Mekari Insight

- With contract positions in tech tripling in two years, companies must rethink how they manage expenses to keep operations seamless and cost-effective.

- Businesses must choose between corporate, prepaid, virtual, and travel cards based on their spending patterns, contractor needs, and financial control preferences.

- With Mekari Limitless Card, you can choose between physical cards for everyday transactions or virtual cards for safe online payments—giving you the flexibility to manage contractor expenses with ease.

With the rapid increase in contract roles, especially in the tech industry, managing expenses for contract employees has become a key challenge for businesses. According to recent LinkedIn data, the number of job postings for contract roles in the technology sector has tripled in the last two years.

As more companies turn to contract workers, finding efficient ways to handle business expenses is crucial. One of the most effective solutions is providing expense cards to streamline spending, increase control, and reduce administrative burden.

In this article, we’ll explore the top expense card for contract employees recommendations and share tips on how to choose the best one to meet the needs of your contract workforce.

What is an expense card for contract employees

An expense card for contract employees allows them to make business-related purchases directly using company funds.

Instead of employees waiting for approvals or dipping into their own pockets, they can use company-provided funds to purchase materials, office supplies, or other work essentials instantly.

For you, as a business leader, this means:

- More control: Set spending limits and track expenses in real time.

- More efficiency: No more chasing receipts or processing reimbursements.

- More oversight: See exactly where company funds are going, per employee.

Kinds of expense card for contract employees

Business owners have several options when choosing expense cards for contract employees. Each type of employee expense cards serves a specific purpose, offering different levels of control, flexibility, and perks.

1. Corporate cards

Corporate cards are an effective way for businesses to handle expenses, offering both credit and debit options. With corporate credit cards, contractors can make purchases for business needs, with the company either directly covering the expenses (corporate liable) or reimbursing contractors who pay upfront (individually liable).

On the other hand, corporate debit cards are directly linked to the company’s bank account, allowing businesses to avoid interest fees and credit lines. These cards are often easier to obtain, even for companies with less established credit.

Read more: Business Debit Card vs Corporate Credit Card: Which One’s Better?2. Virtual cards

A digital-first alternative, virtual cards can be accessed from any device, making them ideal for remote workers and online transactions.

Many expense card providers offer virtual versions of corporate, fuel, and travel cards, ensuring flexibility while maintaining security and spending controls.

3. Travel cards

For businesses with frequent travel expenses, these cards offer higher rewards on flights, hotels, and transportation costs.

While they maximize savings on travel, they’re less useful for everyday business purchases due to limited benefits outside of travel-related spending.

Read more: Top Benefits of Business Travel Expense Card & Recommendation4. Prepaid cards

Prepaid cards are a budget-friendly option where the company preloads a fixed amount onto the card. Contractors can only spend the preloaded amount, which limits overspending.

Prepaid cards don’t require a credit check, making them accessible for businesses with less favorable credit histories. While they typically don’t offer perks or rewards, they provide strict spending limits and financial control.

Read more: Prepaid Business Expense Cards: Simplifying Business Spending5. Fuel cards

Designed for businesses with transportation needs, fuel cards offer discounts on gas and diesel, helping to cut costs in industries like logistics and trucking.

Some fuel cards also cover vehicle maintenance and repairs and come with built-in reporting tools to comply with regulation standards.

Benefits of using expense card for contract employees

Expense cards offer a range of benefits that make managing contractor expenses smoother and more efficient, both for the company and the contractors themselves.

These employee expense cards bring convenience, safety, and more control over business spending.

1. Convenient access to funds

With expense cards, contractors can easily access the funds they need for business-related expenses. Companies pre-fund these cards, setting clear limits and eligible expense categories, so contractors don’t have to worry about approvals.

This instant access is much more efficient than the old method of using personal credit cards and submitting reimbursement requests, which can be time-consuming for both the contractor and the company.

2. Streamlined expense reporting

Employee expense card providers often offer built-in analytics that track spending in real-time. This means companies can get a clear view of where funds are being used, how much is being spent, and break down expenses by category.

This is especially helpful for businesses that want to maintain tight control over their budget. Many providers also allow integration with accounting software, making the expense reporting process even faster and more efficient.

3. Safer and more organized spending

Unlike using a single company card that can be difficult to track, xpenses card for employees give businesses the ability to set limits for each contractor and categorize spending by type.

This not only helps reduce the risk of fraud but also ensures that each contractor only spends within their designated budget. It’s an effective way to manage expenses without losing sight of where the money is going.

4. Clear separation of personal and work expenses

For contractors who use their personal credit cards for business expenses, managing personal and work-related purchases can get confusing. Expense cards make it easy to separate these, reducing the chances of accidental mixed charges.

