Mekari Insight

- Remittance processing software helps businesses speed up cross-border and domestic payments while reducing errors and costs.

- These tools enhance compliance, security, and transparency—making them essential for companies with high-volume transactions.

- Mekari Expense stands out as the best international remittance software, with real-time exchange rates, multi-currency support, seamless integration with Mekari Jurnal, and advanced approval workflows tailored for corporate needs.

Remittance processing software helps businesses handle payments faster, safer, and with fewer errors.

For companies managing high transaction volumes, whether paying vendors, employees, or overseas partners; these tools ensure smoother workflows and better compliance.

This article reviews 7 best remittance processing software for corporate and business needs, along with their key features and benefits. Keep reading to find out.

Importance of using remittance processing software for business

Remittance processing software is a digital tool that automates the sending and receiving of payments, especially international transfers.

It manages everything from data verification to settlement and reporting, and is commonly used by banks, money transfer providers, and businesses with high transaction volumes.

Adopting remittance processing software brings major advantages for businesses and the economy.

- Faster and more efficient: Processes that took days can now finish in minutes, keeping cash flow smooth and scalable.

- Stronger security and compliance: Features like fraud detection, real-time monitoring, and AML/KYC checks protect data and reduce risks.

- Lower costs: Automation cuts banking fees, paperwork, and manual labor—savings that can benefit customers too.

- Better accuracy and data use: Clean, real-time data reduces errors and improves reporting, liquidity, and decision-making.

Here are eight of the best remittance processing software options, with their features and ideal uses.

| Software | Key Features | Best Suited For |

|---|---|---|

| Mekari Expense | Real-time exchange rates, multi-currency support (40+ countries, 15+ currencies), customizable approvals, vendor management, integration with Mekari Jurnal | Corporations and finance teams managing high-volume international and domestic payments |

| HighRadius | AI-powered automation, aggregates remittance data, high straight-through processing, exception handling | Large enterprises with complex, high-volume transactions |

| Stripe | Accepts 135+ currencies, APIs and checkout customization, invoicing, subscriptions, instant payouts | Online businesses, e-commerce, platforms needing flexible developer-friendly payments |

| Wise | Multi-currency business accounts, low-cost transfers, accounting software integration, batch payments | SMEs, freelancers, and individuals seeking affordable and transparent international transfers |

| Adyen | Unified commerce payments, dynamic currency conversion, fraud protection, global coverage | Large enterprises and omnichannel merchants with extensive international operations |

| Airwallex | Multi-currency accounts, competitive FX rates, e-commerce integrations, batch payments | E-commerce businesses, marketplaces, and global companies expanding internationally |

| WorldRemit | Cash pickup, mobile money, bank deposit options, real-time tracking, operates in 150+ countries | Individuals and small businesses sending smaller, frequent payments internationally |

| Remitly | Express and Economy transfer options, transparent fees, flexible delivery (bank, cash, mobile wallet), 24/7 support | Individuals and expatriates sending money abroad with flexible delivery needs |

1. Mekari Expense

Mekari Expense International Remittance helps businesses manage cross-border and domestic payments with ease. It automates processes such as recording, reconciliation, and approvals, while providing full transparency into exchange rates, cut-off times, and transfer statuses.

By connecting businesses with 40+ countries and 15+ currencies, this solution simplifies global transactions and ensures payments are fast, accurate, and secure.

Features:

- Real-time exchange rates: Monitor live rates before sending funds to avoid budget risks and ensure accurate conversion to IDR.

- Transparent monitoring: Track the status of international transfers in real time, complete with updated cut-off times and reporting.

- Global connectivity: Transfer funds to 40+ countries and 15+ currencies, including SGD, USD, EUR, and more.

- Custom approval workflows: Align payment approvals with company policies; approve or reject multiple requests at once.

- Vendor management: Build and manage a database of domestic and international vendors to streamline procurement.

