Mekari Insight

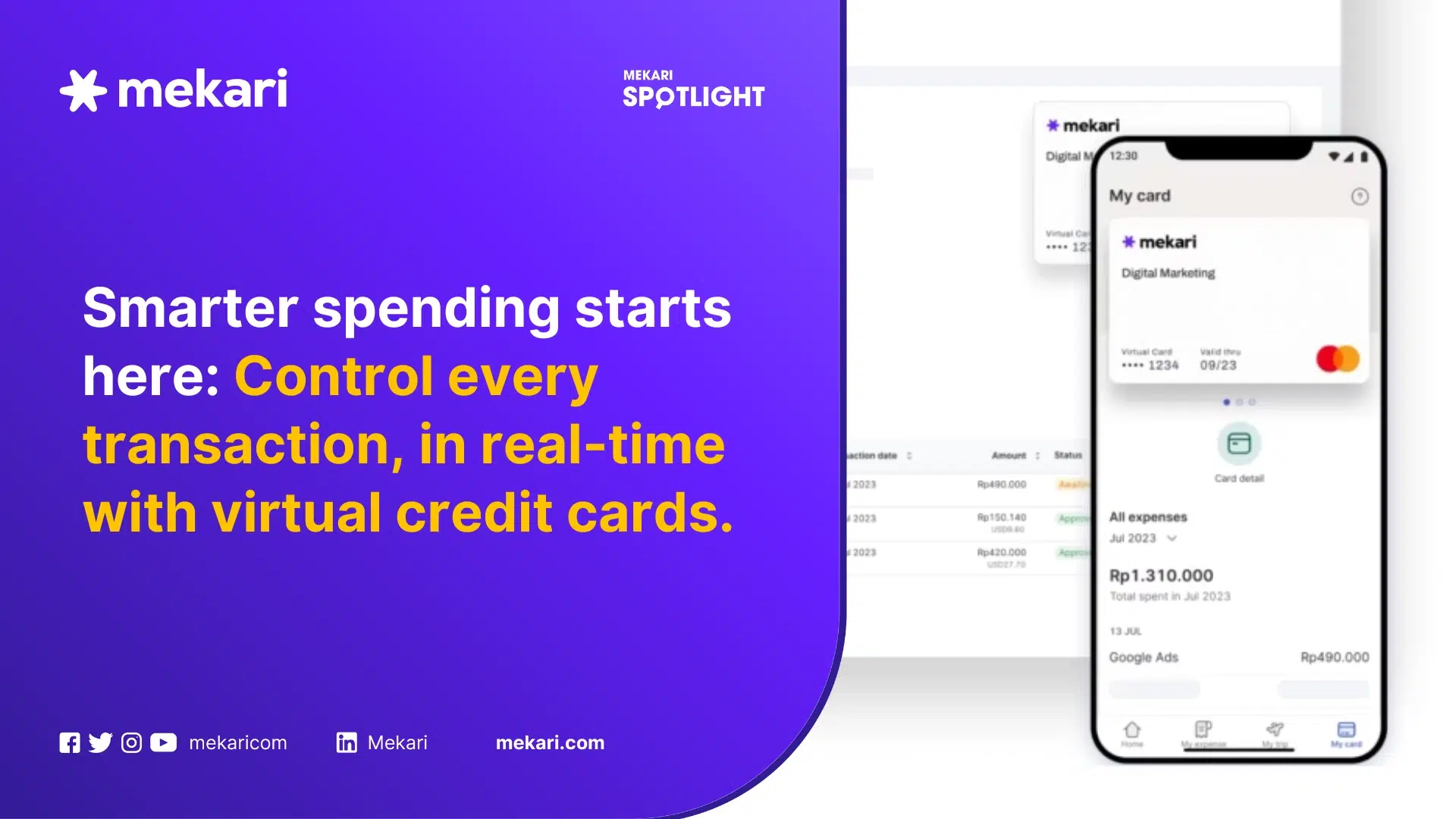

- Virtual cards give businesses more control, speed, and visibility. With features like instant issuance, custom spending limits, and real-time tracking, virtual cards help companies simplify expense management, especially across teams, vendors, and subscriptions.

- They offer stronger security and reduce the risk of fraud. Unlike physical cards, virtual cards can be restricted to specific merchants or time periods, deactivated instantly, and assigned per transaction, minimizing exposure and keeping sensitive data safe.

