Streamline your insurance business operations with Mekari integrated solutions

Mekari’s integrated software ecosystem solution helps automate various operational and strategic business processes in the insurance industry, from HR, sales and customers, to financial and accounting, to increase efficiency and accelerate growth.

89% of the insurance industry faces high agent and employee turnover, as well as complex payroll, performance, and HR administration management

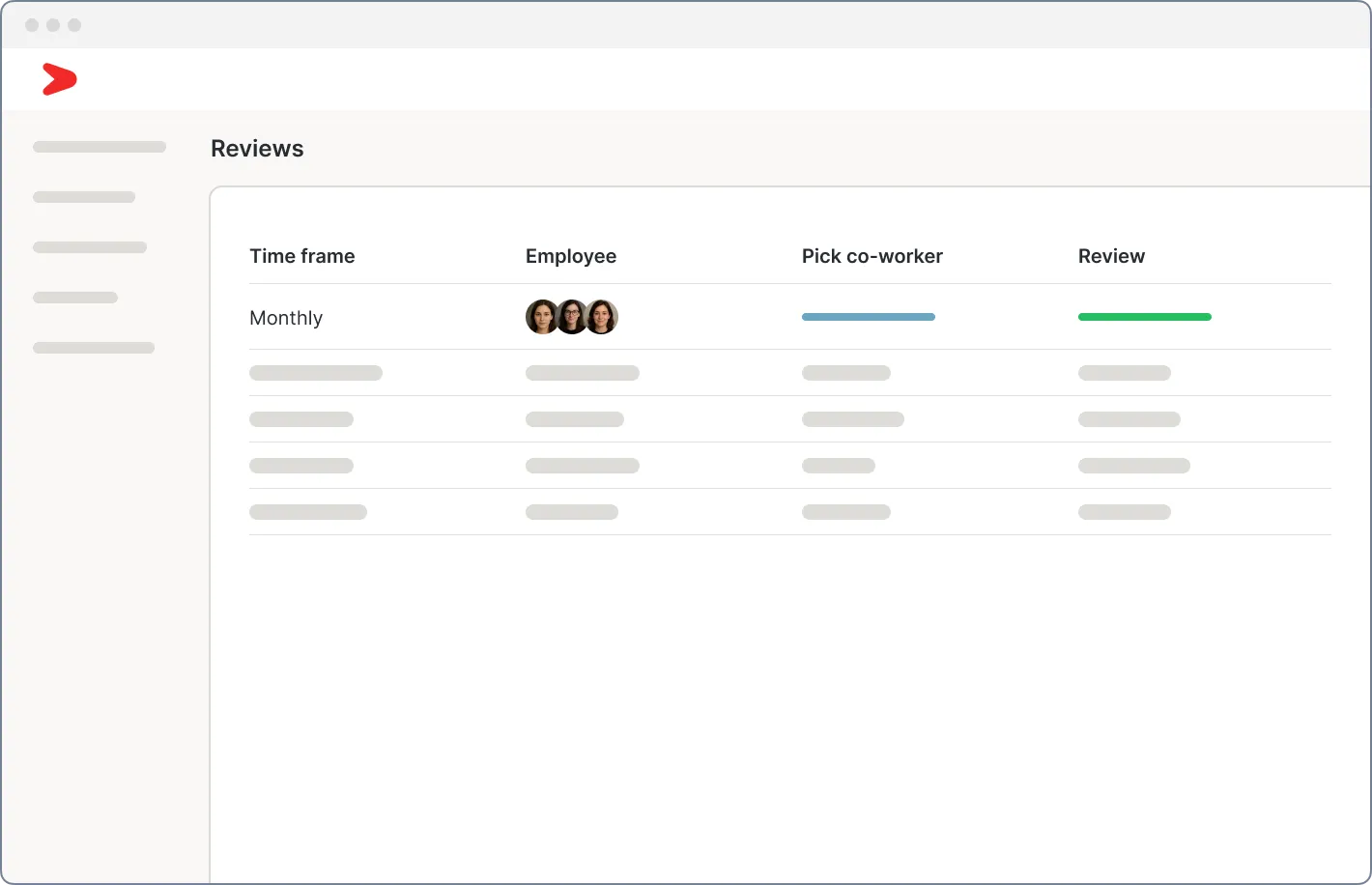

Track and review employee performance and increase productivity measurably with performance management feature by Mekari Talenta.

