Mekari Insight

- Virtual credit cards help businesses move faster and stay in control. They simplify company spending by replacing reimbursements and shared cards with secure, trackable, and customizable digital payments.

- Integration is what makes a virtual card truly powerful. When connected to platforms like ERP, procurement, or expense systems, virtual credit card payments for business can reduce manual work, cut costs, and give finance teams real‑time visibility.

- VCC Mekari Limitless Card delivers the best all‑around experience. With flexible card creation, seamless integration, and Mastercard‑powered global reach, it helps companies manage every transaction efficiently, no matter the size or structure of the team.

Virtual credit cards have become a necessity for modern business payments, but how you use them makes all the difference.

While many companies turn to banks for virtual credit cards, the real advantage lies in using VCCs through technology software providers. They gain far more value when those cards are integrated into the platforms they already use, like ERP, procurement, or expense management systems.

Embedding payments this way streamline transactions, reduces friction, lowers costs, and improves visibility.

In this article, we highlight 5 virtual credit card payment solutions that do exactly that, designed to support business growth, global transactions, and finance teams that want more than just another payment method.

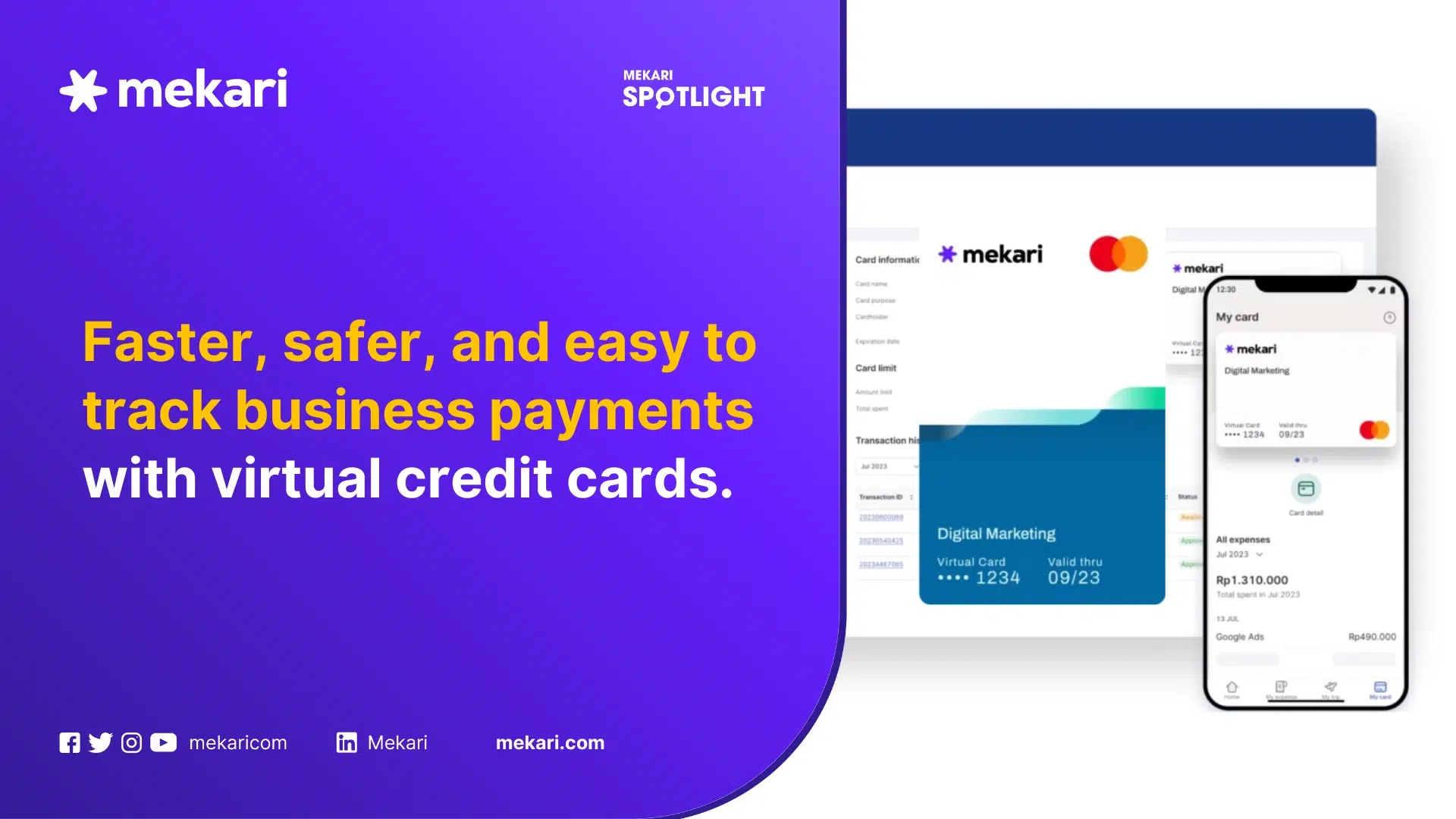

1. Mekari Limitless Card

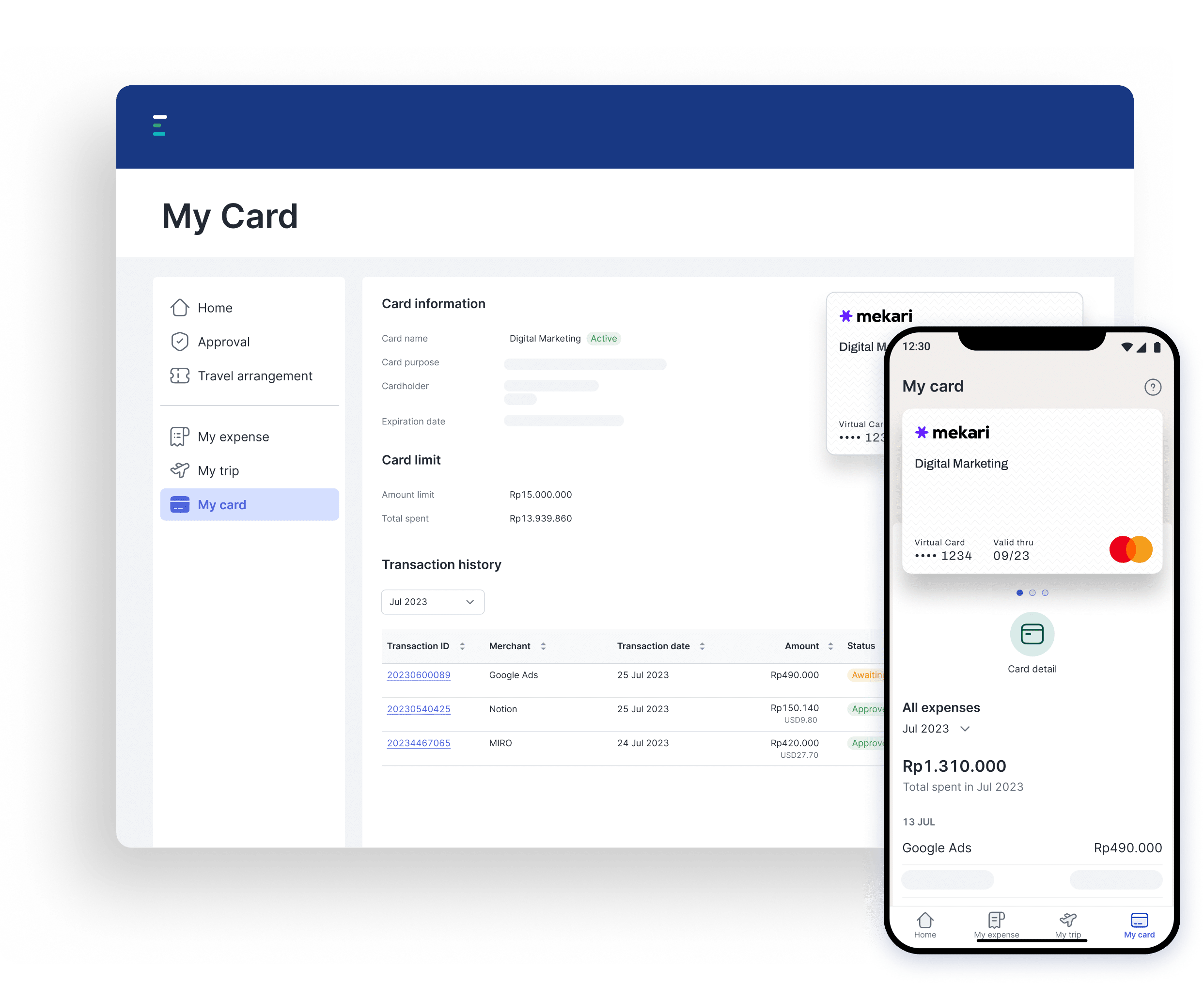

VCC Mekari Limitless Card is a corporate credit card solution in the form of a Virtual Credit Card (VCC) that lets businesses instantly issue digital payment cards for employees, teams, vendors, or specific projects, all without the hassle of physical cards.

Each card comes with a unique number, custom spending limit, and active period, all of which can be managed and monitored directly through the Mekari Expense platform. Transactions are recorded in real time, giving finance teams full visibility and control over every expense.

