Mekari Insight

- Slow invoice processing isn’t just a finance issue—it affects cash flow, damages supplier trust, and leads to unnecessary penalties. Automating AP ensures faster approvals, on-time payments, and stronger vendor partnerships.

- Manual invoice handling ties up valuable time in data entry, approvals, and corrections. With AP automation, finance teams shift focus from paperwork to strategy, optimizing spending, forecasting, and financial growth.

- Mekari Expense stands out as the most complete accounts payable invoice automation software for businesses in Indonesia and Southeast Asia. It combines all the power of AP automation with features built for local needs.

The smooth operation of accounts payable (AP) is key to financial stability and strong supplier relationships. Yet manual invoice processing often drains time and resources while increasing the risk of costly errors.

Versapay’s research shows delays can cost midsized companies over $900,000 each month.

Accounts payable invoice automation software solves this by processing invoices swiftly and accurately, freeing teams to focus on higher-value work. Curious how it can boost efficiency and cut costs? Let’s explore its benefits and real-world applications.

Understanding accounts payable and invoice processing

Accounts payable (AP) is crucial for maintaining good relationships with suppliers by ensuring timely invoice payments. This impacts cash flow, financial reporting, and overall operational effectiveness.

Manual invoice processing, however, poses challenges:

- Time-consuming data entry: Manual data entry is tedious and prone to human error, leading to inaccuracies and delays.

- Paper-based inefficiencies: Physical invoices can be easily lost, misplaced, or damaged, causing payment delays and potential disputes.

- Complex approval workflows: Routing paper invoices for approval can be slow and cumbersome.

- Lack of visibility: Manual processes often lack real-time visibility into invoice status.

- Increased risk of errors: Manual data entry and processing increase the risk of errors, such as duplicate payments, incorrect amounts, and missed deadlines.

- Increased costs: Manual processing requires more staff and storage space.

These inefficiencies can strain supplier relationships, lead to late payment penalties, cause financial discrepancies and reporting errors, and divert resources from strategic financial activities.

The evolution of AP automation software

Accounts payable (AP) processes have undergone a significant transformation moving from laborious manual tasks to streamlined digital solutions.

Traditional AP

Early AP workflows were characterized by paper-based processes, manual data entry, physical routing and approvals, limited visibility, and high storage costs. These manual processes were time-consuming, prone to errors, and lacked transparency.

While the adoption of basic accounting software and electronic spreadsheets offered some improvements by digitizing certain aspects of AP, these solutions still relied heavily on manual intervention and did not address the core challenges of manual AP.

Modern AP automation software

Modern accounts payable (AP) automation software leverages technologies like Optical Character Recognition (OCR) and Artificial Intelligence (AI) to streamline the entire invoice lifecycle, from receipt to reconciliation and payment.

These systems are designed to minimize manual work, improve accuracy, and enhance control. Key features include:

- Automated data capture and extraction using OCR and AI to digitize and validate invoice data efficiently

- Three-way matching of invoices, purchase orders, and receipts to prevent overpayments and ensure accuracy

- Customizable approval workflows that route invoices based on roles, amounts, and business rules

- Integration capabilities with existing ERP systems for seamless data synchronization across finance operations

- Real-time tracking and reporting functionalities to monitor invoice statuses, approvals, and payment timelines

- Fraud detection tools that flag suspicious activity and enhance internal controls

- Mobile accessibility to approve or review invoices on the go

- Supplier portals that enable vendors to check payment status, submit invoices, and resolve queries easily

- Automated payments to streamline disbursements, reduce late fees, and minimize errors

These advancements lead to improved efficiency, accuracy, and cost savings by eliminating manual tasks, reducing errors, and optimizing processes. By automating AP, finance teams can focus on strategic initiatives that drive business growth.

Read more: 7 Best Expense Management Software with Accounting IntegrationBest 6 accounts payable invoice automation software

To help you choose the right solution for your business, here are six of the best accounts payable invoice automation software platforms, each offering unique strengths in streamlining invoice processing, improving accuracy, and reducing operational costs.