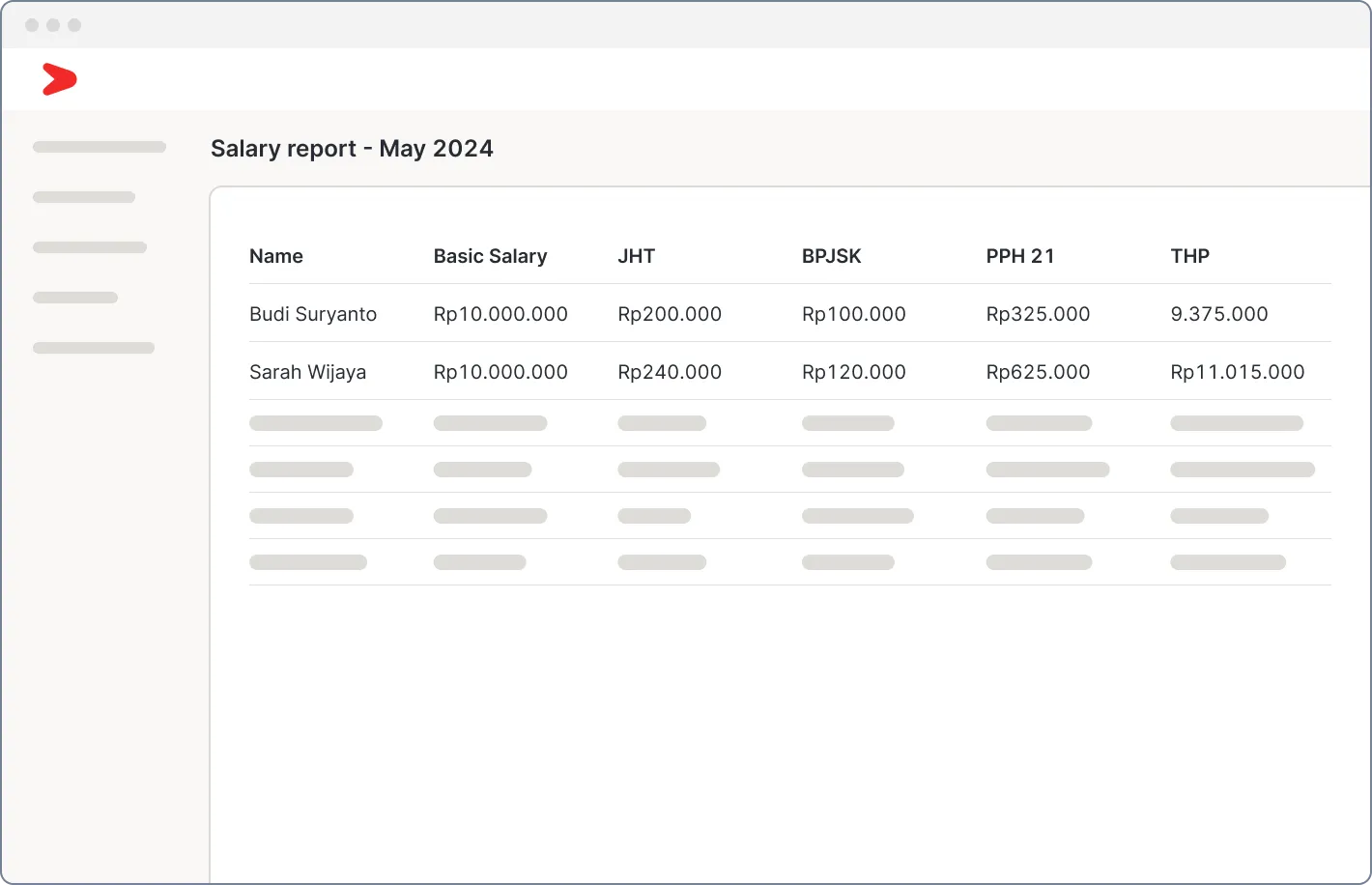

Calculate payroll component, including attendance, leave, and bonus automatically and effortlessly manage benefits, taxes, and BPJS, while ensuring compliance with labor laws with Mekari Talenta.