Powered by Mastercard, Mekari Limitless Card is accepted by over 30 million merchants worldwide, making it a reliable option for both local and global payments.

Key features & capabilities:

- Instant card creation: Issue virtual cards instantly via web or mobile, as many as your business needs.

- Unique cards for different use cases: Create separate cards for teams, projects, campaigns, or vendors, each with tailored limits and expiration dates.

- Flexible budgeting by team or department: Assign limits per card to stay organized and prevent overspending.

- Real-time tracking in one dashboard: Monitor all transactions instantly for faster reporting and smarter decisions.

- Automatic payments for subscriptions: Perfect for recurring tools like Zoom, Figma, or Atlassian. You can freeze cards anytime to stop unexpected charges.

- Direct integration with Mekari Jurnal: All transactions are automatically synced to your accounting system, no manual input needed.

- No daily admin fees: No hidden costs, only applicable third-party charges (e.g., from specific merchants).

- Full card control: Pause, edit, or deactivate cards anytime based on internal policies.

- Approval workflows: Built-in approval steps to match your organization’s spend policies.

Best suited for:

Mid-size to large companies managing multiple teams, projects, or vendors, and need a simple, secure, and scalable way to handle business expenses with full visibility and control.

Read more: Corporate Card: Definition, How It Works, and Applying For It2. Wallester

Wallester offers flexible and secure virtual credit card payments for business, enabling companies to issue cards with spending controls and monitor transactions in real time.

Supporting multiple currencies and digital wallets, Wallester is built for teams managing global expenses at scale.

Key features:

- Issue single-use or reusable virtual cards instantly

- Real-time spend tracking through the Wallester app

- Supports multi-currency transactions

- Integrates with Apple Pay and Google Pay

- Free demo available without registration

