Mekari Insight

- Expense management software helps businesses save time, reduce errors, and keep all spending transparent.

- Different tools cater to different needs, from simple reimbursements for SMBs to advanced compliance for global enterprises.

- Mekari Expense is the most complete spend management solution for businesses in Indonesia, offering automated reimbursements, corporate cards, budget controls, and integration with Mekari Jurnal — all in one platform.

Expense management software is a tool that helps businesses record, track, and control company spending in a simpler way. Instead of dealing with paper receipts or messy spreadsheets, everything can be managed digitally — making the process faster and more accurate.

By using this kind of software, companies save time, reduce errors, and keep spending transparent. Finance teams can see expenses in real time, while employees find it easier to submit claims and get reimbursed. The overall impact is better control over budgets and healthier financial decisions for the business.

Expense management software recommendations

Here are some of the best expense management software solutions that can help you streamline and control your company’s expenses more effectively:

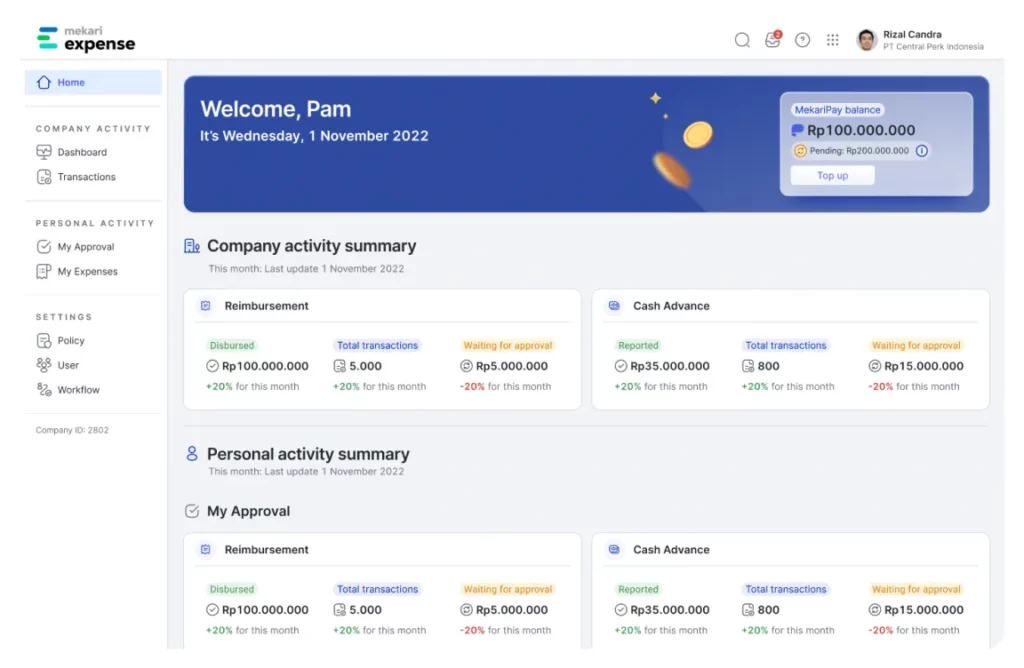

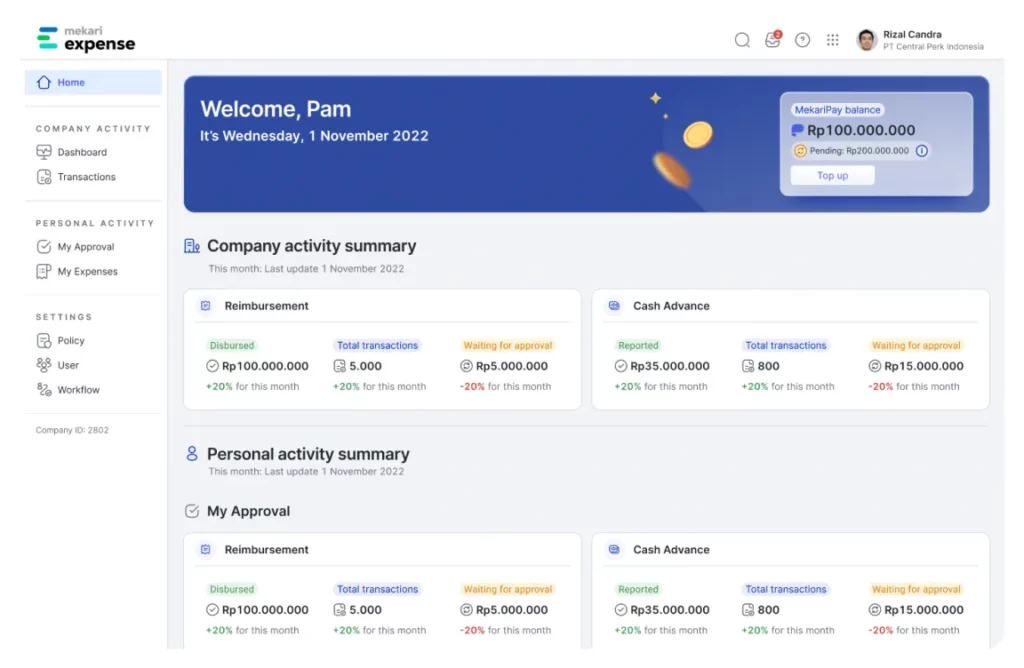

1. Mekari Expense

Mekari Expense is a spend management system that unifies travel, purchasing, invoice, and card expenses into one system. Built with a strong focus on SMEs in Southeast Asia, it helps companies simplify financial reporting, stay compliant, and gain better control of spending.

The platform provides complete control over the entire spending process—from reimbursements, corporate cards, and business travel to bill payments—all integrated into a single intuitive dashboard.

This enables finance, operations, and management teams to work faster, more accurately, and more efficiently.

Best features:

- Automated Reimbursement: Speed up claims and payouts seamlessly.

- Mekari Limitless Card: Create physical and virtual cards for business transactions directly from the app.

- Budget Allocation: Set and monitor budgets with a structured account system.

- International Remittance: Transfer payments abroad quickly and in real-time.

- Mekari Jurnal Integration: Sync directly with the accounting system for automated reporting.

- Purchase Management: Automate procurement processes and maintain full control over expenses.

- Business Travel Management: Easily manage and track employee travel costs with transparency.

With its comprehensive features, Mekari Expense is the ideal solution for companies looking to manage the entire expense cycle within one integrated system.

It enhances transparency, efficiency, and flexibility—empowering businesses to maintain better financial control and make faster, data-driven decisions.