This clear distinction makes it simpler for contractors to manage their finances while also making it easier for companies to audit expenses.

Key considerations before choosing expense card for contract employees

While security, international use, and integration with software are all crucial, let’s dive into some of the deeper factors that could make all the difference.

1. Customization and control options

Customization is key to controlling business expenses. Many card providers offer features that allow companies to:

- Set spending limits for contractors

- Restrict purchases to specific vendors or categories

- Limit spending on certain days or during international transactions

These options give companies better control over how contractors spend funds and ensure compliance with company policies. Some cards even allow contractors to request additional funds when necessary, making it easier to handle unexpected expenses.

2. Integration with expense management software

If your business already uses accounting or financial software, you’ll want to ensure the expense card is compatible with the systems.

The right card should integrate seamlessly with your current programs, making the process of tracking expenses, generating reports, and managing budgets easier. Many prepaid card providers offer software compatibility, making it simple to import transaction data directly into accounting programs.

Before selecting a provider, check if integration options are available. Testing this through a trial run can save you time and frustration later on.

Read more: Best 10 Employee Expense Reimbursement Software3. Fee structure and accessibility

When it comes to fees, it’s crucial to look beyond the basic monthly charges. Some expense card providers offer tiered pricing based on your company’s needs, with extra perks tied to premium options, like higher spending limits or exclusive benefits.

If your business plans to scale up or expand, it’s worth investigating whether the card provider can grow with you by offering a range of flexible packages that suit different stages of business development.

4. Reports

What really sets the best expense cards apart is the ability to auto-generate reports that not only save time but boost financial clarity. These reports give you a comprehensive view of your spending across all departments, down to the last cent.

Having detailed transaction history can help you spot spending trends and fine-tune budgets for different teams or projects.

But here’s something extra: real-time reporting. With certain providers, you can access data instantly, allowing you to make informed decisions quickly. Whether you’re managing cash flow or auditing spending, being able to track and analyze expenses in real-time gives you an edge.

5. Security features

Security is about ensuring that your business remains safe from unauthorized transactions. Many top-tier providers offer advanced fraud protection like real-time transaction alerts, encryption, and tokenization.

Furthermore, you can set spending limits or lock cards temporarily if a suspicious transaction occurs. The more security layers the provider offers, the more peace of mind you’ll have knowing your business is protected.

Expense card recommendation for contract employees

Choosing the right expense card for contract employees can make expense management smoother, improve financial oversight, and provide better control over spending.

Below are some of the best options, each with unique features tailored to contract workforce needs.