Best for:

Wallester is a strong fit for businesses managing high-volume ad spending, global travel expenses, vendor payments, and even payroll distribution.

Its flexibility makes it a valuable tool for media buyers, resellers, and corporate finance teams needing reliable expense control.

Read more: How to Track Business Expenses Easily3. Intergiro Virtual Corporate Card

Intergiro’s virtual business credit card provides fast, secure, and scalable virtual credit card payments for business, especially those with cross-border needs.

Integrated directly with Intergiro’s banking platform, it gives businesses complete visibility and control over their spending.

Key features:

- Instant virtual card issuance for online payments

- Multi-currency support for international transactions

- Real-time tracking and detailed expense reporting

- Custom spending limits and user-level access control

- Integration with accounting systems

Best for:

Designed for small to mid-sized companies and growing enterprises that want efficient online payment tools with robust spend management. Great for teams needing global payment capabilities while maintaining financial transparency and control.

Read more: How to Manage & Track Marketing Expenses with Expense Card4. Mesh Payment Virtual Card

Mesh Payments allows businesses to create unlimited corporate cards, offering unparalleled control and visibility over spending.

As a platform centered on automation, Mesh simplifies reconciliation and improves the efficiency of virtual credit card payments for business.

Key features:

- Instantly generate unlimited virtual cards per employee or team

- Configure vendor-specific limits and expiry dates

- Real-time spend insights and smart budgeting tools

- Connect physical and virtual cards for hybrid usage

- Built-in receipt capture and automatic expense matching

Best for:

Ideal for businesses focused on automation and detailed financial control. A strong choice for tech companies, remote-first teams, and organizations managing multiple SaaS subscriptions or travel expenses.

