Mekari Insight

- CRM and accounting integration ensures customer and financial data stay in sync, reducing errors and duplicate entries.

- Automated invoicing, payment tracking, and reporting speed up workflows and improve cross-team collaboration.

- Mekari Officeless provides flexible low-code/no-code integrations, making it easier for businesses in Indonesia to connect any software with the Mekari ecosystem.

Many businesses struggle with disconnected systems; sales teams manage customer data in a CRM while finance teams handle invoices and payments in separate accounting software.

This siloed setup often leads to duplicate data entry, delayed updates, and reporting errors that slow down decision-making. CRM accounting integration solves these issues by synchronizing customer and financial data in one flow.

With both systems connected, companies can speed up invoicing, improve forecasting accuracy, and boost overall productivity; ultimately turning customer insights into measurable business growth.

Benefits of CRM & accounting integration

Bringing CRM and accounting together creates a single hub for customer and financial data. Instead of juggling two systems, businesses get real-time visibility into revenue, cash flow, and customer value. Here are the key benefits:

1. Improve sales forecasting & pipeline visibility

When sales and finance data are connected, forecasts become more accurate because they’re based on actual spending and payment patterns.

Teams can also spot upsell or cross-sell opportunities and monitor deal progress in real time, leading to better alignment between sales and finance.

2. Streamline invoicing & collections

Integration removes the need for duplicate data entry. Invoices can be generated automatically once a deal closes, and reminders for overdue payments are sent without delay.

This speeds up the invoicing process, reduces errors, and helps maintain a healthier cash flow.

3. Enhance customer insights & personalization

With financial data available in CRM, businesses gain a clearer view of customer value and behavior. This makes it easier to tailor offers, run targeted campaigns, and identify at-risk customers.

As a result, companies can strengthen relationships and increase loyalty.

4. Make smarter, data-driven decisions

Having a unified perspective helps leaders allocate resources strategically and focus on profitable segments.

Decisions about sales, marketing, and product development are supported by accurate insights that combine both customer engagement and financial performance.

5. Boost efficiency & team productivity

Switching between multiple systems wastes time. Integration eliminates repetitive tasks, reduces errors, and allows sales and finance to collaborate seamlessly.

Teams work faster and spend more time on strategic tasks that directly drive business growth.

6. Time savings

Automating routine tasks like invoicing, posting, and reconciliation frees employees from manual work. The time saved can be redirected to higher-value activities such as customer engagement and long-term planning.

7. Real-time automatic posting

Transactions from CRM can be instantly recorded in the accounting system. This keeps financial data up to date at all times, ensuring timely reporting and more reliable decision-making.

CRM and accounting software integration use case

Integration is building automated workflows that make operations faster, more accurate, and more efficient. Below are five of the most impactful use cases businesses can implement right away:

1. Synchronization of customer and transaction data

With integration, every new customer or transaction entered into the CRM is instantly reflected in the accounting system.

This eliminates duplicate data entry, reduces administrative errors, and ensures both teams are always working with the same up-to-date information. The result is smoother collaboration between sales and finance, and less time wasted fixing inconsistencies.

2. Automatic invoice generation when a deal closes

Instead of waiting for manual handover, invoices can be generated automatically in the accounting system the moment a deal is marked as closed in CRM.

This accelerates the billing process, improves accuracy, and helps cash flow by ensuring invoices reach customers without delay. Businesses benefit from faster revenue recognition and fewer payment disputes.