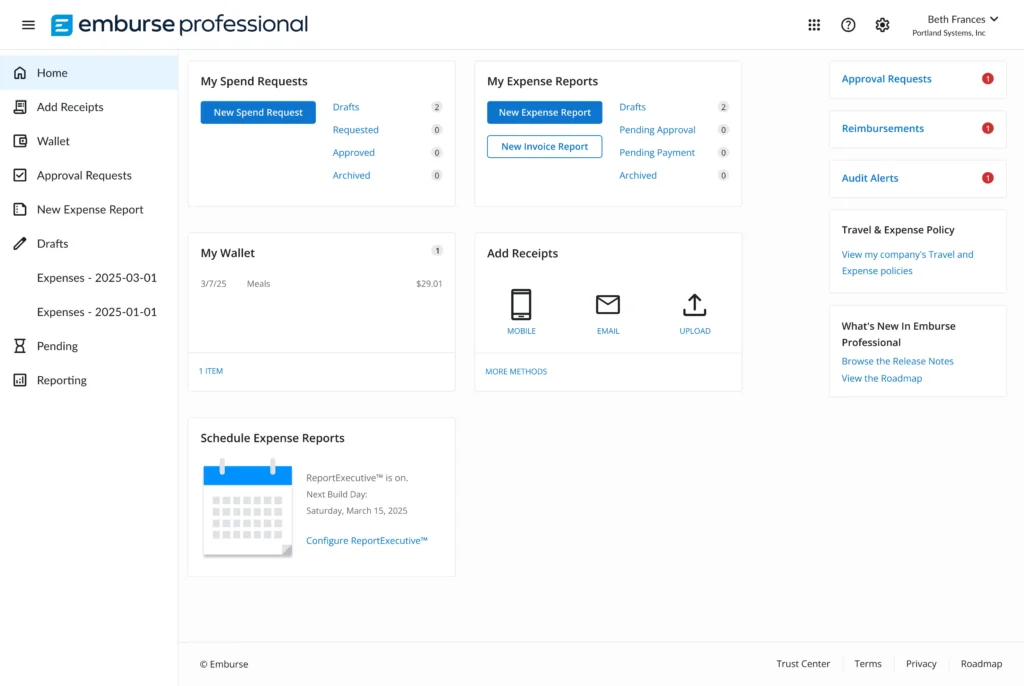

2. Emburse

Emburse is an enterprise-focused expense management solution designed to deliver deep insights and strong automation.

It stands out with advanced analytics dashboards and policy enforcement features, making it ideal for organizations that prioritize compliance and data-driven decision-making.

Best features:

- Analytic dashboards: Over 40 dashboards provide real-time spend insights.

- Automated audits: Policy checks and approvals run automatically.

- Offline receipt capture: Employees can upload receipts even without internet.

- Custom policies: Configure rules that match complex business needs

- Credit card integration: Available in advanced plans for seamless card tracking.

- Cross-platform access: Accessible from both desktop and mobile devices.

Pricing: Quote-based, positioned for enterprise budgets.

Limitations / cons: Features may be excessive for small teams, and advanced card options require premium plans.

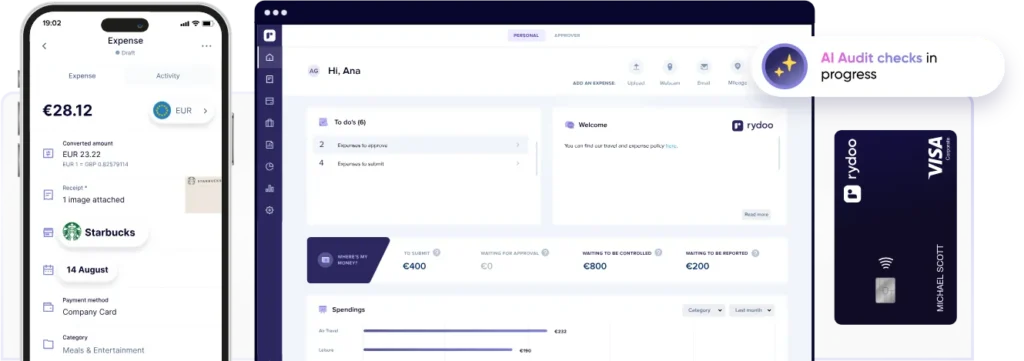

Read more: How to Manage & Track Marketing Expenses with Expense Card3. Rydoo

Rydoo is a globally compliant, AI-powered expense platform designed for multinational companies.

Its key strength is combining automated policy enforcement with international tax and regulatory support, helping organizations manage expenses consistently across borders.

Best features:

- AI audits: Detects policy violations automatically.

- Global compliance: Supports international tax and expense regulations.

- Instant validation: Expenses can be approved in real time.

- Multi-currency support: Handles expenses across different currencies.

- Mobile receipt scanning: Employees can upload receipts on the go.

- Policy enforcement: Automatically ensures expenses follow company rules.

Pricing: Starts at about $10 per user per month.

Limitations / cons: Less flexible for highly customized or legacy workflows.