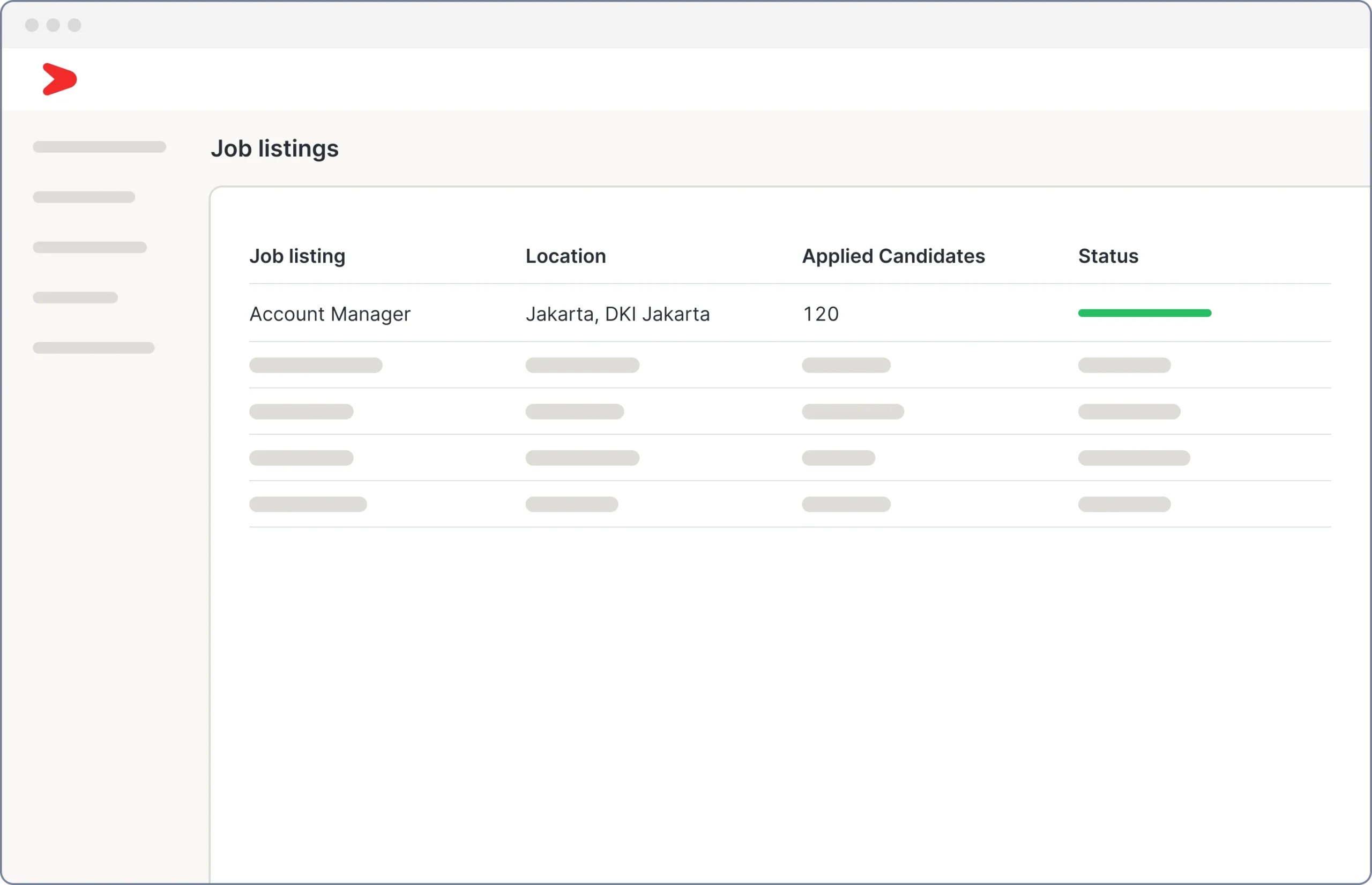

Simplify the employee recruitment process, from posting vacancies, assessing candidates, to onboarding, through a single integrated HRIS by Mekari Talenta.

