittance and money transfer platforms and select the one best suited to your individual or business requirements.

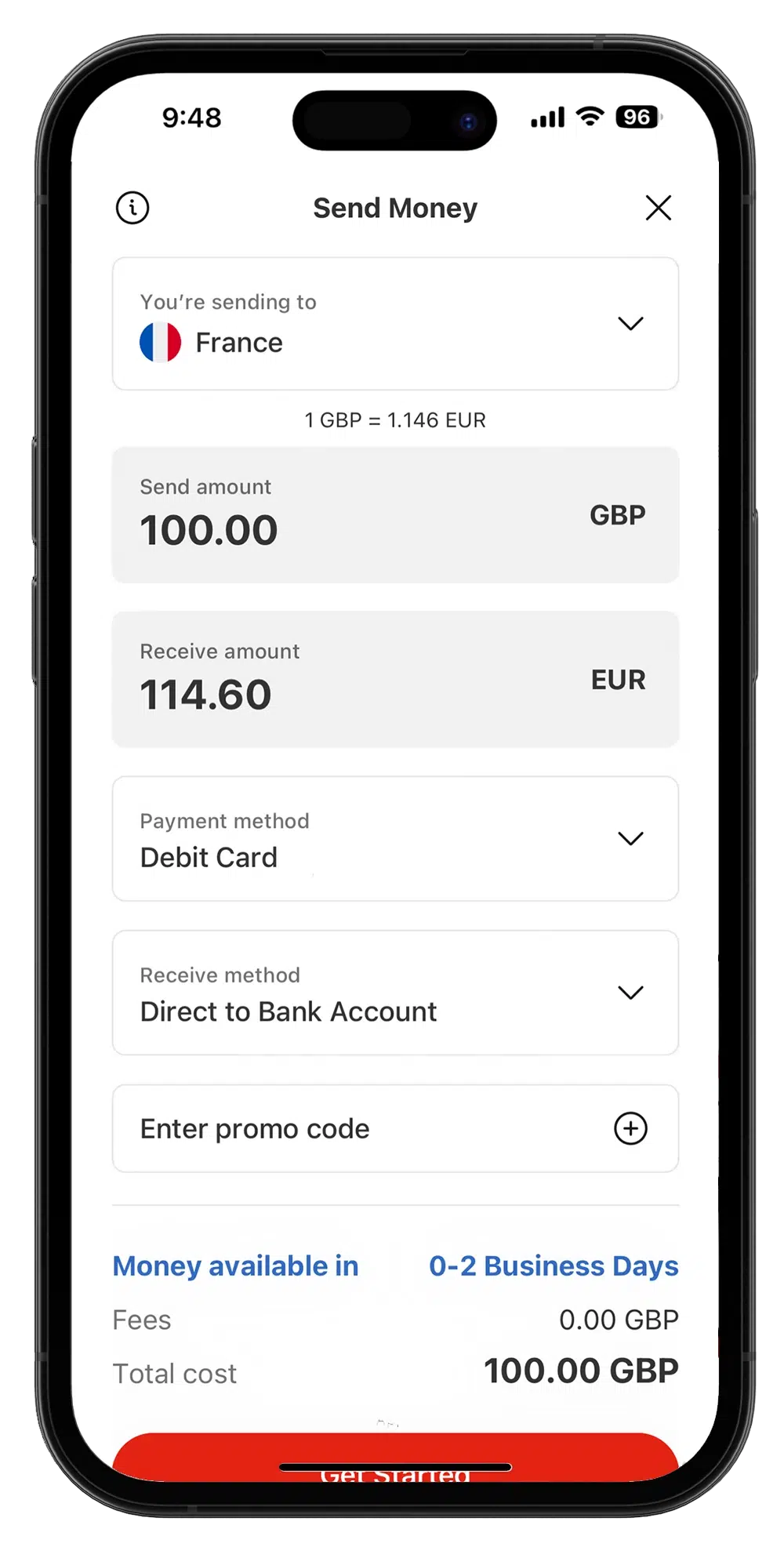

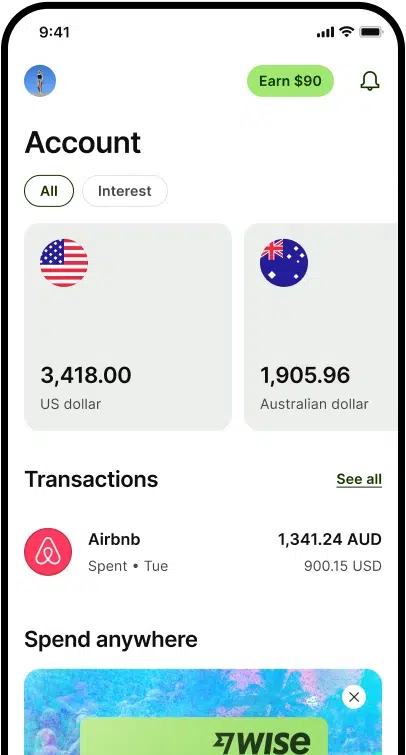

10. Wise (formerly TransferWise)

Wise emphasizes transparency and affordability, making it ideal for individuals and businesses aiming for cost-effective and clear international transfers.