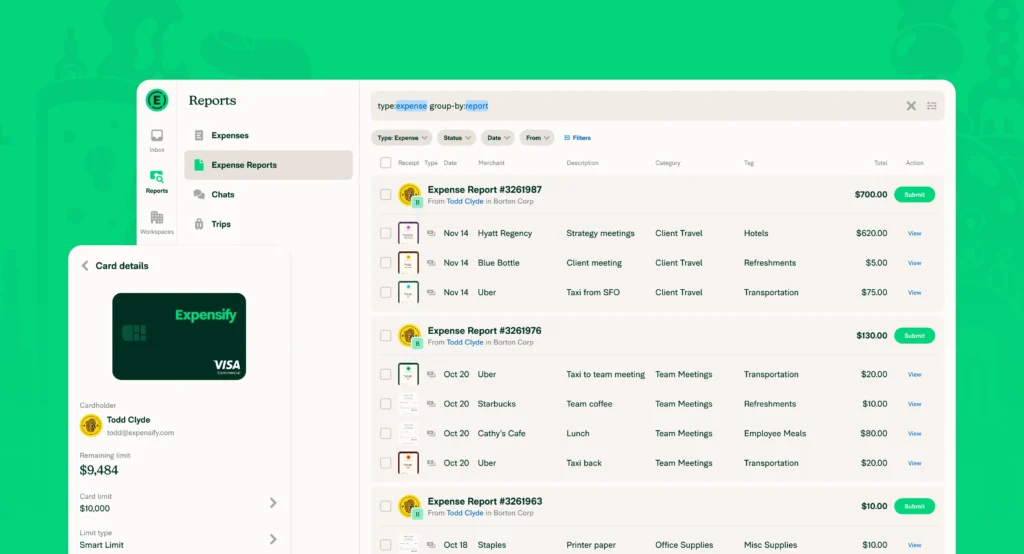

Read more: How to Track Business Expenses Easily4. Expensify

Expensify is a simple, user-friendly tool built for small and medium businesses that want quick reimbursements and easy reporting. Its strength lies in automation and ease of use, making expense management feel more like a chat than a chore.

Best features:

- Chat-style dashboard: Makes expense reporting more interactive and easy to follow.

- Smart receipt scanning: Uses OCR to capture expense data automatically.

- Quick reimbursements: Speeds up approval and payout cycles.

- Software integrations: Connects with QuickBooks, Xero, and other accounting tools.

- Basic policy enforcement: Simple rules to guide employee spending.

- Multi-device access: Works on both web and mobile.

Pricing: $5 per user per month for basic features, $9 per user per month for full access.

Limitations / cons: Limited corporate card support outside the US and lacks enterprise-level controls.

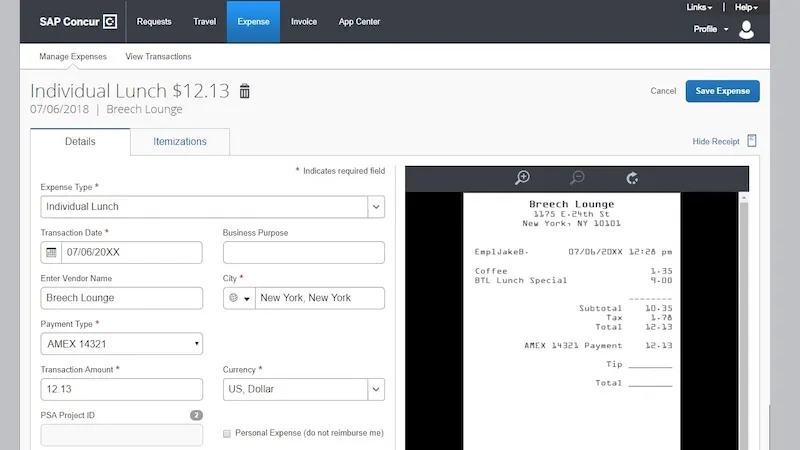

Read more: Company Expense Policy Guideline: How to Create & Start Easily5. SAP Concur

SAP Concur is a market leader in enterprise-grade travel and expense management.

It is best known for its ability to integrate with ERP systems and ensure compliance across multiple regions, making it a trusted choice for large multinationals with complex financial structures.

Best features:

- Travel integration: Connects booking directly to expense management.

- Audit tools: Automated fraud detection and compliance controls.

- Tax compliance: Supports multiple countries and tax frameworks.

- Customizable workflows: Adjust approval routes for complex setups.

- ERP integration: Syncs with SAP and other major financial systems.

- Mobile capture: Submit expenses while traveling.

Pricing: Custom pricing depending on company size and complexity.

Limitations / cons: High implementation costs, long setup time, and best suited for large organizations.

6. Pleo

Pleo is a modern, card-first expense management platform built for startups and SMEs in Europe.

Its strength lies in combining prepaid corporate cards with an intuitive mobile app, giving finance teams real-time visibility and employees a frictionless way to manage expenses.

Best features:

- Prepaid cards: Issue physical and virtual cards instantly.

- Spend visibility: Finance teams can monitor spending in real time.