1. Mekari Expense

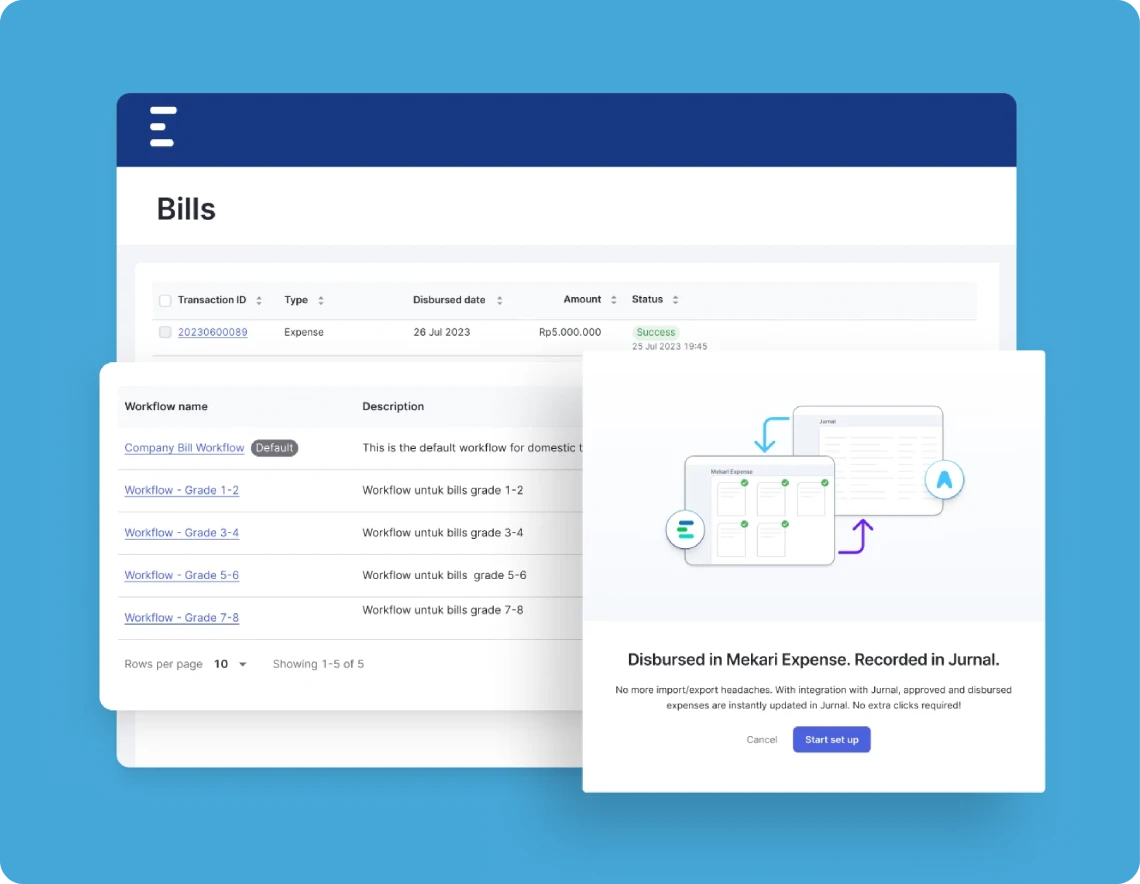

Mekari Expense is a cloud-based accounts payable invoice automation software designed specifically for businesses in Indonesia and Southeast Asia.

Powered by AI and OCR, it simplifies and automates every step of the invoice-to-payment process, covering both domestic and international transactions, with seamless integration into Mekari’s finance and HR ecosystem.

What sets it apart:

Unlike many global solutions, Mekari Expense is tailored to local regulations, banking systems, and accounting practices. It also offers built-in integration with Mekari Jurnal (accounting) and Mekari Talenta (HRIS), plus localized support and onboarding, making it a comprehensive and context-aware solution for regional businesses.

Key features:

- AI-powered OCR invoice capture: Automatically detects and extracts invoice data from email or uploaded documents, reducing manual input and errors.

- Domestic payments to 50+ Indonesian banks: Transfer funds to BCA, Mandiri, BNI, and other major banks, directly from the platform.

- International payments with competitive exchange rates: Send payments overseas while monitoring transaction status in real time.

- Customizable approval workflows: Configure payment approval routes based on your internal policies, including batch approvals and rejections.

- Effective vendor management: Build and manage a centralized database of domestic and international vendors for streamlined procurement and payments.

- Seamless integration with Mekari Jurnal: All invoice and payment data is automatically mapped and synced with your accounting system, no manual re-entry needed.

- Real-time spend tracking and reporting: Gain full visibility into invoice statuses, cash outflows, and budget allocations from a single dashboard.

- Localized onboarding and support: Get hands-on assistance from Mekari’s local team during setup, training, and post-launch support, something rarely offered by global providers.

Read more: 10 Best Expense Management Software for Corporate & Business2. Tipalti

Tipalti is a comprehensive, cloud-based accounts payable automation platform designed to handle the entire invoice-to-payment process at scale.

It’s especially popular among companies with global operations, offering robust features to manage multi-entity and cross-border transactions.