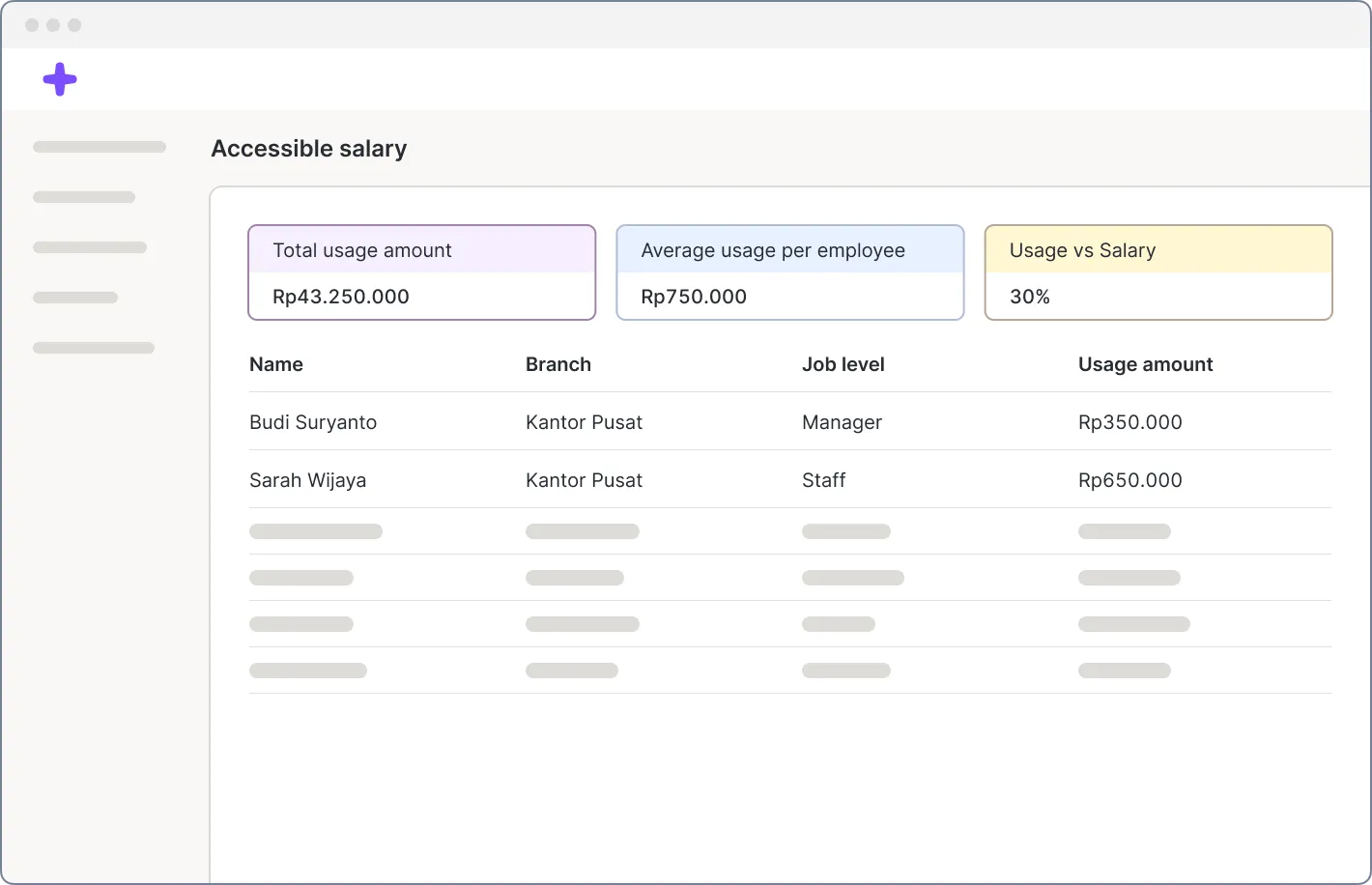

Improve employee welfare, satisfaction, and retention with innovative programs such as earned wage access and flexible benefit management with Mekari Flex.