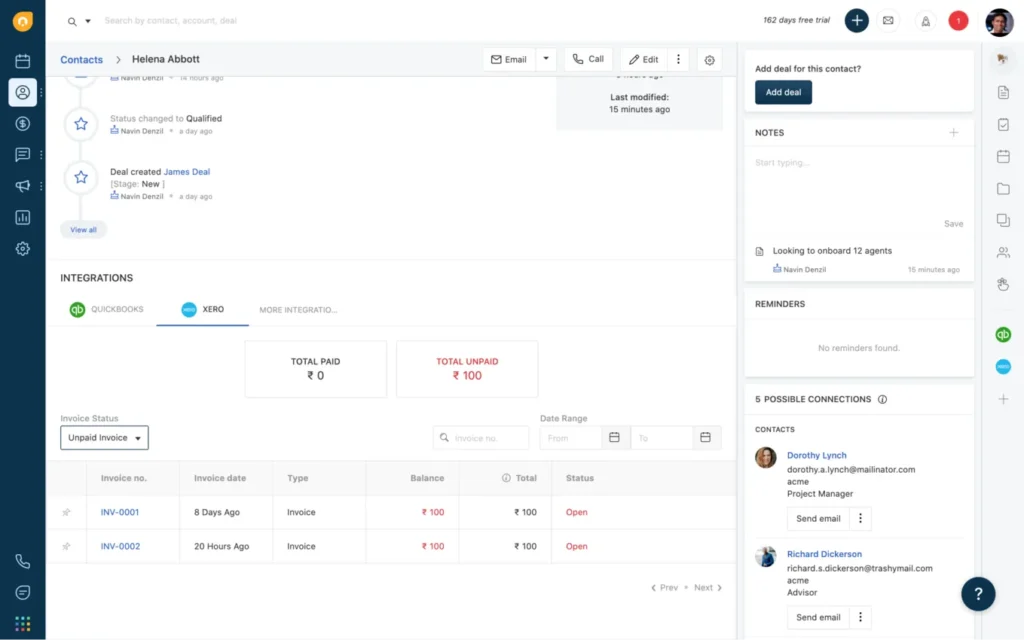

3. Monitoring payment status directly in CRM

Sales teams no longer need to chase finance for payment updates. By integrating systems, invoice status; whether paid, pending, or overdue; appears directly in the CRM.

This transparency allows sales to follow up confidently with clients, maintain professional relationships, and coordinate better with finance on collections.

4. Bill reminder automation

Automated reminders can be scheduled and sent via email or WhatsApp before invoice due dates. This reduces late payments and makes the billing process more systematic.

Customers appreciate the timely, polite reminders, while businesses maintain healthier cash flow and lower the administrative burden on their teams.

5. Unified financial and sales reporting

Integration makes it possible to generate comprehensive reports that combine sales activity with financial data.

Profit and loss statements, cash flow overviews, and performance dashboards become more accurate and timely. Management gains a clearer view of business performance, enabling them to make smarter, data-driven decisions that support growth.

Best CRM & accounting software integration tools

Integrating CRM and accounting software has become essential for businesses aiming to streamline operations, reduce manual work, and improve customer and financial data consistency.

Below are some of the best CRM and accounting software integration tools you can consider, along with their key capabilities.