Key features:

- Automated invoice data capture using OCR and AI for accurate extraction

- Three-way matching of invoices, purchase orders (POs), and receipts to prevent payment errors

- Customizable approval workflows based on roles, amounts, and business rules

- Multi-currency and international payments to over 190 countries with built-in tax compliance

- Integration with leading ERP systems such as NetSuite, QuickBooks, Sage, and more

- Self-service supplier onboarding and W-8/W-9 tax form collection

- Advanced audit trails and real-time visibility into every stage of the AP process

3. Stampli

Stampli is a modern AP automation software that focuses on simplifying collaboration across departments, improving visibility, and using AI to reduce invoice processing time.

It’s especially beneficial for teams that manage high volumes of invoices and need flexible approval routing.

Key features:

- Invoice-centric communication platform where AP teams, approvers, and vendors can collaborate in one place

- AI-powered assistant “Billy the Bot” helps with coding suggestions, duplicate detection, and identifying anomalies

- Dynamic approval workflows that adapt to different invoice types, amounts, or departments

- Built-in support for three-way and two-way matching

- Real-time dashboards and audit-ready tracking for all actions and invoice statuses

- Seamless integration with major ERPs and accounting systems without disrupting existing workflows

4. AvidXchange

AvidXchange is a modular AP automation suite tailored for mid-sized businesses and specific industries like real estate, construction, and nonprofits.

It offers full control over invoice approval, payment disbursement, and vendor communication.

Key features:

- Automated capture and digital storage of incoming invoices

- Rules-based workflow management to automate approvals and exception handling

- Electronic payments through ACH, virtual card, or check printing

- Vendor network and payment services to simplify disbursement and vendor onboarding

- ERP and accounting system integrations to ensure consistency in financial reporting

- Customizable reports and dashboards to monitor payment status, aging, and cash flow

5. BILL (formerly Bill.com)

BILL is a user-friendly AP automation platform ideal for small to medium-sized businesses. It helps digitize and streamline the entire accounts payable workflow, from receiving invoices to issuing payments, while ensuring strong accounting integration.

Key features:

- OCR and AI-based invoice scanning for quick and accurate data extraction

- Pre-built approval workflows to route invoices automatically based on set rules

- Payment automation via ACH transfers, checks, or international wire

- Two-way sync with popular accounting platforms like QuickBooks, Xero, and NetSuite

- Mobile app for invoice approvals, status checks, and payment tracking on the go

- Vendor self-service portal to upload invoices and track payment status

6. Sage Intacct (AP Module)

Sage Intacct is a robust cloud ERP system with built-in AP automation features, tailored for growing businesses and enterprises that need strong financial management tools, especially in multi-entity and multi-department environments.

Key features:

- Integrated invoice capture and coding using OCR and AI within the ERP environment

- Three-way matching and smart approval workflows to reduce risks of overpayment or fraud

- Multi-entity support for businesses managing several subsidiaries or departments

- Detailed financial reporting and compliance tools for audit readiness

- Tight general ledger integration ensures every approved invoice is accurately reflected in the books

- Real-time dashboards and analytics for spend control and budget tracking

Benefits of implementing invoice automation

Adopting accounts payable invoice automation software turns AP from a cost center into a strategic advantage. Here’s how:

- Faster processing, greater efficiency: Automation powered by OCR and AI extracts invoice data accurately, reducing manual effort and speeding up approval workflows.

- Fewer errors, higher accuracy: Three-way matching (invoice, PO, receipt) minimizes discrepancies and eliminates common errors like duplicates or incorrect amounts.

- Significant cost savings: Less manual work means lower labor costs. Automation also cuts expenses related to paper, printing, and mailing, delivering fast ROI.

- Better vendor relationships: On-time, accurate payments build supplier trust. Self-service supplier portals improve communication and boost vendor satisfaction.

Conclusion

In conclusion, accounts payable invoice automation software offers a transformative solution for organizations seeking to optimize their financial operations.

By automating manual processes, enhancing accuracy, and providing real-time visibility, these solutions empower businesses to achieve significant cost savings and improve overall efficiency.

Among these six solutions, Mekari Expense stands out as the most complete choice for businesses in Indonesia and Southeast Asia. It combines all the power of AP automation with features built for local needs:

- Seamless domestic payments to 50+ Indonesian banks

- Competitive international transfers with real-time tracking

- Automatic integration with Mekari Jurnal for error-free accounting

- Customizable approval workflows to fit your company policies

- Localized onboarding and support rarely offered by global tools

Get started with Mekari Expense today to experience smarter, faster, and more accurate accounts payable management.

References

Versapay. ”Poor Invoice Processing is Hurting Cash Flow and Draining Revenues”