- Mekari Limitless Card go beyond payments. As a dual-format corporate card (virtual and physical), it integrates directly with spend and accounting systems, making it easier for finance teams to control budgets, track expenses, and scale confidently.

Managing expenses across teams, vendors, and departments is one of the most persistent challenges for CFOs and business owners. Without the right tools, it’s easy to lose visibility, overspend, or waste time on manual reconciliation.

Virtual credit cards (VCCs) are quickly becoming a preferred solution. The global VCC market is projected to hit $28.37 billion by 2024 and grow to $238.80 billion by 2034 at a 21.5% CAGR. Companies using VCCs also report significant reductions in admin workload and payment processing cost.

This guide is built for CFOs and business leaders who want to take a more strategic, data-driven approach to managing corporate spend, while staying agile, accountable, and audit-ready.

What is a virtual credit card?

A virtual credit card (VCC) is a digital-only version of a traditional credit card, used for secure and flexible business payments. It comes with a 16-digit number, expiration date, and CVV, just like a physical card, but exists entirely online.

Unlike physical corporate cards that take time to issue and offer limited controls, virtual cards are created instantly and give you full control over how, when, and where they’re used.

How virtual cards differ from traditional cards:

- Instant issuance: No waiting for physical delivery, cards can be generated and used immediately.

- Enhanced control: Set custom limits, assign cards to vendors or teams, and cancel anytime.

- Stronger security: Virtual cards can expire after one use or a set period, reducing the risk of fraud.

- Real-time tracking: Every transaction is logged instantly, simplifying expense reconciliation.

Virtual cards can be used for vendor payments, SaaS subscriptions, digital ads, and more, anywhere online payments are accepted.

Types of virtual credit cards:

- Single-use: Great for one-off payments; expires after use.

- Multi-use: Reusable for regular payments to the same vendor.

- Recurring: Perfect for ongoing subscriptions or monthly services.

These options give businesses the flexibility to assign specific cards to campaigns, departments, or even individual employees; while keeping full control and visibility at every level.

Read more: Corporate Card: Definition, How It Works, and Applying For ItHow do virtual credit cards work for business?

Virtual credit cards streamline business payments by offering speed, security, and precise control. Here’s how they work:

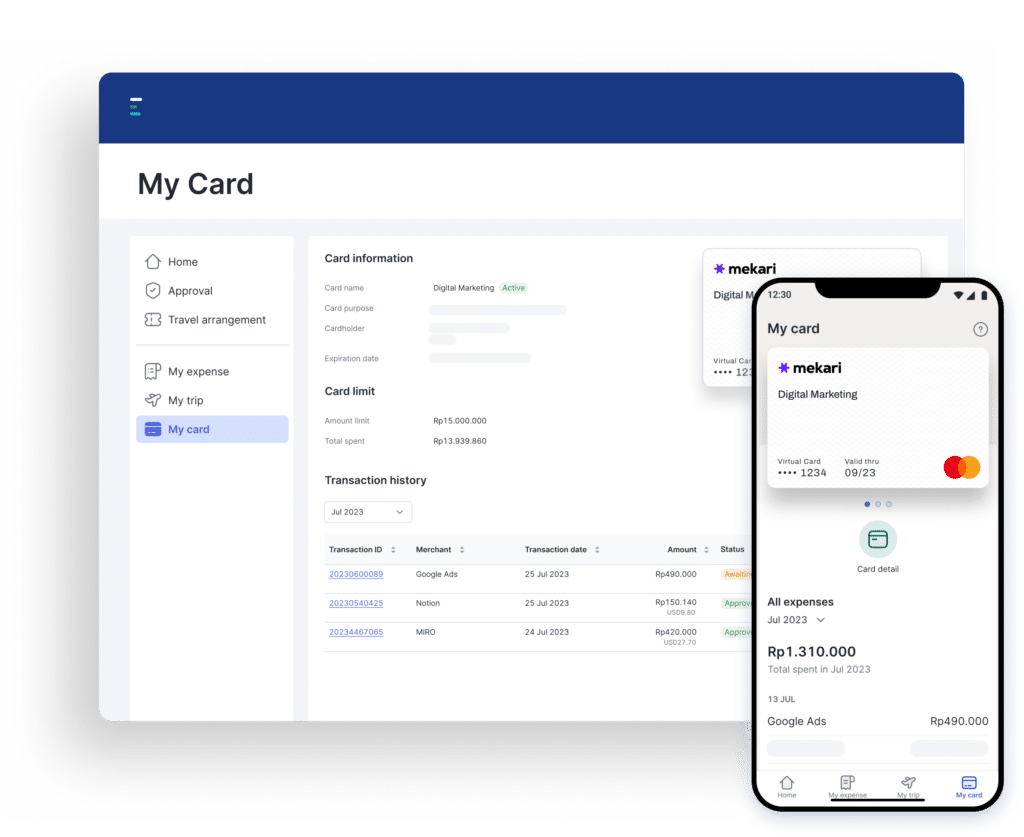

- Card creation: Virtual cards are generated instantly through a spend management platform or your bank’s dashboard. Each card comes with a unique 16-digit number, expiration date, and CVV, and can be assigned to a specific employee, vendor, or project.

- Custom spending rules: You can set spending limits, expiration dates, and usage restrictions. Cards can be limited to certain categories (e.g. SaaS, travel) or specific merchants to prevent misuse.

- Secure transactions: Payments are processed through the same networks as physical cards. However, virtual cards come with enhanced security such as tokenization, one-time use options, and auto-expiry to reduce fraud risks.

- Integration with finance systems: Most virtual card platforms connect with your accounting software, ERP system, or banking tools. This makes reconciliation, reporting, and audit tracking much more efficient.

- Real-time visibility: Every transaction is tracked instantly. Finance teams can monitor spending as it happens, match receipts, and stay on top of budgets without delay.

Read more: How to Track Business Expenses EasilyKey benefits of virtual credit cards for business

Virtual credit cards give businesses better control, visibility, and speed when managing expenses across teams and vendors. Here’s how they create real impact across different areas of finance and operations.

1. Enhanced security & fraud prevention

Virtual cards reduce the risk of fraud by assigning a unique card number to each transaction or vendor.

Unlike physical cards, which are reused and more easily compromised, VCCs can be set to expire after a single use or limited to specific merchants. If anything suspicious happens, the card can be deactivated instantly, without interrupting other payments or cardholders.

One recent report from CoinLaw indicates that 90% of financial institutions view virtual cards as a key tool in combating payment fraud.

2. Superior expense control & management

VCCs give finance teams tighter control over spending, right down to the department or individual level. You can assign specific cards for projects, set daily or monthly spending limits, and define usage categories.

Other key benefits include:

- Budget allocation per team or employee

- Real-time tracking for every transaction

- Automatic categorization to streamline analysis

- Enforcement of company policies through pre-set restrictions

These tools make it easier to stay within budget and avoid surprise expenses.

Read more: Best Expense Cards for Contract Employees & Selection Tips3. Streamlined accounting & reconciliation

Manual reconciliation slows down financial reporting and opens the door to errors. With virtual cards, every transaction is automatically logged and categorized. Receipts can be matched instantly, and data flows directly into your accounting or expense management system.

This reduces manual data entry and accelerates processes like:

- Month-end close

- Expense approvals

- Budget vs. actual tracking

It’s a smoother experience for both finance teams and employees.

4. Cost savings

Virtual cards help cut unnecessary costs in multiple ways. They eliminate the need for petty cash systems and reduce transaction processing fees often tied to traditional payment methods.

More importantly, tighter controls prevent unauthorized or out-of-policy spending. By automating workflows and removing repetitive manual tasks, finance teams also save valuable time, freeing them to focus on more strategic work.

5. Operational efficiency

Issuing physical cards takes time and logistics. With VCCs, cards can be created on demand, no printing, no shipping, and no delays.

This is especially useful for remote teams or fast-growing companies that need to onboard new vendors or team members quickly.

Other operational benefits include:

- Simplified vendor payments

- No risk of card loss or theft

- Easy setup for recurring subscriptions or ad spend

- Flexible usage across geographies and business units

Read more: How Corporate Debit Card Can Solve Common Budgeting IssuesAre virtual credit cards safe for business?

Yes, virtual credit cards are generally safer than traditional physical cards, especially for businesses that manage multiple transactions across teams, vendors, and departments. Here’s how:

- No exposure of main account details: Virtual cards are often generated for specific vendors or transactions, meaning your primary business card or bank account isn’t shared. This isolates the risk and prevents sensitive information from being leaked.

- One-time or limited-use functionality: Many virtual cards are designed for single-use or short-term use. Once the transaction is completed, the card automatically expires, rendering any stolen data completely useless.