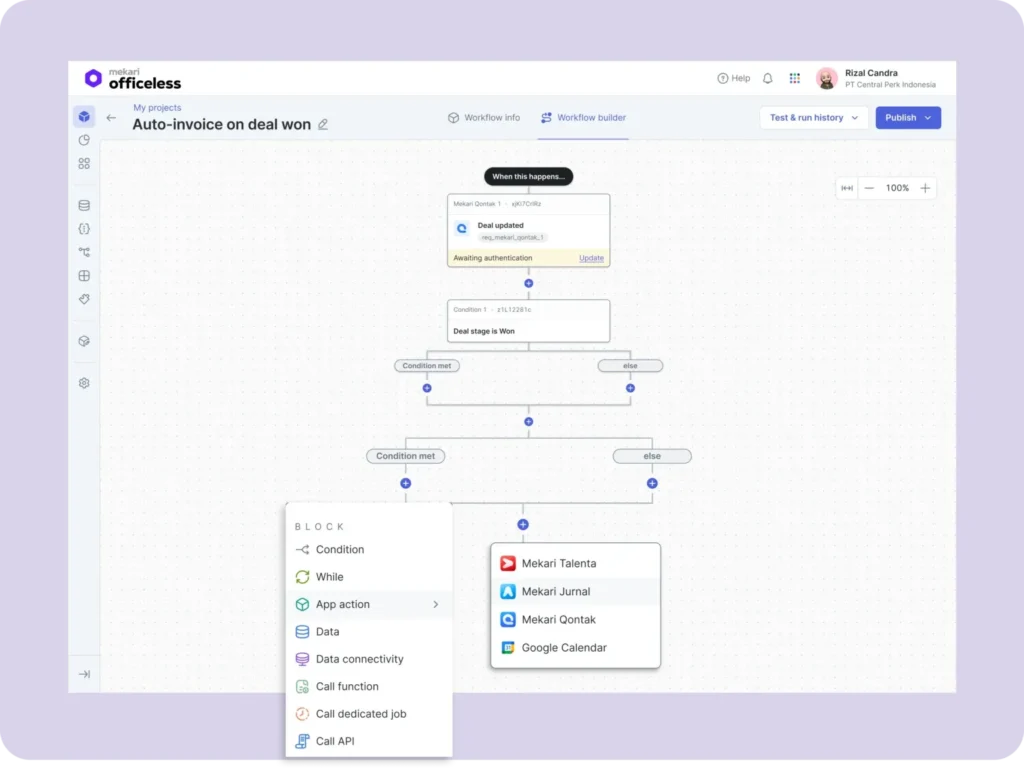

1. Mekari Officeless

Mekari Officeless is a custom software and low-code/no-code platform designed to help businesses in Indonesia build tailored solutions and connect different applications with ease.

As part of the Mekari ecosystem, it enables organizations to integrate their existing tools with Mekari’s suite of products—such as accounting, CRM, and HR software—without the need for heavy development resources.

One of the strongest use cases of Mekari Officeless is its ability to seamlessly connect Mekari Qontak (CRM & customer engagement) with Mekari Jurnal (accounting & finance).

Many companies in Indonesia have adopted Mekari Officeless to ensure that customer data, sales activities, and financial transactions flow automatically between these systems.

Integration capabilities of Mekari Officeless include:

- Low-code/no-code workflow builder: Design custom automation and data flows without needing advanced coding skills.

- Multi-software connectivity: Integrate third-party apps with Mekari products, including Qontak, Jurnal, Talenta, and Klikpajak.

- Real-time synchronization: Keep records consistent across CRM, accounting, HR, and tax platforms instantly.

- Customizable rules and triggers: Set up workflows that match your unique business processes.

- Scalability: Support for enterprises that need more complex integrations across multiple departments and business units.

With its flexibility and ease of use, Mekari Officeless empowers businesses to break down silos, increase efficiency, and gain greater visibility across operations.