93% of insurance businesses are overwhelmed with handling customer interactions and internal communications across multiple channels, and face tax complexity

Consolidate interactions with customers on WhatsApp, phone, email, and social media in one integrated platform from Mekari Qontak omnichannel.

Increase responsiveness and create personalized customer service for faster problem resolution and follow-ups with Mekari Qontak AI chatbot automation.

87% of the insurance industry struggles to handle high transaction volumes and complex compliance management

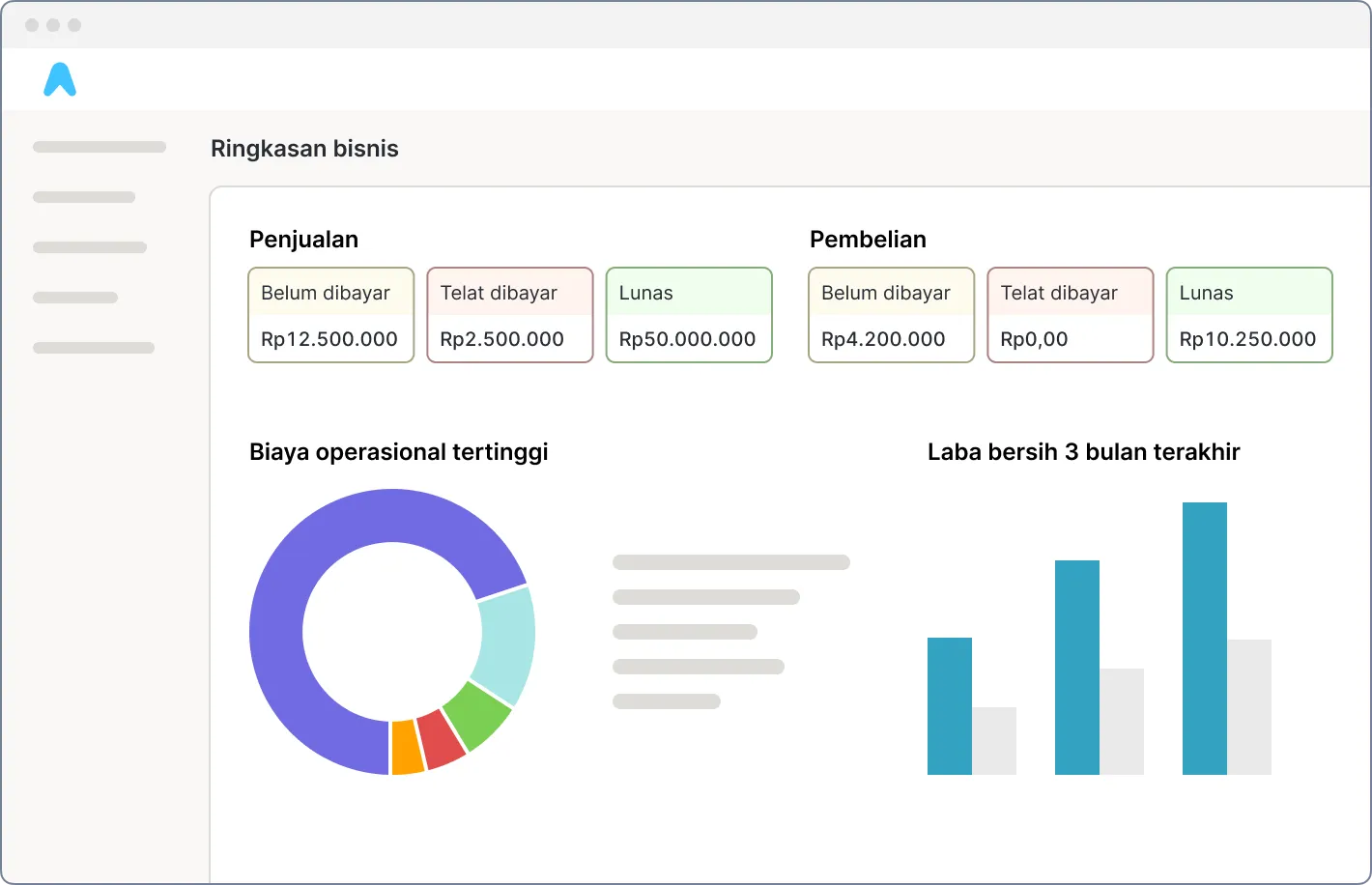

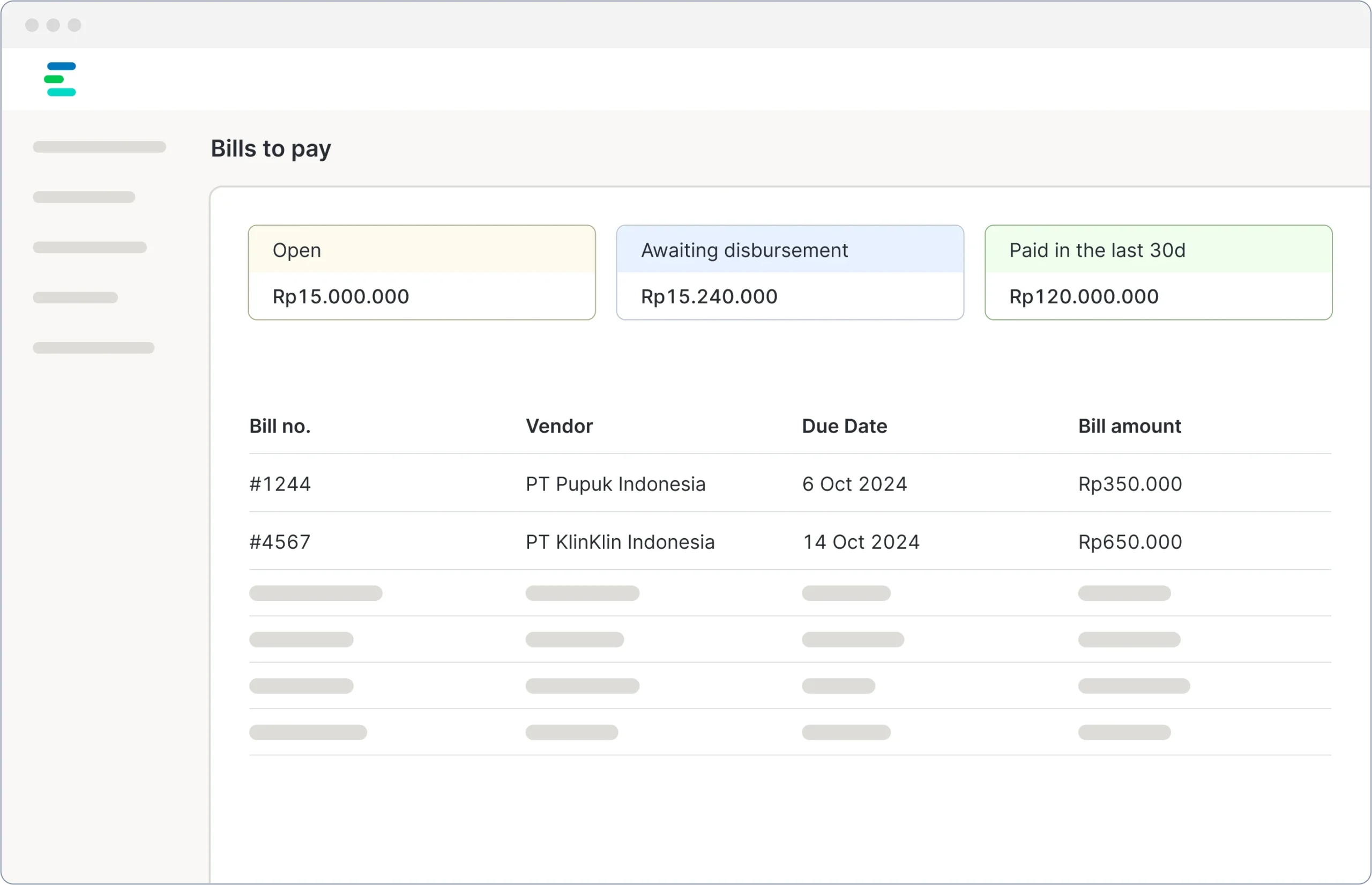

Automate end-to-end financial operations, from bookkeeping, transaction tracking, and real-time multi-branch data integration with Mekari Jurnal.