- Seamless integration with Mekari Jurnal: Automatically sync with account mappings for multi-currency transactions, reducing manual input.

- Detailed transaction records: Create bills in specific currencies, view log histories, track currency changes, and compare total payments in both foreign currency and IDR equivalents.

Best suited for:

Businesses that frequently make international or multi-currency payments—such as corporations with overseas vendors, global suppliers, or cross-border operations—will benefit most from this solution.

It’s especially valuable for finance teams that need accuracy, transparency, and automation in handling high transaction volumes while staying compliant and efficient.

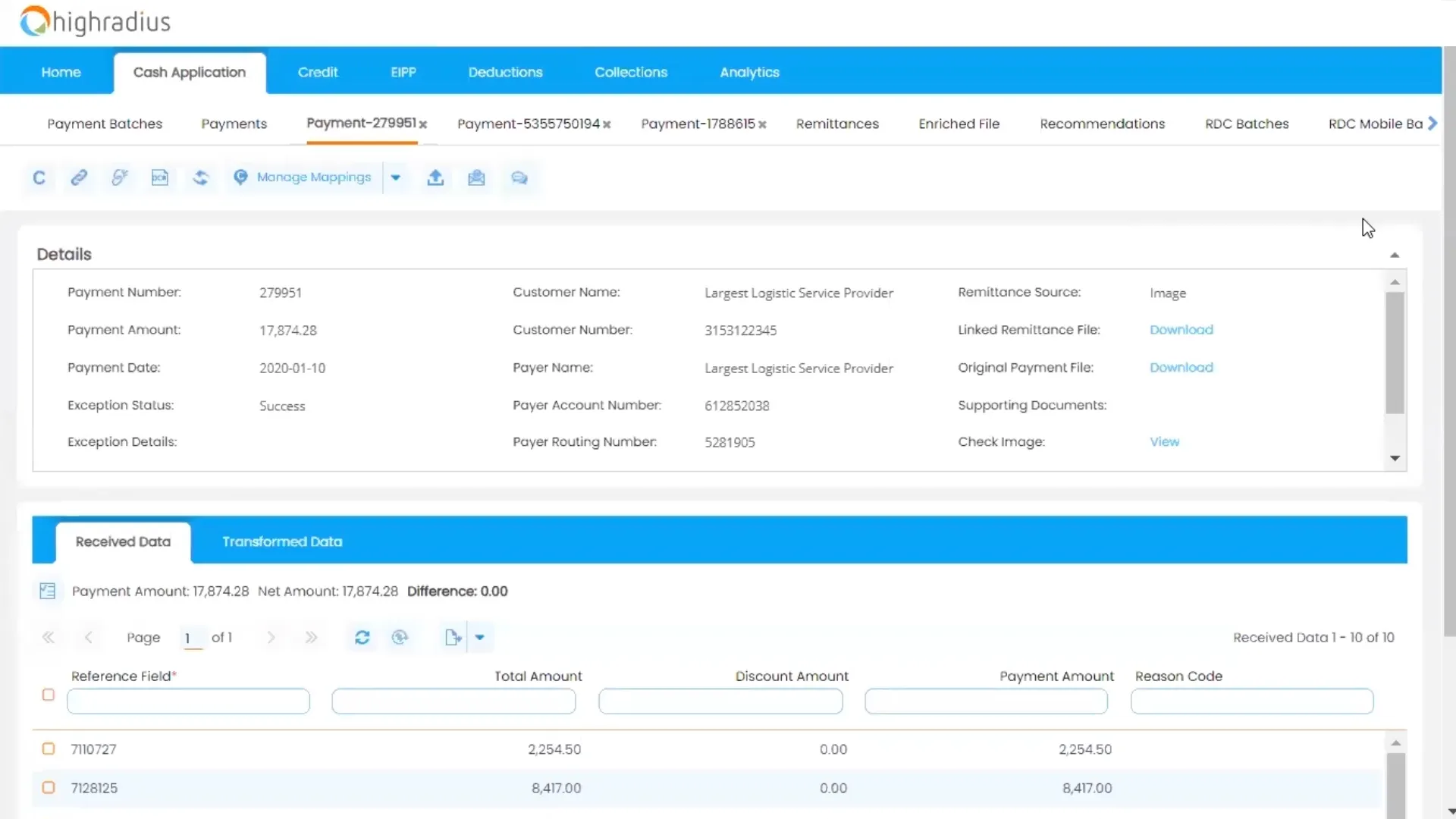

Read more: 7 Best Remittance Processing Software for Global Payments2. HighRadius

HighRadius offers AI-powered, autonomous remittance processing designed for large enterprises with complex, high-volume payment streams.

Features:

- Aggregates remittance data automatically from various sources, such as emails, bank portals, and lockboxes.