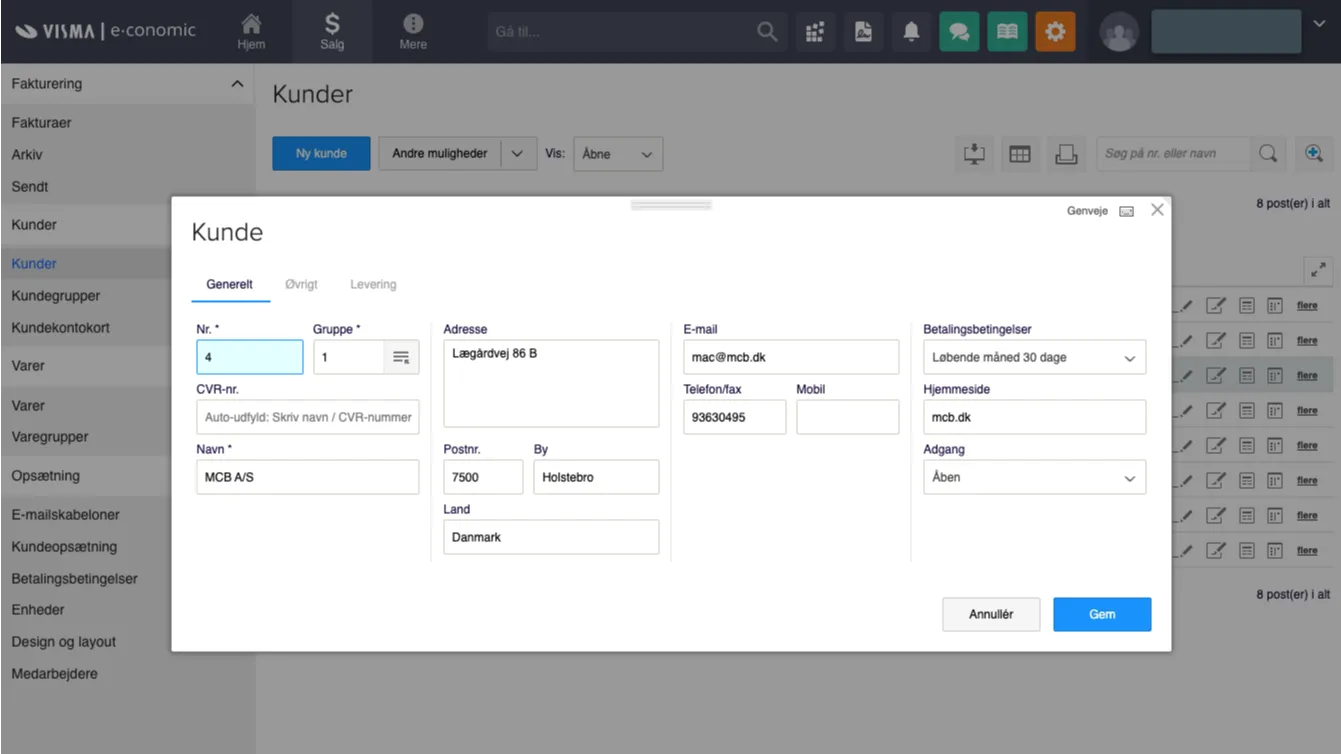

2. Visma e-conomi

This integration connects HubSpot CRM with Visma e-conomic, enabling bi-directional data sync between customer records and financial operations.

Key features:

- Automatic customer creation: When a sync is triggered, customer details from HubSpot are automatically created or updated in Visma e-conomic and vice versa.

- Automatic deal creation: New deals in HubSpot trigger corresponding records in e-conomic, eliminating the need for duplicate data entry.

- Invoice automation: Once a deal is closed in HubSpot, an invoice or draft order can be created automatically in e-conomic, with updates reflecting across both systems.

- Quotation syncing: Quotation records are auto-generated and updated as the deal progresses in HubSpot.

- Campaign linking: New invoices in Visma can trigger customer additions to HubSpot marketing lists.

Pipedrive – Visma e-conomic integration

Similar to HubSpot, Pipedrive’s integration with Visma e-conomic supports a fully synchronized sales-to-accounting workflow.

Key features:

- Create invoices from Pipedrive deals with real-time syncing to Visma.

- Automated approval and sending: Finance teams can approve and send invoices without leaving the accounting system.

- Product linking and data sync: Products, invoice status, and customer data are synchronized between both platforms, keeping records accurate and up-to-date.

Best for: Mid-sized to large businesses using HubSpot or Pipedrive for sales and Visma for accounting, especially those wanting automation across their invoicing and sales workflows.

3. Freshworks

Freshsales by Freshworks is a modern CRM solution that combines sales automation with client engagement and basic accounting capabilities. While not a full accounting system, it offers essential tools that support billing and financial visibility.

Key features:

- Automate workflows, sequences, and client engagement rules

- AI assistant for smart deal forecasting and decision-making

- Real-time alerts, detailed client timelines, and contact summaries

- Built-in reporting and dashboard features for performance tracking

- User-level access controls to secure sensitive data

Best for: Businesses looking for a CRM-first platform with strong automation and light financial tracking to support sales and customer engagement.

4. Bitrix24

Bitrix24 offers an all-in-one CRM that includes invoice and quote management tools, making it useful for teams that want to connect sales with billing operations in a single platform.

Key features:

- Manage invoices, quotes, and client interactions in one place

- Customize invoice forms with your brand and additional fields

- Convert quotes into invoices seamlessly

- Set granular access controls to protect financial data

- Maintain detailed contact records with activity history

Best for: Small to medium-sized businesses looking for an affordable CRM with integrated billing and document management.

5. QuickBooks

QuickBooks is a widely-used financial management platform designed for small to mid-sized businesses. While not a CRM itself, it integrates with many CRM systems, enabling a powerful combination of customer management and financial tracking.

Why it’s a standout:

- Automates bookkeeping and reduces manual data entry

- Generates and sends invoices, tracks receipts, and manages bills

- Captures mileage and supports tax filing preparation

- Offers multi-currency support and profitability tracking

- Integrates with a wide range of QuickBooks tools and CRM platforms

Best for: Businesses that need comprehensive financial management, and want to connect that system with their CRM to automate billing and improve financial insights.

How Mekari Officeless help to integrate any software olutions

Mekari Officeless provides a powerful yet flexible approach to integration by combining low-code/no-code technology with customizable workflows.

With its integration features, businesses can connect virtually any platform—whether it’s an external SaaS tool, an in-house legacy system, or software within the Mekari ecosystem like Qontak, Jurnal, Talenta, and Klikpajak.

With these capabilities, Mekari Officeless stands out as the best integration tool for businesses in Indonesia. It helps companies eliminate silos, reduce manual work, and achieve end-to-end visibility across operations—all without the heavy cost of custom development.

Discover how Mekari Officeless can unify your business systems.