Mekari Insight

- The right employee expense reimbursement software saves time, cuts manual work, and ensures faster payouts.

- Features like OCR, multi-layer approvals, ERP integration, and fraud detection make reimbursements seamless and compliant.

- Mekari Expense stands out with auto disbursement, accounting software integration, and mobile-first tracking—making it the best all-in-one choice for any company.

Managing employee expenses can quickly get messy: lost receipts, slow approvals, and endless manual checks.

The right reimbursement software solves all that by automating requests, enforcing policies, and integrating seamlessly with your expense management system.

In this guide, we’ll walk you through the 10 best employee expense reimbursement software to keep your reimbursement process fast, compliant, and hassle-free.

Must-have features in reimbursement software

To choose the right solution, it helps to know what truly matters. Below are the essential features every reimbursement software should have:

- Mobile expense submission: Snap receipts with OCR, submit on mobile, and track status in real time.

- Evidence processing automation: Auto-extract receipt data, match with card transactions, and build a digital audit trail.

- Multi-layered approval system: Custom workflows, auto-routing to approvers, and instant notifications.

- Accounting integration: Sync with accounting software and reduce manual entry errors.

- Multi-currency support: Submit in local currency, auto-convert with live rates, and manage VAT compliance.

- Corporate card integration: Import transactions instantly, match receipts, and track card spend in real time.

- AI and fraud detection: Flag duplicates or anomalies, automate policy checks, and improve detection with machine learning.

- Reporting and analytics: Real-time dashboards, spend trend reports, and customizable analysis.

- Compliance and security: Enforce company policies, secure data with encryption, and maintain audit-ready records.

Read more: Expense Reimbursement Guide: Best Practices and Solutions1. Mekari Expense

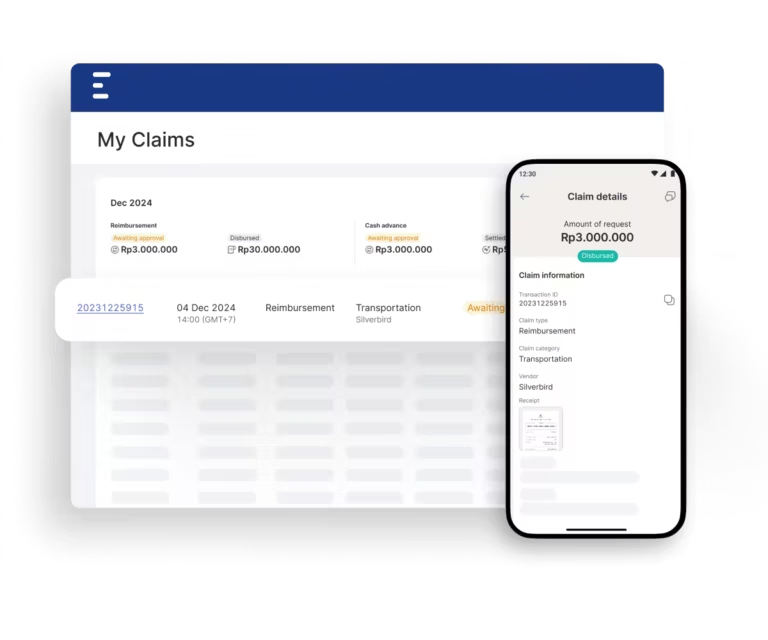

Mekari Expense is an employee expense reimbursement software designed to simplify how finance, procurement, marketing, and other teams manage expense claims.

By consolidating everything in one integrated platform, companies can ensure the reimbursement process is faster, more transparent, and fully traceable—from request to payout.

Key features

- Customizable policies to match company-specific reimbursement rules.

- Flexible multi-layer approval workflows aligned with organizational structures.

- Real-time notifications on submission and approval status.

- Detailed expense reporting for better spending analysis.

- Mobile app access for submitting claims anytime, anywhere.

