Mekari Insight

- Get ahead in Indonesia by choosing the right business entity—whether it’s PT PMA or other business entities—ensuring legal compliance from day one.

- Build strong, trust-based relationships and respect local hierarchy to succeed in Indonesia’s unique business culture. Patience and politeness go a long way!

- Indonesia’s island-based geography can complicate logistics. Embracing smart solutions can streamline your supply chain and deliver efficiently across the archipelago.

Indonesia, with its 276 million people, is the largest economy in Southeast Asia, offering an immense and growing domestic market. Doing business in this dynamic country presents incredible opportunities for foreign investors looking to expand into the ASEAN region.

However, success business expansion in Indonesia requires a clear understanding of its unique business environment—ranging from foreign investment regulations to local market trends and cultural practices.

In this article, we outline the 10 essential things you need to know before doing business in Indonesia, helping you navigate the country’s economic landscape and build a strong foundation for your business.

1. Foreign investment regulations

Indonesia offers a range of business entities available for foreign investors, each with its own benefits and regulations. Whether you’re looking for a full investment setup or a lower-commitment entry option, it’s essential to understand your choices.

Importantly, any foreign business intending to operate in Indonesia must register under one of these entities to ensure legal compliance.

PT PMA, Representative Office, and Subsidiary Office

Foreign investors have several options when doing business in Indonesia:

- PT PMA (Penanaman Modal Asing): The PT PMA is the most common choice for foreign investors. This entity allows foreign ownership and the ability to run a fully operational business.

It grants legal recognition and the right to conduct a range of business activities in Indonesia. However, certain sectors may impose restrictions on the percentage of foreign ownership allowed. - Representative Office: A representative office allows foreign companies to explore the market without fully committing to business operations.

Representative offices cannot engage in direct sales or income-generating activities but can conduct market research, promote brand presence, and act as a liaison between the parent company and the local market. It’s an ideal option for testing the market before making larger investments. - Subsidiary Office: A subsidiary is a separate legal entity that operates independently from its foreign parent company. In a subsidiary, foreign investors typically hold a majority stake, but local shareholders must own a portion.

A subsidiary can engage in a full range of business activities, and it provides flexibility in terms of managing operations locally.

BKPM: Key contact for investment approval

The Investment Coordinating Board (BKPM) plays a central role in facilitating and approving foreign investments in Indonesia. As the government body responsible for overseeing investment activities, BKPM ensures that all foreign investments comply with the country’s regulations and contribute to the national economic development.

If you’re unsure about the requirements or need guidance, you can always go to BKPM for support.

You can’t miss these!

Some details in Indonesia’s investment regulations might not be immediately obvious but are essential for your success. For instance, there are minimum capital requirements, reporting obligations, and specific conditions for different sectors. Be sure to familiarize yourself with the fine print to avoid any regulatory surprises.

Read more: Foreign Company Registration in Indonesia: A Simple Guide2. Business licensing & compliance