1. Mekari Limitless Card

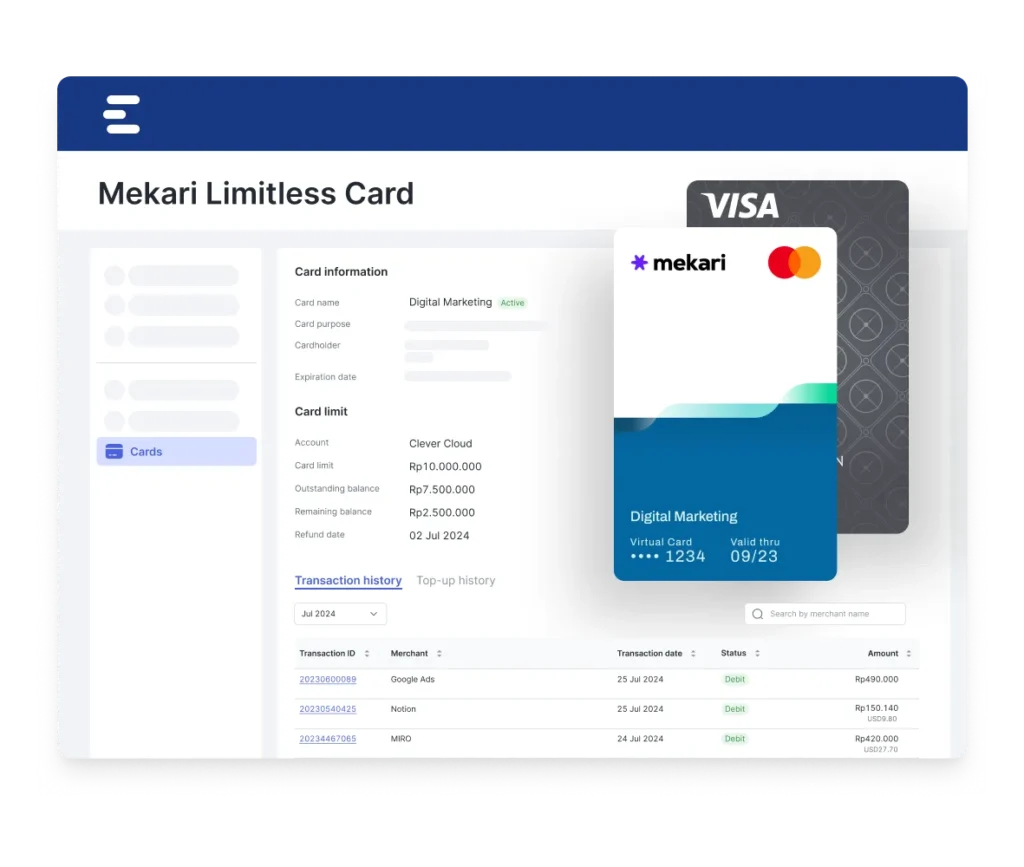

Mekari Limitless Card offers two options to suit different business needs:

- Physical cards: Ideal for in-person transactions, purchases, and managing contractor expenses that require a physical payment method.

- Virtual cards: A secure, digital option for online transactions, vendor payments, and team-based budgeting with better control and real-time tracking.

Both options come with several features that making financial management smoother for businesses working with contract employees, such as:

- Real-time expense tracking: Transactions are automatically recorded, offering full financial transparency and helping businesses make quick, accurate decisions.

- Easy online application: Apply and activate the Mekari Limitless Card entirely online, with immediate access to funds for contract employees.

- Flexible usage: Assign cards to specific teams or departments with adjustable spending limits, allowing for better budget control.

- Secure online transactions: Virtual cards come with unique numbers and customizable budgets for better control over spending, including automatic subscription payments.

- Global acceptance: Mekari virtual cards, powered by Mastercard, are accepted by over 30 million merchants worldwide, ideal for international and remote contractor expenses.

- Integrated with accounting software: Easily sync expense data with accounting tools to simplify financial tracking and reporting.

- Creating as many virtual cards as needed incurs no extra costs

- A dashboard is available to evaluate employee spending and optimize future budget planning

- There are no limits on the number of debit cards issued, offering flexibility to meet business needs

- New users may need a brief period to get familiar with the interface, though the process is straightforward with the provided dashboard

It offers real-time tracking, flexible spending limits, and global acceptance, ensuring secure and controlled payments for both in-person and online transactions.

2. Bento for Business Card

Bento for Business offers a prepaid model, allowing companies to assign fixed budgets to contractors. This ensures spending stays within set limits, preventing unexpected overages.

- User-friendly dashboard for tracking expenses in real-time

- Instant card issuance for quick access to funds

- Customizable spending limits for each contractor

- Basic reporting features compared to competitors

- Prepaid model may restrict cash flow flexibility

- Limited integration with accounting software

If your business relies on a contractor workforce, Bento provides the right balance of control and flexibility for managing payments efficiently.

3. Airbase Corporate Card

The Airbase Corporate Card is ideal for businesses that need both physical and virtual cards for contract employees.

It provides automated expense approvals, real-time tracking, and seamless vendor payments, ensuring easy expense management for remote and on-site workers.

- Detailed reporting features for in-depth expense tracking

- Built-in vendor payment integration for smooth transactions

- Strong spending controls to manage contractor expenses

- High fees for international transactions

- Limited integration with some external systems

- Occasionally slow interface and transaction processing

4. PEX Card

PEX is a great fit for companies with multiple contractors who need customized spending controls and automated payments.

The integration with accounting software makes financial tracking easier, while the ability to issue prepaid virtual and physical cards ensures contract employees get access to business funds when needed.

- Automated vendor payment solutions

- Integrates with QuickBooks, Xero, Sage, and Zapier

- No maximum balance limit on the main account

- 1% cashback on eligible purchases

- Lengthy application process

- Foreign transaction fees can be costly

- Higher setup and monthly fees compared to other options

Seamless integration & reporting for expense usage with Mekari Expense

Mekari Expense makes managing contractor expenses simple and efficient. Mekari Limitless Card offers both physical cards and virtual cards, making it easy to choose the right option based on your business needs.

Whether you need physical cards for in-person transactions or virtual cards for secure online payments, Mekari provides flexibility to manage contractor expenses effectively.

- The card features real-time expense tracking, where every transaction is automatically recorded.

- Applying for and activating the Mekari Limitless Card is completely online, providing instant access to funds for contractors.

- You can assign cards to specific teams or departments, set adjustable spending limits, and maintain better control over your budget.

- With global acceptance powered by Mastercard, Mekari virtual cards are ideal for international and remote contractor expenses.

- The integration with accounting software simplifies financial tracking and reporting, making it easier to manage your expenses.

Try Mekari Limitless Card now to efficiently manage contractor expenses, maintain control over budgets, and streamline your financial processes!