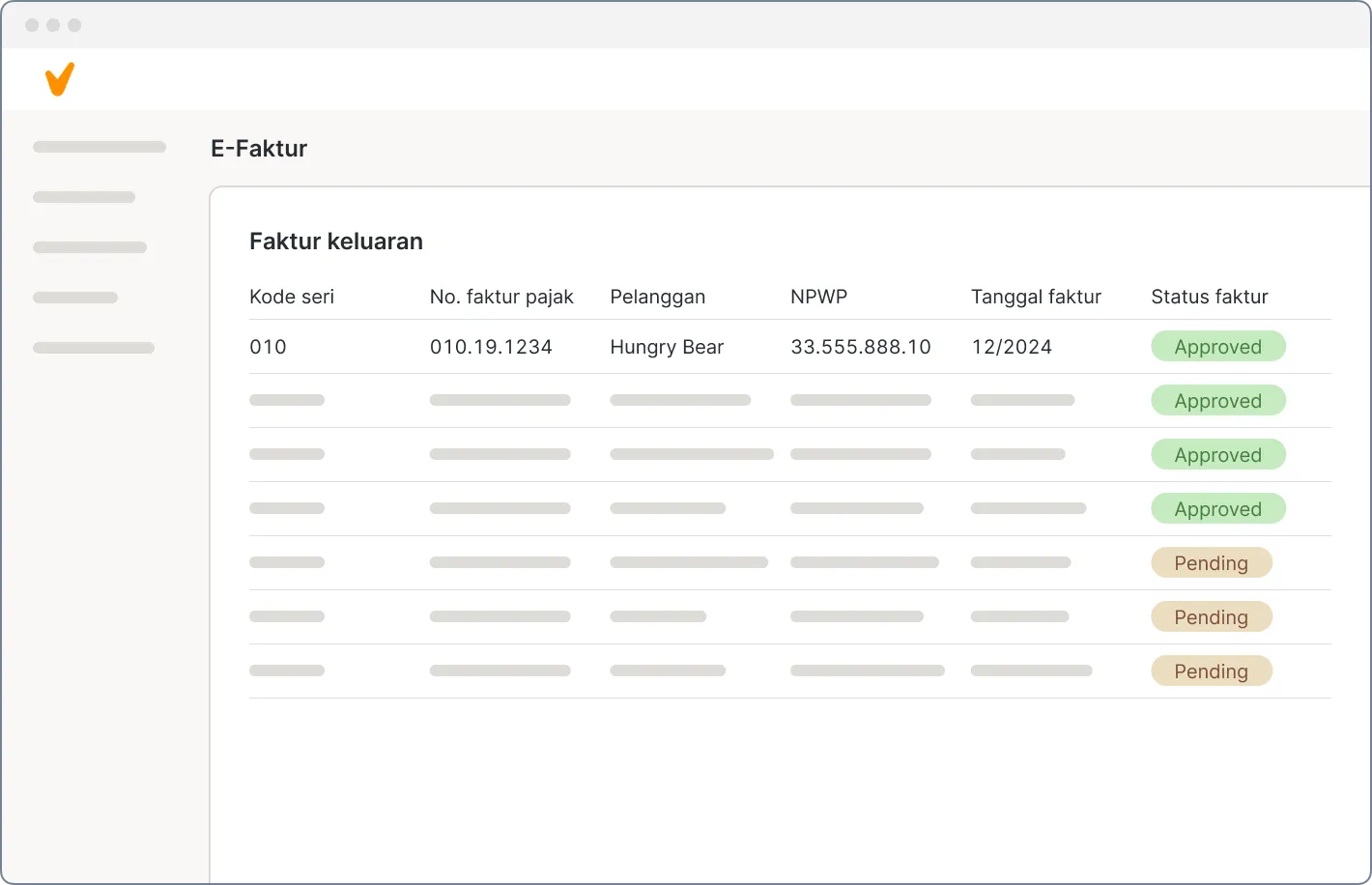

Automate the reporting and management of various tax administrations, including withholding taxes to e-invoices, according to Indonesian government regulations with Mekari Klikpajak.