- Mobile-first experience: Employees capture receipts and submit claims via app.

- Flexible spend controls: Set spending limits by team or purpose.

- Auto-categorization: Transactions are sorted into categories automatically.

- Multi-currency support: Useful for international business trips.

Pricing: Quote-based, scalable for SMEs and startups.

Limitations / cons: Limited availability outside Europe and less effective for non-card expenses.

7. Wallester

Wallester is a fintech-focused expense platform that specializes in fast issuance of physical and virtual corporate cards.

Its key strength is flexibility and developer-friendly API integration, making it ideal for startups or fintechs that want to customize expense workflows and card programs.

Best features:

- Instant card issuance: Generate new physical or virtual cards in minutes.

- Transaction monitoring: Track spending in real time.

- API integrations: Connects easily with ERP and other software.

- Custom branding: Design cards and portals with company identity.

- Spend controls: Set flexible restrictions for employees.

- Funds management: Manage card balances and cash flow efficiently.

Pricing: Quote-based, depending on features and usage.

Limitations / cons: Still relatively new with smaller market presence compared to global leaders.

8. Zoho Expense

Zoho Expense is an affordable tool that belongs to the wider Zoho business suite. Its biggest advantage is seamless integration with Zoho Books, CRM, and third-party apps, making it a cost-effective choice for small businesses that already use Zoho tools.

Best features:

- Receipt scanning: Upload and process receipts automatically.

- Mileage tracking: Record travel costs with GPS-based logging.

- Multi-currency support: Manage expenses in different currencies.

- Approval workflows: Automates approval chains for faster processing.

- Zoho integration: Works seamlessly with Zoho Books, CRM, and third-party apps.

- Policy enforcement: Basic checks for employee compliance.

Pricing: Free for up to 3 users; paid plans start at $5 per user per month.

Limitations / cons: Better suited for smaller teams; lacks advanced features for enterprises.

9. Brex

Brex is a corporate card and expense management platform built for startups and high-growth companies in the US.

Its strength lies in combining flexible corporate credit with real-time expense tracking and financial management tools, making it especially useful for venture-backed businesses.

Best features:

- Corporate credit cards: Designed for startups with flexible terms.

- Real-time tracking: Monitor spending as it happens.

- Fast reimbursements: Automates employee payouts.

- Software integrations: Works with popular accounting platforms.

- Employee cards: Issue multiple cards with individual controls.

- Cash management: Built-in account and financial tools.

Pricing: No annual fees, with terms based on credit profile.

Limitations / cons: Available only to US-based companies; requires strong financial credentials.

10. Airbase

Airbase is an all-in-one spend management platform that combines corporate cards, reimbursements, and bill payments.

Its strength is offering mid-sized companies a unified way to manage spending while scaling financial operations with tighter control and compliance.

Best features:

- Unified spend management: Covers reimbursements, bills, and cards in one tool.

- Real-time reporting: Provides instant insights into spending.

- Approval workflows: Flexible routes for different departments.

- Accounting sync: Integrates with QuickBooks, Xero, and NetSuite.

- Virtual cards: Issue cards for employees or projects.

- Audit trail: Keeps a detailed log for compliance.

Pricing: Custom, quote-based pricing depending on features.

Limitations / cons: Setup can take time, and pricing is not transparent.

The best expense management software for corporate & business

When it comes to managing corporate spending, efficiency and control are essential. Among the many solutions available, Mekari Expense stands out as the best option for businesses in Indonesia.

More than just an expense management tool—Mekari Expense is a spend management system that provides a complete financial control system designed to simplify every stage of expense management.

Why Mekari Expense is the best choice:

- Automated reimbursements that cut down manual processes and speed up payouts.

- Mekari Limitless Card (physical & virtual) for seamless business transactions.

- Budget allocation tracking to keep spending within control.

- International remittance with fast, real-time transfers.

- Integration with Mekari Jurnal for automated accounting and reporting.

- Purchase management tools that streamline procurement from start to finish.

- Business travel management for easier and more transparent handling of travel costs.

For organizations aiming to scale, optimize resources, and ensure accountability across teams, Mekari Expense delivers everything needed in one integrated platform.

Start transforming the way your company manages expenses today with Mekari Expense.