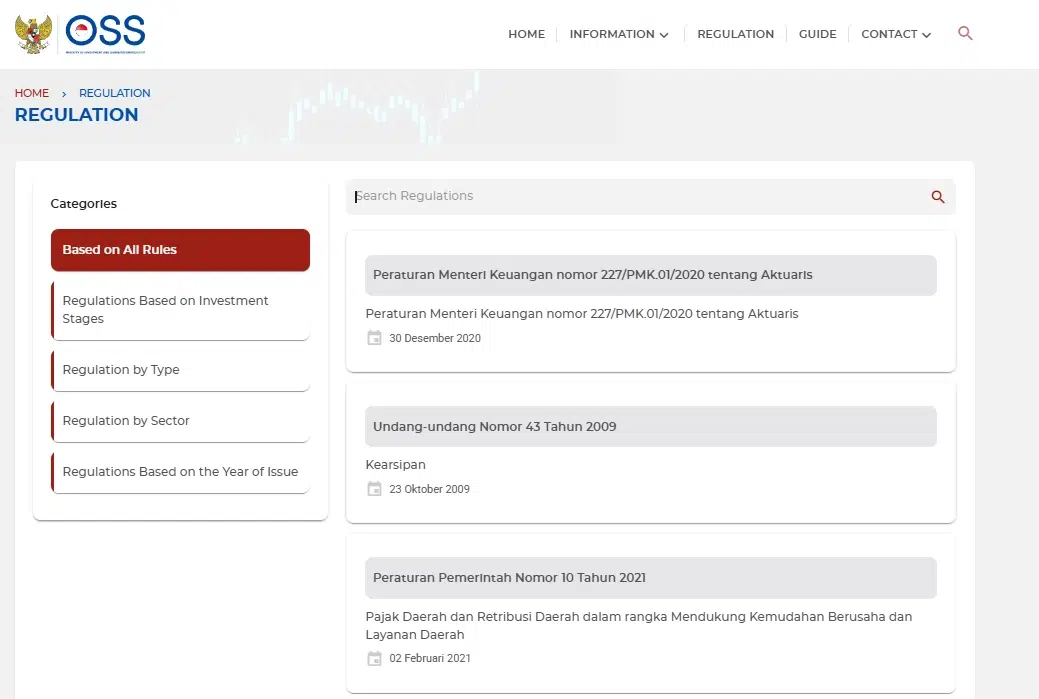

In the past, navigating bureaucracy in Indonesia was often seen as a major hurdle for businesses. However, the introduction of the Online Single Submission (OSS) system has revolutionized the process.

OSS: One-stop online portal for business permits

OSS is your one-stop online portal for managing business permits and compliance in Indonesia. This platform makes it easier to:

- Register your company, apply for licenses, and track your compliance status.

- It simplifies the process and cuts down on paperwork, giving you more time to focus on growing your business.

Sector-specific requirements

While OSS covers the basics, there are still sector-specific permits you might need depending on the type of business you’re running. For example:

- Food and Beverage (F&B) industry: Businesses in the F&B sector must obtain several additional licenses, including Food Safety Certificate (Sertifikat Laik Sehat or SLS), obtained from the Local Health Office (Dinas Kesehatan) to ensure that your food production meets health and hygiene standards.

- Manufacturing industry: Manufacturing businesses are required to apply for Industrial Business License (Izin Usaha Industri or IUI), issued by the Ministry of Industry (Kementerian Perindustrian) for companies in manufacturing to ensure compliance with industrial regulations.

Read more: International Business Expansion: Steps, Challenges, Strategies3. Tax system & obligations

Indonesia’s tax system is one of the most important elements of doing business in the country. Navigating taxes, including corporate taxes and VAT, requires careful attention to detail.

Corporate tax

Indonesia has a standard corporate tax rate of 22%. While this rate is competitive in the region, it’s important to stay updated on any potential changes. Additionally, certain tax incentives or exemptions may apply to specific sectors, so it’s worth investigating whether your business can take advantage of any tax breaks.

VAT: Value Added Tax

VAT (Value Added Tax) is another important part of Indonesia’s tax system. Businesses are required to charge Value-Added Tax (VAT) at 11% for most goods and services.

Pay and report your tax

Companies must also:

- Register for a Taxpayer Identification Number (NPWP) to conduct business in the country or fulfill your tax obligations.

- Stay on top of your tax deadlines. Indonesia’s tax reporting system has monthly and annual obligations. Missing a deadline can lead to penalties, so it’s essential to keep track of when reports are due.

Pro Tip!

Tax regulations can be tricky, so it’s always a good idea to work with a local tax advisor who can guide you through the nuances of the Indonesian system and help you stay compliant.

4. Labor laws & employment regulations

Indonesia has strict labor laws designed to protect employees, which include minimum wage policies, severance pay, and various employee benefits.

Minimum wage and fair compensation

Indonesia’s minimum wage varies by region, so it’s important to understand the specific rates in the areas where you plan to operate. Beyond minimum wage, fair compensation and benefits packages are essential for attracting and retaining talent.

BPJS: Employee benefits

Indonesia has mandatory social security programs, including:

- BPJS Ketenagakerjaan (for employment): Employers are responsible for registering your employees, which provides social security benefits. You must contribute a portion of your employees’ salary to these programs.