Key features:

- Clearly visible fees with no hidden charges

- Real-time, competitive exchange rates

- Multi-currency account to manage and convert currencies easily

- Rapid transfer processing for quick transactions

- Smooth integration with existing banking apps

Key features to consider in international remittance software

When selecting the best international remittance software, it’s important to consider several factors that directly impact the efficiency, cost, and security of your transfers.

Here are the key features to focus on when choosing a remittance app:

1. Global coverage & currency support

One of the most crucial aspects of an international money transfer app is its global reach. The more countries and currencies it supports, the easier it will be to send money without running into unexpected fees or issues.

An app with broad coverage ensures your funds arrive quickly and reliably, no matter where they’re going.

2. Flexible transfer methods

A good remittance app should offer various transfer options, each suited to different needs.

- Debit or credit card payment might be the best choice if time is critical, as transfers are often instant

- Direct debits can be a cost-effective option if you’re not in a rush, taking a few business days to process.

- Wire transfers, meanwhile, are ideal for larger sums and typically clear within 1-2 business days.

Having the flexibility to choose the right method for each situation can save you time and money.

3. Security

Your financial data is valuable, and the safety of your transfer should be a top priority. Look for remittance apps with strong security features like bank-level encryption and multi-factor authentication.

These measures ensure that your hard-earned money stays safe throughout the entire transaction process. With enhanced security, you can send funds with confidence, knowing that your information is well-protected.

4. Fees and exchange rates

Fees and exchange rates can make or break your transfer, as small discrepancies can add up quickly. It’s important to choose an app that offers transparent pricing, so you know exactly what you’re paying and how much the recipient will receive.

Some platforms may offer low fees but offset them with less favorable exchange rates. Apps like Xe provide clear visibility into the full cost of the transfer, making it easier to plan and budget for your transactions.

5. Ease of use & convenience

Lastly, user experience matters a lot when you’re sending money internationally. A well-designed app that is intuitive to navigate can simplify the process and save you valuable time.

Features like saved recipients, automatic currency conversion, transfer tracking, and alerts for exchange rate fluctuations enhance the overall experience. With an easy-to-use interface, you can send funds quickly and efficiently without unnecessary complications.

Benefits of using international remittance software

Selecting the right money transfer software simplifies international transactions, making life easier for businesses and individuals alike. Here are key reasons why choosing the right software matters:

1. Cost-effectiveness and transparency

Reliable software clearly displays fees and exchange rates upfront, allowing you to transfer money internationally without hidden charges, ensuring you always get the best value.

2. Security and compliance for peace of mind

Trustworthy software protects your personal and financial data through advanced encryption, multi-factor authentication, and adherence to regulatory standards (AML and KYC). This guarantees each transfer remains secure and worry-free.

3. Easy integration and automatic reconciliation with accounting software

For businesses, remittance software that integrates directly with accounting systems streamlines financial management by automatically syncing transaction data.

This integration eliminates the need for manual data entry and ensures transactions are automatically reconciled, saving time and minimizing errors in accounting processes.

4. Fast transfers and convenient user experience

The best software solutions offer quick, often same-day or instant transfers, minimizing delays and eliminating unnecessary stress. A simple, user-friendly interface further streamlines this process, allowing hassle-free money transfers.

5. Extensive global reach

Opting for software that connects with a broad network of banks and financial institutions ensures you can reliably send and receive money from nearly anywhere in the world—expanding your possibilities and removing geographical barriers.

The fastest way to send money internationally

Mekari Expense simplifies international money transfers by offering key features tailored for business efficiency:

- Instant transfer speeds: Funds reach recipients within minutes, allowing swift transactions without delays.

- Integration with accounting software: Automatically synchronizes transaction data, simplifying bookkeeping and financial reconciliation.

- Expense management integration: Easily manages, tracks, and reconciles business expenses, minimizing manual work.

- Low transfer fees: Provides competitive rates, reducing costs associated with international transfers.

With Mekari Expense, businesses can effortlessly streamline their international transactions, save time, and reduce operational costs.

Explore Mekari Expense to experience seamless international transfers today: simplify your payments, save costs, and enhance your business productivity.

References

10XSheets. ”9 Best Remittance and Money Transfer Software in 2025”

Xe. ”The Best International Money Transfer Apps in 2024”