Mekari Insight

- Mastering HR compliance in 2025 means staying updated on contracts, payroll, and labor law changes.

- Employee experience is shaped by the details—from leave, overtime, and BPJS to tax and THR policies.

- Mekari Talenta empowers HR teams with an integrated platform that simplifies payroll, tracks employee benefits, and manages expenses through seamless tools like Mekari Expense and Mekari Flex.

HR teams in Indonesia face increasing pressure to stay accurate, agile, and compliant as employment laws, payroll rules, and contract standards continue to evolve in 2025.

Clear understanding of these fundamentals is essential, not only to meet regulations, but to support smooth operations and stronger employee relationships.

Read on to explore the key updates and practical insights every HR professional should know.

Read More: 10 Things you Should Know Before Doing Business in IndonesiaEmployment laws in Indonesia

In Indonesia, employment is regulated by several key laws that ensure fair treatment and protect worker rights. The main legal foundations include:

- Manpower Law (originally from 2003, updated by the Job Creation Law and its latest amendments)

- Law on Labor Unions (Law No. 21 of 2000)

- Law on Industrial Relations Dispute Settlement (Law No. 2 of 2004)

These laws require employers to uphold the following employee rights:

- Minimum wage: Must comply with rates set by the region and industry.

- Social security: Includes healthcare, pensions, life and work accident insurance, and old-age savings.

- Religious holiday allowance (THR): Equal to one month’s salary, based on length of employment.

- Paid leave: Employees must receive statutory annual leave or compensation if unused.

- Overtime pay: Any extra hours worked must be compensated according to labor regulations.

These protections form the core of labor rights in Indonesia, helping create a more secure and fair workplace for all employees.

Read More: 9 Key Insights to Understand Business Culture in IndonesiaTypes of employment contracts in Indonesia

Employment in Indonesia generally falls under two main types: permanent and fixed-term contracts. Each serves different needs and comes with specific legal requirements.

1. Permanent employment contract (PKWTT)

This is a long-term agreement with no set end date. It’s typically used for ongoing roles and offers job security. Key points:

- Can include a probation period of up to 3 months.

- During probation, employees must be paid at least the local minimum wage.

- Employers are required to follow full termination procedures if ending the contract.

2. Fixed-term employment contract (PKWT)

Used for short-term or project-based work, this contract ends automatically when the term expires. The latest regulations now recognize three kinds of PKWT:

- Based on work completion (no strict time limit but must state estimated duration).

- Based on a fixed period (up to 5 years including extensions).

- Based on non-permanent work like seasonal or volume-based tasks (up to 20 workdays/month).

3. Other employment types

- Outsourced work contracts: Workers are hired through third-party providers. Contracts must include legal protections for the worker.

- Probation contracts: Only applicable to permanent jobs. Probation isn’t allowed for fixed-term contracts.

- Part-time contracts: For roles with fewer than 7–8 hours/day or 35–40 hours/week. Wages and hours are set by agreement, commonly used by students or casual workers.

Key aspects of a permanent employment contract (PKWTT) in Indonesia

For long-term employment in Indonesia, a Permanent Employment Contract (PKWTT) provides the most stability and legal protection for both employers and employees.

Below are the key elements that define how a PKWTT works and what rights and responsibilities it includes:

- Indefinite duration: The contract has no fixed end date and continues until lawfully terminated.

- Probation period: May include up to 3 months of probation to assess the employee’s performance.

- Written agreement: While not mandatory, a written contract is recommended. If not provided, an official appointment letter is required.

- Required details: Must include company and employee information, job description, salary, working terms, and both parties’ signatures.

- Employee benefits: Includes annual leave, sick leave, maternity leave, and any other benefits agreed in the contract.

- Termination process: Requires proper notice and may involve severance pay as per labor laws.

Minimum wages

In Indonesia, the minimum wage is set by local governments, either at the provincial or district level, based on recommendations from the regional wage council.

The decision takes into account several key factors:

- The local cost of living (purchasing power)

- Employment conditions (how easily people can find jobs)

- Wage fairness (measured by the median wage in similar roles).

This approach ensures that minimum wages reflect both economic realities and the well-being of workers in each region.

Working hour and overtime

To promote fair working conditions, Indonesian labor law clearly defines regular working hours and outlines how overtime should be paid.

Employees in Indonesia typically work 40 hours per week, which can be arranged in two ways:

- Five-day workweek: 8 hours per day

- Six-day workweek: 7 hours per day

If work goes beyond these limits—or takes place on weekends or public holidays—overtime rules apply. The summary below explains how overtime is calculated:

| Category | Details |

|---|---|

| Overtime Pay – Weekdays | – 1st hour: 1.5× hourly wage – Following hours: 2× hourly wage |

| Overtime Pay – Holidays (5-day week) | – 1st–8th hour: 2× – 9th hour: 3× – 10th+ hour: 4× |

| Overtime Pay – Holidays (6-day week) | – 1st–7th hour: 2× – 8th hour: 3× – 9th+ hour: 4× |

These rules ensure that employees are fairly compensated for any extra hours worked beyond the standard schedule.