Advantages

- Auto disbursement for instant, hassle-free payouts.

- Budget-controlled disbursements across multiple accounts for tighter cost management.

- Seamless integration with Mekari Jurnal, ensuring expense records flow directly into financial reports.

- Secure digital storage of receipts and claim history.

Best suited for

Companies that need a reimbursement system integrated with expense management—especially those handling frequent travel, vendor payments, tool subscriptions, events, and other operational costs.

2. Mekari Talenta

Mekari Talenta is an HRIS platform with a built-in reimbursement feature that connects directly with payroll and employee attendance. This eliminates manual steps and ensures HR teams can process employee claims quickly and accurately, all through one system.

Key features

- Policy setup based on employee level and company budget.

- Mobile app submission with instant photo upload for proof of payment.

- Real-time notifications for every submission, approval, or rejection.

- Direct integration with payroll to calculate and pay reimbursements automatically.

- Instant reporting with automatically recorded data, minimizing information loss.

Best suited for

Companies that need reimbursement fully integrated with HR processes—connecting claims with employee data, attendance, and payroll for a seamless HR and finance workflow.

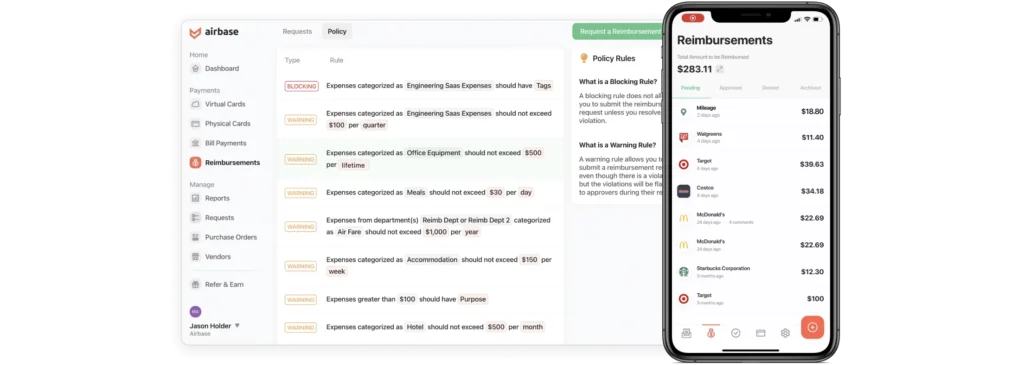

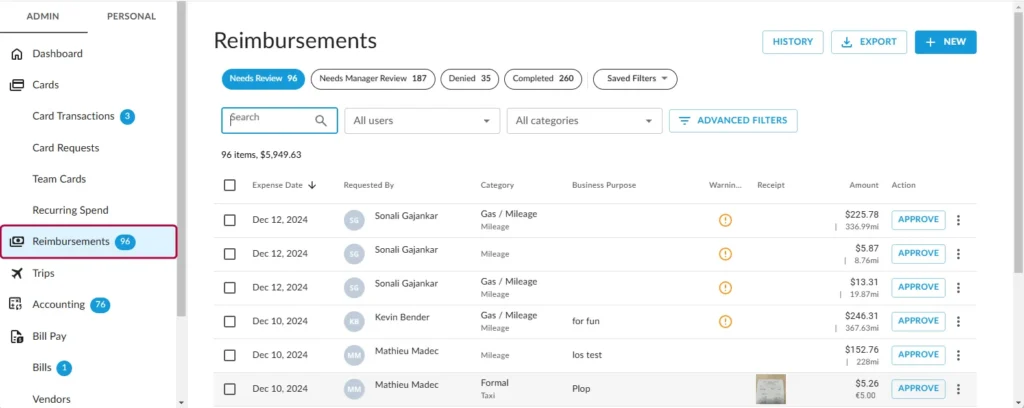

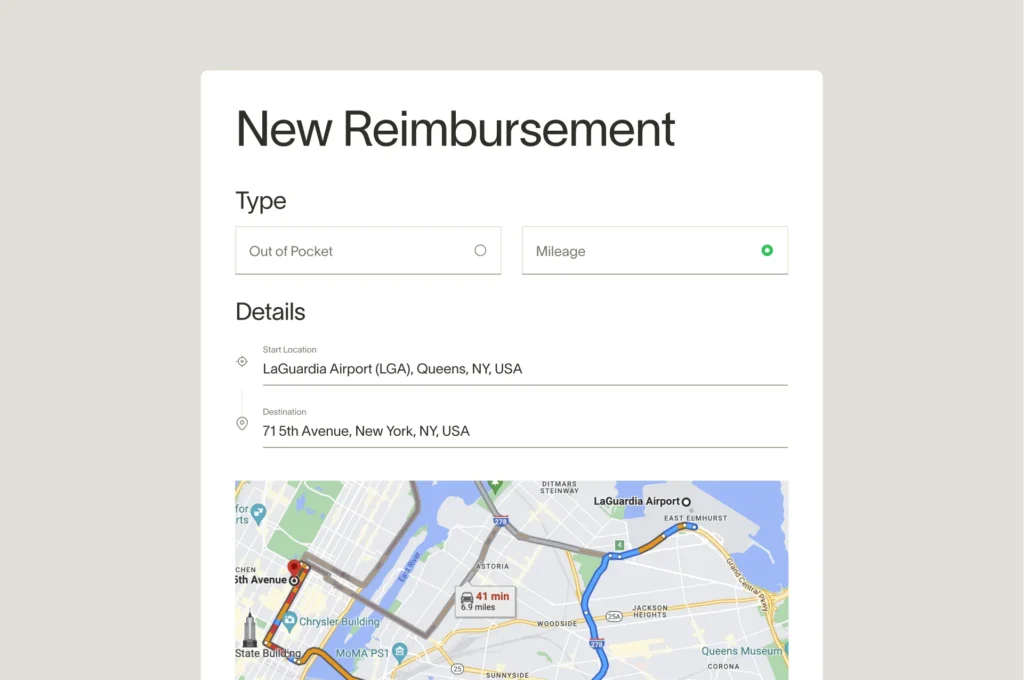

3. Airbase

Airbase is more than just a reimbursement tool, it’s a full spend management platform. It consolidates expense submission, approvals, and reimbursements into one system, ensuring employees are reimbursed fast while finance teams maintain oversight and compliance.