- Achieves high straight-through processing rates for rapid cash posting.

- Continuously adapts to new remittance formats and transaction volumes using AI and machine learning.

- Automates cash application management and exception handling.

Best suited for: Large enterprises with high-volume, complex remittance processing needs who want to maximize automation and increase cash flow speed.

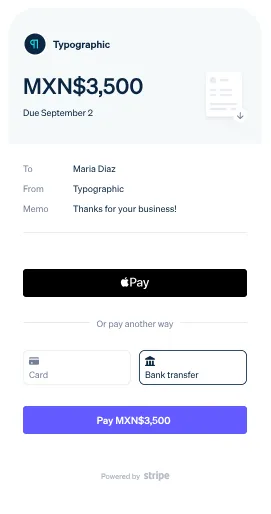

Read more: International Money Remittance Software: Guide & Comparison3. Stripe

Stripe is a versatile payment processing platform with strong remittance capabilities, especially for online businesses, and features extensive developer tools.

Features:

- Accepts over 135 currencies and more than 50 payment methods.

- Provides customizable checkout experiences and APIs.

- Offers subscription billing, automated invoicing, and instant payouts.

- Integrates with numerous third-party platforms.

Best suited for: Online businesses, e-commerce stores, and platforms that require a flexible and developer-friendly solution for a variety of payment types and currencies.