- BPJS Kesehatan (for healthcare): You are responsible for contributing 4% of each employee’s monthly salary to BPJS Kesehatan, while employees contribute 1%.

Hiring and terminating employees

Hiring and terminating employees requires careful attention to Manpower Law No. 13/2003. The process can be complex, so it’s essential to comply with local labor laws to avoid legal challenges and ensure fair treatment of employees.

5. Cultural & business etiquette

Doing business in Indonesia is all about relationships, trust, and respect. Understanding cultural nuances can help you build strong connections and succeed in the market.

Building relationships and communication

Trust and personal connections play a major role in business dealings, so take the time to network and foster meaningful relationships with key stakeholders.

Negotiations often involve indirect and polite communication, so patience and cultural sensitivity are important for successful interactions. Be polite and respectful, and avoid confrontation.

Hierarchy: Understanding the structure

Respecting hierarchy is crucial in when doing business in Indonesia. Seniority matters, so be sure to address decision-makers with respect and be mindful of the appropriate etiquette when engaging with different levels of authority.

Read more: 9 Key Insights to Understand Business Culture in Indonesia6. Market trends & consumer behavior

Indonesia offers a dynamic and rapidly growing market, driven by the expanding middle class and the rise of digital technology.

Growing middle class

Indonesia’s middle class is expanding rapidly, driving demand for goods and services across various sectors. Understanding this market shift will help businesses identify opportunities and tailor their offerings to meet evolving consumer needs.

Digital economy

The digital economy, particularly e-commerce, fintech, and SaaS, is experiencing rapid growth. Companies that are able to tap into Indonesia’s growing digital infrastructure will be well-positioned for success.

Cultural preferences: Localized brands matter

Indonesian consumers tend to favor brands that understand and align with local culture and values. Businesses that localize their products and marketing strategies are more likely to build strong brand loyalty.

7. Infrastructure & logistics challenges

Indonesia’s vast geography presents unique challenges for businesses, particularly in terms of logistics and infrastructure.

With over 17,000 islands, Indonesia faces significant logistics challenges. Traffic congestion in cities and the need for inter-island distribution can complicate supply chains. Developing effective logistics strategies is key to overcoming these challenges.

To address these issues, businesses are increasingly investing in smart logistics, warehousing, and e-commerce fulfillment technologies to improve efficiency and reach.

Read more: Boost Efficiency with Custom Logistic Software Solutions8. Political & economic stability

Indonesia’s political and economic climate is generally stable, but shifts in government policy and regulations can happen quickly. Staying informed about potential changes in foreign investment laws, trade policies, and tax regulations is essential for managing risk.

Partnering with local legal and business advisors is crucial for navigating regulatory changes and mitigating potential risks.

9. Intellectual property protection

Protecting your intellectual property (IP) is vital to safeguarding your brand and innovations in Indonesia.

Registering your IP, including trademarks and patents, with the Directorate General of Intellectual Property (DGIP) is essential. Early registration ensures your rights are protected in Indonesia.

However, counterfeiting and brand piracy remain concerns in certain industries, so staying vigilant is important. Companies must actively monitor their IP rights and take action if infringement occurs.

10. Business network & local partnerships

Forming the right local partnerships is vital for navigating regulations, cultural differences, and market challenges. Many foreign companies enter joint ventures or work with local distributors to expand their market presence efficiently.

Additionally, government agencies, business chambers, and trade associations can provide valuable insights and support to help your business grow in Indonesia. Building a strong local network is essential for long-term success.

Easier business expansion in Indonesia with local SaaS solution

Expanding your business into Indonesia is a golden opportunity, but it’s all about making the right moves: choosing the perfect business structure, building relationships based on trust, and navigating logistics with smart solutions.

By adapting to Indonesia’s unique landscape, you can unlock its vast potential and set your business up for long-term success.

To make your expansion smoother and more efficient, why not use the right tools? Mekari integrated SaaS platform is designed to adapt to Indonesia’s specific regulations and business requirements, including tax compliance, HR management, and legal frameworks.

With Mekari, you can streamline your operations, ensure compliance with local laws, and focus on scaling your business efficiently in Indonesia.

References

In.Corp Indonesia. ”Doing Business in Indonesia: The Challenges”