Key features

- Real-time expense capture with mobile receipt uploads

- Automated approval workflows tailored to company policies

- Corporate and virtual cards for controlled spending

- Direct, cashless reimbursements to employees’ bank accounts

- Mileage tracking and travel expense support

- Built-in policy enforcement and spending limits

- Smooth integration with major accounting platforms

Pricing: Custom quotes based on company size and requirements.

Best for: SMBs to large enterprises that want both speed and strong financial controls in their reimbursement process.

4. Emburse

Emburse focuses on creating a frictionless reimbursement experience. By combining AI-powered automation with flexible policies, it helps companies handle everything from simple expense claims to complex, global reimbursements with ease.

Key features

- AI-driven receipt scanning and automatic policy checks

- User-friendly mobile app for instant submissions

- Automated routing of expenses for approval and reporting

- Direct payout integration for faster reimbursements

- Multi-currency support for international claims

- Configurable rules by department, project, or location

- Strong integrations with ERP and accounting software

Pricing: Tailored pricing available upon request.

Best for: Organizations with complex, cross-border reimbursement needs that value automation, compliance, and mobile-first tools.

5. Ramp

Ramp positions itself as a zero-cost, automation-first platform. Employees can quickly submit out-of-pocket expenses, and the system ensures rapid reviews and direct deposits without hidden costs.