- Custom spending and usage controls: Finance teams can set rules for each card, including maximum budget, time period, and approved merchant category. These controls limit the impact of any unauthorized activity and align spend with policy.

- Vendor-specific locking: Some platforms allow virtual cards to be restricted to a single merchant. If someone tries to use the same card elsewhere, the transaction will automatically be declined.

- Instant activation and deactivation: Virtual cards can be created or canceled on demand. If there’s a suspected security issue, the card can be terminated immediately, no need to replace the whole card system or wait for new physical cards.

- Real-time transaction alerts: Many VCC platforms offer instant notifications for every transaction, helping teams spot suspicious activity as it happens.

- No risk of physical loss: Since virtual cards exist only online, there’s no risk of someone stealing or misplacing the actual card.

Common use cases for business virtual cards

Virtual credit cards can be used across a wide range of business functions. Here are some of the most common and practical ways companies use them:

- SaaS and subscription management: Assign a separate virtual card for each software tool to easily manage renewals, prevent surprise charges, and cancel unused subscriptions instantly.

- Digital advertising: Use different cards for Google Ads, Facebook Ads, or LinkedIn to set strict budget limits, monitor ad spend, and avoid overspending on campaigns.

- Employee expense management: Issue individual cards to employees for work-related expenses like travel or meals, with custom limits and real-time tracking, no reimbursements needed.

- Travel and entertainment bookings: Book flights, hotels, or event registrations using cards that can expire after the trip ends, minimizing the risk of post-travel misuse.

- Vendor and supplier payments: Assign vendor-specific cards to track spending per supplier and reduce fraud risks through tighter control and visibility.

- Contractor and freelancer payments: Create cards for freelancers based on project or milestone; deactivate them once payment is complete for better spend control.

- Department-specific budgets: Provide each team or department with its own card and spending cap to enforce budget limits and simplify reporting.

- One-time project expenses: Generate cards for short-term projects and deactivate them after completion to keep financial records clean and organized.

Virtual cards vs traditional business credit cards

Choosing between virtual and traditional business credit cards depends on your company’s needs, risk appetite, and how you manage spending.

| Category | Virtual Cards | Traditional Business Credit Cards |

|---|---|---|

| Issuance speed | Created instantly and at scale; ready to use immediately and can be added to mobile wallets. | Slower to issue due to approval, printing, and shipping; some issuers offer a temporary virtual number while waiting for the physical card. |

| Security features | Unique numbers per vendor or project, single-use or time-limited options, merchant restrictions, and instant deactivation without disrupting other cards. Exposure is minimal if compromised. | Use EMV chip, PIN, and standard fraud monitoring. If the card number is stolen, replacing it can affect all recurring payments tied to that card. |

| Control capabilities | Highly customizable controls, set per-card budgets, time limits, merchant category blocks, auto-expiry, and role-based issuance. | Basic controls like per-card limits and freeze/unfreeze options. Less flexible and often shared across multiple merchants. |

| Integration with finance systems | API-first design with seamless ERP/AP integration, real-time updates, and automated spend categorization and reporting. | Integration varies by issuer; common tools include receipt capture and statement feeds, but automation is usually limited. |

| Costs and fees | Typically no annual fee; some cards offer rebates for AP transactions. May face FX fees or supplier surcharges for card-not-present payments. | May include annual or tier-based fees, FX charges, and interest if revolving. Premium cards often come with travel or reward perks. |

| Best use cases | Perfect for online spend, SaaS subscriptions, digital ads, freelancer or contractor payments, vendor management, and department budgets. | Ideal for travel, in-person expenses (fuel, hotels, car rentals), emergency purchases, and merchants requiring card-present transactions. |

| Acceptance rates | Widely accepted online; in-person use depends on mobile wallet compatibility and merchant contactless support. Some suppliers may charge extra or not accept them. | Almost universally accepted for both in-person and online transactions, especially where physical cards are required. |

| Form factor | Entirely digital, no physical card, just a number/token. Can be added to digital wallet | Physical plastic or metal cards that can also be digitized; preferred in situations where presentation is required. |

When your business should choose virtual cards

While both virtual and traditional business credit cards have their place, virtual cards offer unique advantages in specific situations. Here are the most common scenarios where choosing virtual cards makes the most sense:

- Your spending happens mostly online. Virtual cards are perfect for digital-first businesses, whether it’s paying for SaaS tools, online advertising, or cloud services. Issuing one card per vendor helps isolate risk and protect your core accounts.

