Mekari Insight

- While spend management oversees company-wide expenditures and vendor relationships, expense management zooms in on employee-initiated costs, ensuring compliance and efficient reimbursement.

- Spend management makes high-level, strategic decisions to optimize all business spending, while expense management focuses on the day-to-day processing and control of employee expenses.

- Spend management software like Mekari Expense simplifies finance reporting by automating data collection and approval processes, ensuring accuracy and timely insights.

Managing company finances can be tricky, but understanding the difference between spend management vs expense management doesn’t have to be. While they might sound alike, each plays a unique role in your financial strategy.

Want to know which one can help you streamline day-to-day costs and which one sets you up for smarter long-term decisions? Let’s dive into the key differences of spend management vs expense management and explore how each can impact your business.

What is expense management?

Expense management refers to the structured process of tracking, approving, reimbursing, and auditing employee-initiated expenses, such as travel, meals, lodging, or office supplies.

It ensures these costs comply with company policies, adhere to regulatory standards, and are processed efficiently. Also, it helps organizations maintain financial control, ensure policy compliance, and streamline operational efficiency.

Why use expense management?

- Makes sure expenses follow company guidelines, preventing misuse and keeping things compliant with regulations.

- Simplifies submitting and approving expenses, cutting down on tedious manual work for employees and finance teams.

- Organizes expense data to help predict future costs, making budgeting easier and more reliable.

- Pays employees back quickly and fairly, showing they’re valued and boosting their morale.

- Catches unnecessary spending, like overpriced travel, to keep budgets tight and save money.

Read more: How to Track Business Expenses EasilyWhat is spend management?

Spend management is the comprehensive process of overseeing, controlling, and optimizing all of a company’s expenditures to align with its strategic objectives. It covers everything from buying supplies to paying vendors.

It’s about making smart choices to get the best value while supporting business goals like growth or efficiency.

Why use spend management?

- Finds smarter ways to buy, like negotiating better deals with suppliers, to save money without sacrificing quality.

- Spots potential problems, like relying too much on one vendor, and helps fix them before they hurt the business.

- Shows exactly where money goes, making it easier to plan budgets and avoid surprises.

- Ensures spending supports big goals, like choosing eco-friendly suppliers to match a company’s values.

- Speeds up buying with clear rules and tools, so teams spend less time on paperwork and more on their work.

The difference between spend management vs expense management

While both expense management and spend management aim to optimize a company’s financial efficiency, they differ significantly in scope, focus, and approach, as outlined below.

| Aspect | Spend Management | Expense Management |

|---|---|---|

| Focus | Comprehensive oversight of all organizational expenditures | Costs primarily driven by employees |

| Scope | Wide-ranging perspective, covering indirect costs and purchasing strategies | Detailed attention to specific expense categories (e.g., travel, meals, etc.) |

| Approach | Strategic, guiding vendor partnerships, procurement plans, and high-level decisions | Operational, managing the daily handling and processing of expenses |

Expense management works by:

- Employees submit expense reports (e.g., receipts for travel or meals) via an app or system.

- Managers or software review submissions for policy compliance (e.g., checking if a hotel stay exceeds the allowed rate).

- Approved expenses are paid back to employees, and records are updated for accounting.

- Tracks expense patterns to identify areas for cost control (e.g., frequent overspending on client dinners).

For instance, a sales team submits receipts for client lunches and flight tickets. The expense management system reviews the receipts to ensure they follow company guidelines, such as a $150 cap for hotel stays.

Once approved, the system processes the reimbursement and categorizes the expenses for accounting. The system also tracks spending trends to prevent over-expenditure on recurring items like client dinners.

Meanwhile, spend management involves:

- Aggregates all spending data (e.g., vendor payments, contracts, indirect costs like utilities) into a centralized system.

- Identifies patterns, inefficiencies, or opportunities for savings (e.g., consolidating suppliers)

- Guides high-level choices like negotiating bulk discounts or selecting long-term vendors.

- Tracks spending trends to ensure alignment with budgets and goals.

For example, a retailer reviews both store maintenance costs and supplier payments for inventory.

By consolidating services like cleaning into one contract across all locations, the retailer can reduce costs. Strategic decisions, such as partnering with a single logistics provider, help secure better rates through long-term contracts.

How expense management can help finance reporting

While spend management gives a broad overview of company-wide spending, let’s dive deeper into how expense management, specifically, plays a key role in improving the accuracy and efficiency of financial reporting.

Expense management can transform finance reporting by streamlining and automating the process, making it faster, more accurate, and hassle-free.

- Automates data collection and categorization, eliminating the need for manual data entry and reducing errors.

- Provides immediate visibility into expenses as they occur, helping finance teams stay on top of spending.

- Speeds up the approval process, ensuring timely and accurate reporting without delays.

- Generates detailed reports with just a few clicks, providing clear insights into trends, budgets, and cost allocation.

- Ensures all expenses follow company policies, reducing the risk of errors or non-compliance in financial reports.

- Empowers finance teams to identify areas for cost-saving and make informed financial decisions.

Expense management isn’t just about tracking expenses—it simplifies the entire process and enables smarter, data-driven decisions.

Expense management recommendation for all industry

No matter your industry, managing expenses doesn’t have to be complicated.

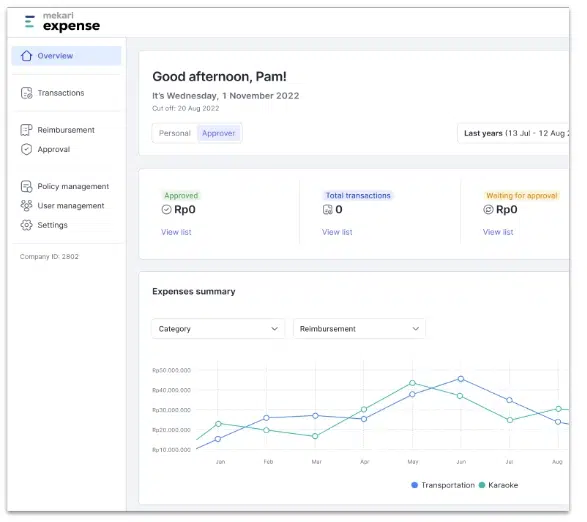

With Mekari Expense, you get an all-in-one spend management platform that makes handling company spending, reimbursements, reporting, and payments smooth and effortless.

Its powerful features give businesses the control they need, so they can focus on what really matters: growth.

Here’s how Mekari Expense helps you stay ahead:

- Automated reimbursements: Speed up reimbursements with automation—faster and error-free.

- Bills: Keep everything organized and process invoices without the hassle.

- Business Trip: Manage business trip expenses easily, keeping things coordinated.

- Mekari Corporate Card: Issue virtual or physical company cards for simple, streamlined spending.

- Budget allocation: Allocate and track budgets easily with integrated tools.

- International Remittance: Make international transactions simple with real-time currency exchange.

- Sync with accounting software: Integrated with Mekari Jurnal to ensure your expenses match your financial reports.

Choosing Mekari Expense means getting a reliable partner to reduce manual work and bring clarity to your financial operations—making it the perfect expense management solution for any business.

References

Expensify. ”Expense management vs. spend management”

Sievo. ”What is Spend Management and Why Is It Important?”