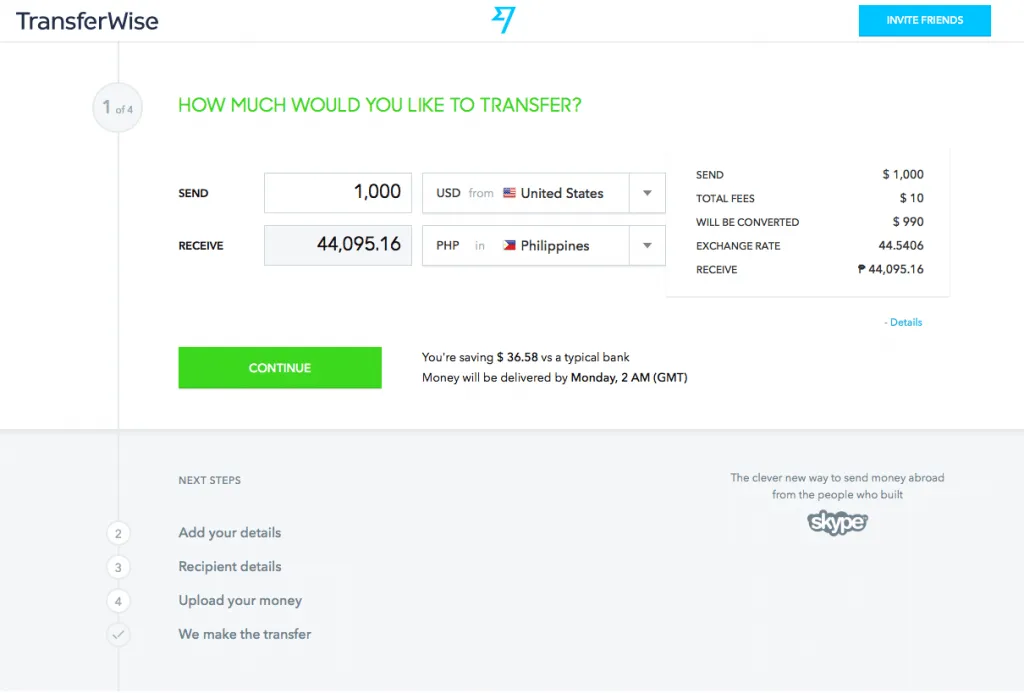

Read more: How to Transfer Money Internationally: 5 Ways & Protips4. Wise (formerly TransferWise)

Wise is known for transparent and cost-effective international money transfers for both businesses and individuals, offering mid-market exchange rates.

Features:

- Provides multi-currency business accounts to hold and manage funds.

- Offers low-cost, fast international transfers.

- Integrates with accounting software like Xero and QuickBooks.

- Supports batch payments for multiple recipients.

Best suited for: SMEs, freelancers, and individuals who need a low-cost, transparent way to send and receive international payments.

5. Adyen

Adyen is a global payment processing platform that supports unified commerce, serving businesses with significant international and multi-channel operations.

Features:

- Handles payments in a wide range of currencies and local payment methods.

- Includes robust fraud protection and risk management tools.

- Provides dynamic currency conversion.

- Uses a single, unified payments API for easy integration.

Best suited for: Large global enterprises and omnichannel merchants that require a powerful, integrated payment solution with extensive international reach.

6. Airwallex

Airwallex is a global payments and financial platform that provides multi-currency accounts and transfers for businesses that operate and expand internationally.

Features:

- Offers multi-currency accounts to hold funds in over 40 currencies.

- Provides international transfers at competitive FX rates.

- Integrates with e-commerce platforms like Shopify.

- Offers expense management tools and batch payments.

Best suited for: E-commerce businesses, marketplaces, and other companies with global operations that require seamless and cost-effective cross-border payments.

7. WorldRemit

WorldRemit is a digital remittance service primarily focused on personal transfers, particularly for sending money to emerging markets.

Features:

- Supports multiple payout options, including bank deposit, cash pickup, and mobile money.

- Offers real-time transaction tracking and notifications.

- Operates in over 150 countries and 130 currencies.

- Is optimized for smaller, frequent payments.

Best suited for: Individuals and small businesses that need to send fast, reliable, and cost-effective personal payments to a wide range of countries, especially those with developing financial infrastructure.

8. Remitly

Remitly is an online remittance service with a focus on providing flexible, fast, and affordable international money transfers, emphasizing transparent fees.

Features:

- Offers “Express” (faster delivery with higher fees) and “Economy” (lower fees with slower delivery) options.

- Guarantees on-time delivery or will refund the transfer fee.

- Supports bank deposit, cash pickup, mobile wallet, and home delivery in select regions.

- Provides 24/7 customer support.

Best suited for: Individuals and expatriates who need a reliable and fast way to send money to family and friends abroad, with flexible delivery options.

Why Mekari Expense is the best choice for remittance processing

For businesses that need to manage both international and domestic remittances, Mekari Expense offers international remittance, the most complete and reliable solution. It combines automation, security, and flexibility to help finance teams handle payments with ease.

Key features include:

- Real-time exchange rates for accurate conversions and minimized budget risks

- Fast and secure transfers to ensure vendors and partners are paid on time

- Multi-currency payments supporting 40+ countries and 15+ currencies

- Customizable approval workflows to align with company policies

- Vendor management tools for both domestic and international partners

- Seamless integration with Mekari Jurnal for automated reconciliation and reporting

With these capabilities, Mekari Expense enables corporations to stay efficient, compliant, and in full control of global payments—helping them save time, reduce costs, and focus on growth.