- You need instant access for new hires or short-term projects. When onboarding freelancers, contractors, or temporary teams, virtual cards can be created and shared in minutes, no waiting, no shipping delays.

- You want tighter spending control. Set per-vendor limits, restrict usage to specific categories, and enable auto-expiry to prevent misuse or budget overruns. This is especially helpful for campaign-based or department-specific spending.

- You use AP automation or manage frequent vendor payments. Virtual cards integrate with your accounts payable system, allowing automated vendor payments with rich remittance data and, in some cases, card rebates.

- You manage multiple subscriptions. Assigning a virtual card to each recurring service makes it easy to pause or cancel subscriptions without affecting others, ideal for managing tools like Slack, Figma, or Google Ads across teams.

While virtual cards offer flexibility and control, there are still situations where traditional business credit cards are more practical, especially when physical presence or specific card benefits are required.

- Your teams frequently travel. Many hotels, car rental companies, and fuel pumps still require a physical card at check-in or point-of-sale.

- Your staff make in-store purchases. In field operations or retail situations where contactless or mobile wallets aren’t accepted, physical cards are often still necessary.

- You want travel perks or insurance benefits. Premium card tiers often come with rewards, airline lounge access, and insurance that apply only when using the physical card.

- You work with vendors who don’t accept virtual cards. Some suppliers may decline VCCs or charge extra fees for card-not-present transactions.

Key features to look for in a business virtual credit card

Not all virtual credit cards are created equal. To get the most value, especially for growing teams or enterprise use, you’ll want to choose a solution with strong controls, robust integrations, and features that scale with your business.

Below are the key areas to evaluate:

1. Core functionality

The basics matter, and a good virtual credit card should make it easy to issue, manage, and control spending at scale.

- Unlimited virtual cards: Create cards for every employee, project, vendor, or subscription without restrictions or added cost.

- Spending limits and controls: Set specific budgets, merchant restrictions, and expiration dates to prevent overspending and enforce policy from day one.

2. Integration capabilities

Seamless integration with your finance stack saves time and reduces manual work.

- Accounting software: Sync transactions directly into your general ledger. This helps automate expense categorization, reduce reconciliation errors, and save time during closing periods.

- Expense management tools: Connect your virtual cards with tools used for capturing receipts, managing reimbursements, and enforcing company policies. This ensures every transaction is tracked, approved, and audited with minimal effort.

3. Security features

Security is critical when dealing with company finances. Look for built-in protections that reduce fraud and keep data safe.

- Two-factor authentication (2FA): Adds an extra layer of login protection for account access.

- Fraud detection: Real-time alerts and suspicious activity monitoring help catch issues early.

- PCI compliance: Ensures the platform follows strict payment data standards.

- Data encryption: Protects sensitive card and transaction information from unauthorized access.

4. Management & reporting

Visibility and control are what set virtual cards apart. Choose a solution that makes monitoring and reporting simple.

- Real-time dashboards: Track spend instantly by user, department, or vendor.

- Custom reporting: Build tailored reports by date range, category, or project to support audits and budget reviews.

- Approval workflows: Set up customizable, multi-step approval flows to enforce spend governance.

- Multi-user access: Allow different levels of access for finance, managers, and employees with role-based permissions.

5. Support & scalability

As your business grows, your virtual card provider should grow with you.

- Customer support availability: Look for responsive, 24/7 support, especially if your team operates across time zones.

- Onboarding process: Easy setup, clear documentation, and training support make adoption faster.

- Scalability for growth: The platform should handle increasing users, departments, and transactions with no performance issues.

- Multi-entity support: Essential for companies with subsidiaries or multiple legal entities that need separate spend tracking.

Top virtual credit card providers for business

With so many virtual credit card options available, choosing the right provider depends on your business’s size, structure, and spending habits. For companies seeking a flexible, secure, and scalable solution, Mekari Limitless Card is the best Virtual Credit Card for business.

Offered through Mekari Expense, the Mekari Limitless Card functions as a corporate card that’s available in both virtual and physical formats, allowing businesses to choose the version that suits each use case.

Whether your team needs virtual cards for online subscriptions, digital ads, and AP automation, or physical debit cards for travel, field purchases, and in-person expenses, Mekari supports both with a unified dashboard and real-time control.

With its seamless integration to Mekari Expense for spend management and Mekari Jurnal for accounting, this card simplifies everything from budgeting to reconciliation, making it a complete solution for modern finance teams.