Read more: How Corporate Debit Card Can Solve Common Budgeting Issues5. Pleo

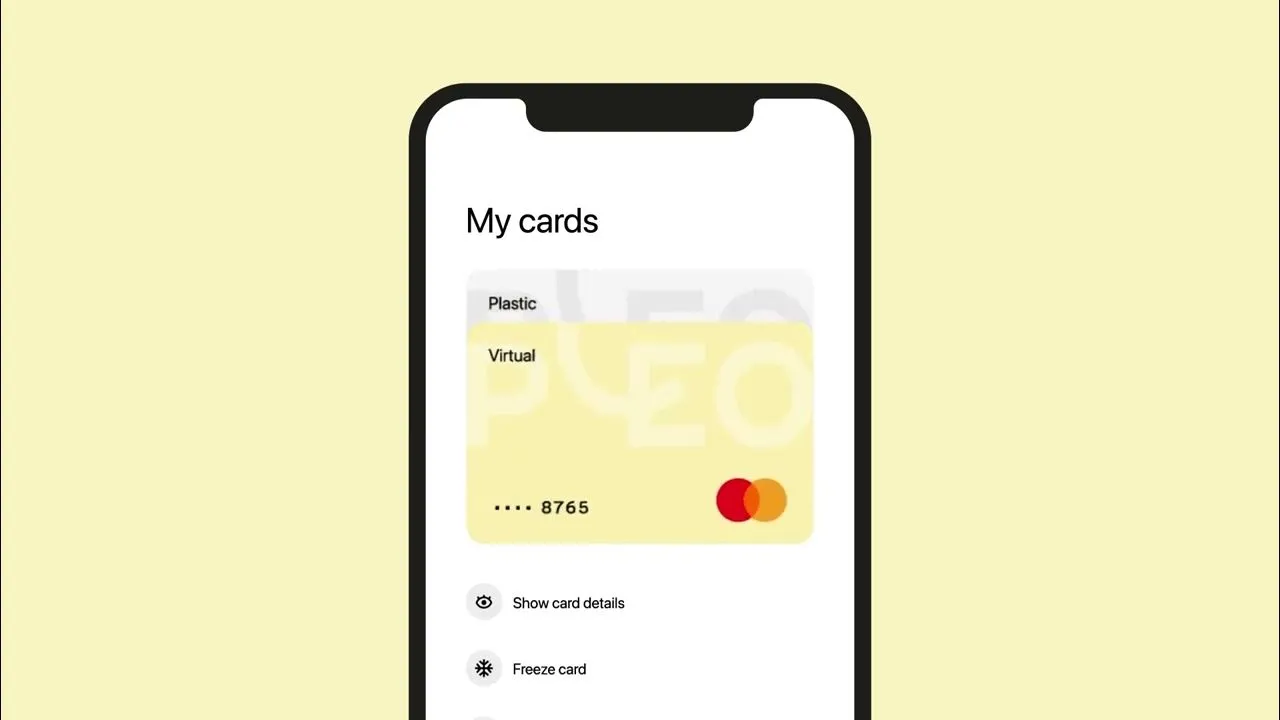

Pleo is a smart solution that redefines virtual credit card payments for business by offering each employee a dedicated card with built-in controls. It simplifies expense tracking and connects directly to your accounting software for smooth reconciliation.

Key features:

- Virtual cards with employee-specific limits

- Instant receipt capture via mobile app

- Real-time purchase notifications

- Direct integration with Xero, QuickBooks, and other tools

Best for:

Pleo is ideal for companies aiming to empower employees while maintaining centralized control. Best suited for modern SMBs, consulting firms, and startups looking to streamline employee reimbursements and reduce manual reporting.

Read more: How to Choose Corporate Card for StartupsBest virtual credit card for business

When it comes to choosing a virtual credit card that combines flexible control, seamless integrations, and real-time visibility, Mekari Limitless Card stands out as the top choice.

Built to support growing businesses, it empowers teams to manage spending across departments, vendors, and subscriptions, with full transparency and no unnecessary complexity.

If you’re looking for a solution that fits right into your existing workflow and scales with your business needs, Mekari offers one of the best virtual credit card payments for business.