Mekari Insight

- An expense policy sets clear guidelines for what’s acceptable to spend, preventing overspending, misuse, and confusion. It ensures everyone stays on the same page, saving time and protecting company funds.

- With a well-defined expense policy, you can stop fraudulent claims like fake receipts or double reimbursements before they happen.

- Using spend management tools like Mekari Expense streamlines the process by automating approvals, tracking, and enforcing budget limits, ensuring your policy is followed seamlessly across the board.

As your business starts to grow, managing expenses effectively becomes crucial—but creating an expense policy often gets overlooked.

While it might not seem urgent when you’re focused on scaling or building your team, establishing clear guidelines for spending will save you time, money, and headaches down the road.

In this article, we’ll walk you through why company expense policy is essential, how it can streamline your operations, and the simple steps to put one in place for smoother financial management.

What is an expense policy

An expense policy is your internal playbook for managing business spending—it sets the rules on what employees can spend on, how much is okay, and how to get it reimbursed. Think of it as a shared agreement that keeps things fair, consistent, and budget-friendly.

Without it, teams are left guessing, approvals get messy, and budgets are harder to control. But with a well-set policy, your finance team saves time, employees feel more confident, and every expense stays aligned with business priorities.

Read more: How to Track Business Expenses EasilyWhy should a company have an expense policy?

When employees make business purchases—meals, transport, client gifts—costs can pile up fast. Without clear rules, people might overspend, buy things that aren’t necessary, or worse, misuse company money.

An expense policy keeps spending on track, prevents confusion, and protects company funds.

It’s also your first line of defense against expense fraud—intentional or not. Clear guidelines help avoid grey areas and make sure everyone plays by the same rules.

What is an expense reimbursement scheme?

Expense reimbursement fraud happens when employees claim money they’re not supposed to. This is usually mentioned as fictitious expense reimbursements schemes.

Some common tricks include:

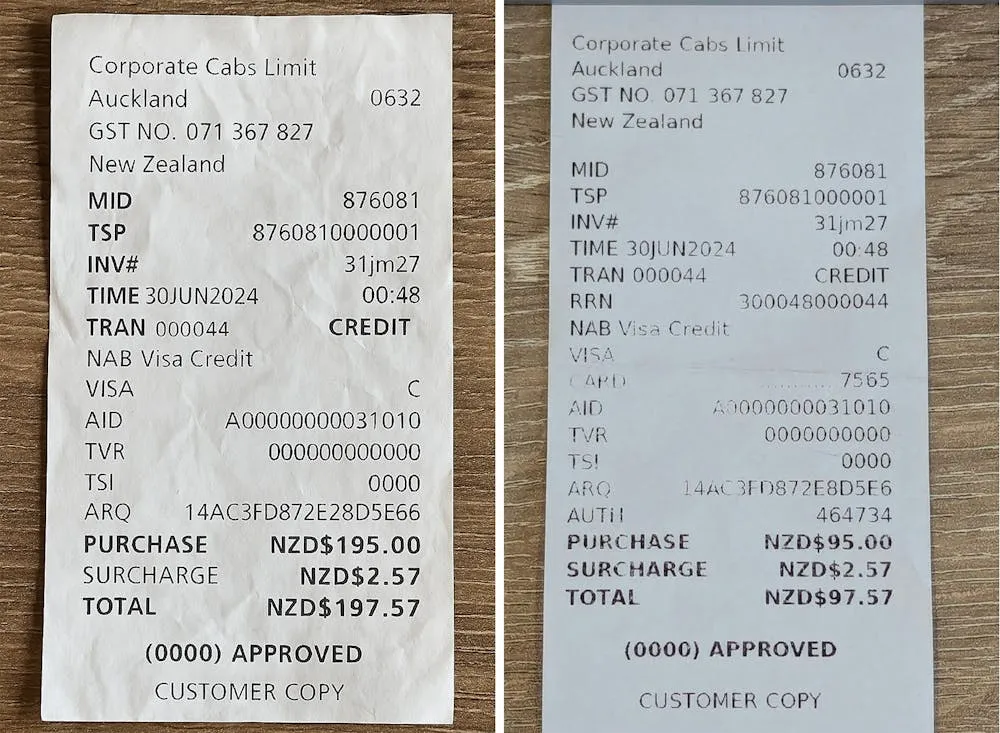

- Fake receipts for items never bought

- Double claims for the same expense

- Personal costs passed off as business expenses

- Old receipts recycled in new reports

Without a strong policy, these things often slip through unnoticed—and they cost more than you think.