Payroll in Indonesia

Managing payroll in Indonesia goes beyond processing salaries.

1. Social security contributions (BPJS)

Indonesia operates two main social insurance programs:

- BPJS Kesehatan (healthcare) covers various medical services including routine care, chronic illness, and major treatments. Contributions:

- 4% paid by the employer

- 1% paid by the employee

- Applied to a maximum salary of IDR 12 million/month.

- BPJS Ketenagakerjaan (employment protection), includes multiple schemes:

- Work accident insurance (JKK): 0.24%–1.74%, fully paid by employer (based on job risk level).

- Death insurance (JKM): 0.3%, paid by employer.

- Old age security (JHT): 3.7% employer, 2% employee

- Pension fund (JP): 2% employer, 1% employee, capped at a monthly salary of IDR 9,559,600, not applicable to expatriate workers.

2. Income tax for individuals

- Uses a progressive tax rate from 5% to 35%, based on annual income.

- Tax residents are taxed on both local and foreign income.

- Non-residents are only taxed on income earned in Indonesia, depending on treaty agreements.

- As of 2022, the lowest tax bracket increased to IDR 60 million, with a 35% tax rate added for income above IDR 5 billion annually.

3. Key notes for expatriates

- Expats must join BPJS Kesehatan and other employment-related protections (excluding pension).

- It’s recommended to consult with local tax professionals to understand personal tax obligations and eligibility for exemptions.

Read More: Company Expense Policy Guideline: How to Create & Start EasilyEmployee leave in Indonesia

Understanding local leave entitlements is key to staying compliant and supporting your team. Here’s a quick overview:

1. Annual leave

- 12 paid days per year after 12 months of work.

- One 6-day block is required annually.

- Unused leave expires after 6 months.

- Must be paid at 100% of salary.

2. Public holidays

- 12–15 national holidays, varying by year.

- Common holidays: Eid, Christmas, Independence Day, Chinese New Year.

- Not mandatory for all, but widely observed.

- Holidays falling on weekends may shift to weekdays.

3. Religious holiday bonus (THR)

- One month’s salary for employees with 1+ year of service.

- Pro-rated for those with less.

- Paid at least 7 days before religious holidays.

4. Sick leave

- Short-term: covered by annual or company sick leave policy.

- Long-term (with doctor’s note):

- 100% pay (first 4 months)

- 75% (next 4 months)

- 50% (following 4 months)

- 25% beyond 12 months

5. Maternity and paternity leave

- Maternity: 3 months paid (6 weeks before + after birth).

- Miscarriage: 6 weeks paid leave.

- Paternity: 2 days paid leave.

6. Family leave

- 3 days: employee’s wedding

- 2 days: child’s wedding/baptism or close family bereavement

- 1 day: death of a household member

7. Other leave

- Time off for job training, union duties, and election day (every 5 years).

8. Work-related injuries

- Usually covered by sick leave and insurance.

- Requires medical proof and proper documentation.

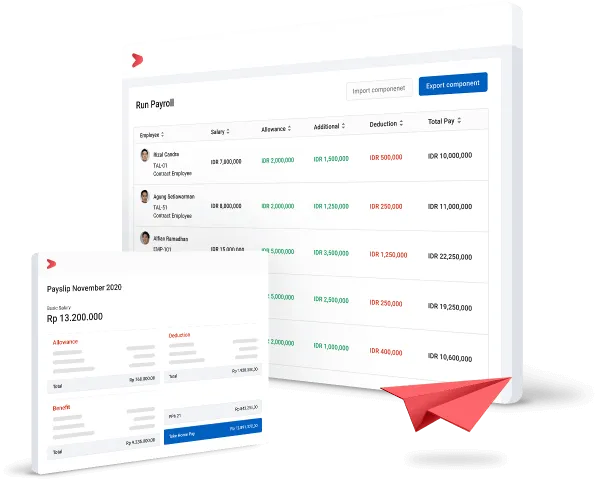

Managing employment & payroll efficiently with Mekari Talenta

Managing employment and payroll doesn’t have to be complicated, Mekari Talenta offers a seamless solution tailored for HR teams in Indonesia.

From automating payroll to tracking attendance, Talenta simplifies core HR processes while integrating effortlessly with Mekari Expense for managing reimbursements and Mekari Flex for handling employee benefits.

Everything your HR division needs, all in one connected platform. Discover how it can transform your HR operations.

References

Acclime. ‘’Understanding labour and employment laws in Indonesia’’

ASEAN Briefing. ‘’Employment and Labor Laws in Indonesia’’