Key features

- Free-to-use platform with no subscription fees

- Automated detection of expense claims and policy enforcement

- Mobile and email-based instant receipt capture

- One-click reimbursements for employees

- Customizable approval workflows

- Real-time duplicate and anomaly flagging

- Integrations with Slack and other business apps

Pricing: $0 per user/month, Ramp earns from card interchange fees.

Best for: Businesses looking for a cost-effective tool that removes manual processes and speeds up reimbursements.

6. Rydoo

Rydoo specializes in fast, international reimbursements. By integrating with Wise, it enables multi-currency payouts directly into employees’ accounts, making it ideal for distributed teams.

Key features

- Mobile app for receipt uploads and claims

- Automated multi-currency reimbursements via Wise

- Weekly batch payouts and one-click payments

- OCR-powered data capture with compliance checks

- Configurable workflows to match company policies

- Direct integrations with payroll and accounting tools

Pricing: Starts at €8 per user/month (billed annually).

Best for: Global and remote teams that need accurate, cross-border reimbursements without delays.

7. Payhawk

Payhawk unifies expense management, approvals, and reimbursements in a single platform, with a strong focus on multinational businesses handling multiple currencies.

Key features

- Real-time receipt capture and automated workflows

- Configurable reimbursement rules and automation

- Mass/bulk payouts for efficiency

- Multi-currency and cross-border support

- Corporate and virtual card issuance

- Native payroll and accounting integrations

Pricing: Custom pricing depending on business scale.

Best for: Enterprises managing international reimbursements and seeking a central hub for expense control.

8. Navan

Formerly known as TripActions, Navan combines travel and expense management in one system. It streamlines everything from trip bookings to out-of-pocket reimbursements, ensuring employees are paid back quickly.

Key features

- Mobile receipt upload with real-time claim tracking

- Instant reimbursements through payroll or bank integrations

- Built-in travel and meal claim management

- Automatic enforcement of expense policies

- Configurable approval workflows with spending limits

Pricing: Free for small businesses; paid plans start at $15/user/month.

Best for: Companies managing frequent travel expenses alongside general reimbursements.

9. Spendesk

Spendesk takes the hassle out of reimbursements by digitizing the entire process, from receipt capture to automated approvals and payouts. It’s designed to reduce admin work while improving transparency.

Key features

- Mobile-first receipt submission

- Multi-level approval workflows

- Options for batch or individual reimbursements

- Automated reminders for missing receipts

- Corporate cards for direct spend control

- Integration with payroll and accounting systems

Pricing: Custom pricing available; free demo offered.

Best for: SMBs seeking a simple, paperless reimbursement process with clear controls.

10. Expensify

Expensify is one of the most widely recognized reimbursement tools. It’s built for individuals, SMBs, and large businesses alike, offering everything from receipt scanning to direct deposits.

Key features

- Unlimited receipt capture with OCR

- Automatic expense report generation

- One-click ACH reimbursements

- Customizable approval flows and policy enforcement

- Real-time notifications for submissions and approvals

- Mileage tracking and card/bank integrations

Pricing: Starts at $4.99/month for individuals and $10–$18/user/month for businesses.

Best for: Freelancers to enterprises that need an affordable, easy-to-use solution for fast reimbursements.

Best reimbursement software for all-in-one needs

If your company is looking for an all-in-one solution to manage expense claims seamlessly, Mekari Expense stands out as the best choice. It’s more than just a reimbursement tracker—this platform combines custom policy settings, multi-layer approvals, real-time notifications, and auto disbursement in one integrated system.

The biggest advantage of Mekari Expense is its ability to connect directly with Mekari Jurnal, ensuring every reimbursement is automatically recorded in your financial reports.

With features like budget-based disbursement, mobile submissions, and secure digital storage of receipts, it provides full visibility and control over company spending.

Whether you’re a growing business or a large enterprise, Mekari Expense makes reimbursement faster, more transparent, and easier to manage.