Baca Juga: Expense Reimbursement Guide: Best Practices and SolutionsHow to write expense policy

An expense policy helps employees understand what they can claim, keeps spending aligned with your budget, and protects your business from errors or even fictitious expense reimbursements schemes.

Here’s how to write one that’s clear, fair, and actually works.

1. Start with purpose and scope

Explain why this policy exists and who it applies to. Is it for all full-time staff? Just sales teams and managers? Setting the scope early avoids confusion down the line.

2. Define what’s allowed, what’s not, and how it’s reimbursed

This is the heart of your policy. Lay out:

- Which expenses are allowed: Break them into clear categories—travel, meals, software, client meetings, etc.—with spending limits or caps where needed.

- Which expenses are not covered: List non-reimbursable items, like personal shopping, meals with no business purpose, or purchases from unapproved vendors. This helps prevent blurry claims and fictitious expense reimbursement schemes, like fake receipts or personal purchases disguised as business.

- How reimbursement works: State how to submit claims (e.g., through software or form), expected processing time (e.g., 7–10 business days), and how the funds will be paid out (e.g., bank transfer or via payroll).

Read more: 25 Essential Business Expense Categories & How to Optimize It 3. Set clear reporting and approval steps

Lay out how employees should submit claims, who approves them, and what the timeline looks like. Mention if you’re using email, Google Forms, or a proper expense management system. The smoother the process, the less frustration for everyone involved.

4. Spell out documentation rules

Require receipts for every claim—ideally itemized. You can also allow card statements or e-invoices when relevant. Clear documentation prevents back-and-forth with finance, and helps flag fictitious claims, like edited receipts or duplicated submissions.

5. Review and update your policy regularly

Your business evolves, and so should your expense policy. New tools, remote work setups, or spending habits might make parts of your policy outdated. Aim to review it at least once a year—or sooner if big changes happen.

6. Use technology to automate and enforce it

Don’t just rely on documents that sit unread in folders. Use expense management tools like Mekari Expense to embed your policy into day-to-day workflows.

Features like auto-categorization, budget limits, and approval routing help ensure your policy is followed—without micromanagement.

Expense policy best practices

Here are some key strategies for developing and maintaining an expense policy that works:

1. Clarity is key

The policy should be straightforward and easy to understand, avoiding complex terminology. Simple, clear language ensures everyone can follow the rules without confusion.

2. Adapt over time

As your business grows, your policy should grow with it. What worked in the early days might not be suitable in the long run, so it’s important to keep the policy current and flexible to meet new needs.

3. Easy access

Make sure employees can easily access the policy, whether it’s through the company intranet, a printed handbook, or expense management software. This is particularly important for employees who travel often and need quick access to guidelines.

4. Support available

Designate a point of contact for any questions or clarifications regarding the expense policy, so employees know where to turn if they need assistance.

Remember that a well-crafted expense policy should give employees the freedom to make decisions within clear guidelines. This balance of control and autonomy is achieved through three main principles:

- Pre-approval for expenses: Set clear approval rules, allowing team leaders to prioritize and approve expenses in advance.

- Real-time monitoring: Track transactions in real-time to prevent out-of-policy spending and stay within budget.

- Post-spending communication: Make it easy for employees to submit receipts and information through multiple channels.

Starting company expense policy easily through Mekari Expense

Establishing an effective company expense policy is crucial for maintaining control over financial resources.

Mekari Expense offers a spend management system that simplifies this process by offering corporate cards, including Virtual Corporate Cards (VCC) and debit cards, that can be easily controlled and limited.

This ensures that employees adhere to the set spending limits, helping companies prevent overspending and manage expenses more efficiently.

Mekari Expense supports the entire expense management process for both large enterprises and small-medium businesses. From approval workflows to real-time expense tracking, it streamlines the procedure, making it easier for businesses to monitor, control, and analyze employee spending, while ensuring compliance with the company’s policies.

For more information on how Mekari Expense can transform your expense management, visit Mekari Expense and explore our Corporate Card solution.

References

Ramp. ”Expense policy best practices”

Spendesk. ”Expense policy 101: understanding the basics”