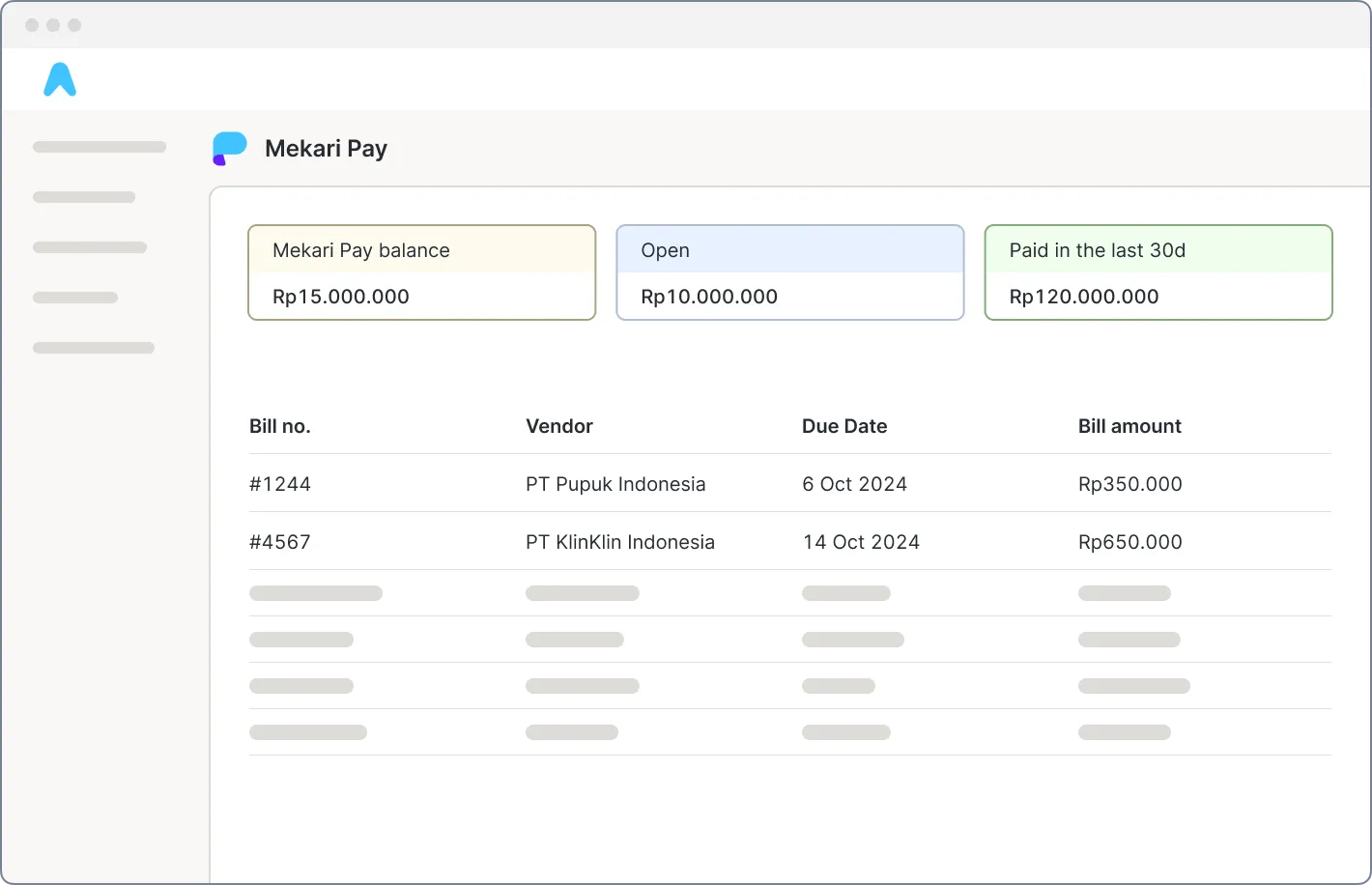

Simplify the management of insurance claim payments to various partners via bank transfer, VA, and credit cards, with multipayment management from Mekari Pay.

Facilitate business expense management with budget allocation, layered approvals, and automated reimbursement for various operations, such as business trips, through Mekari Expense.

73% of the insurance industry is facing complex internal problems, thus delaying business innovation exploration

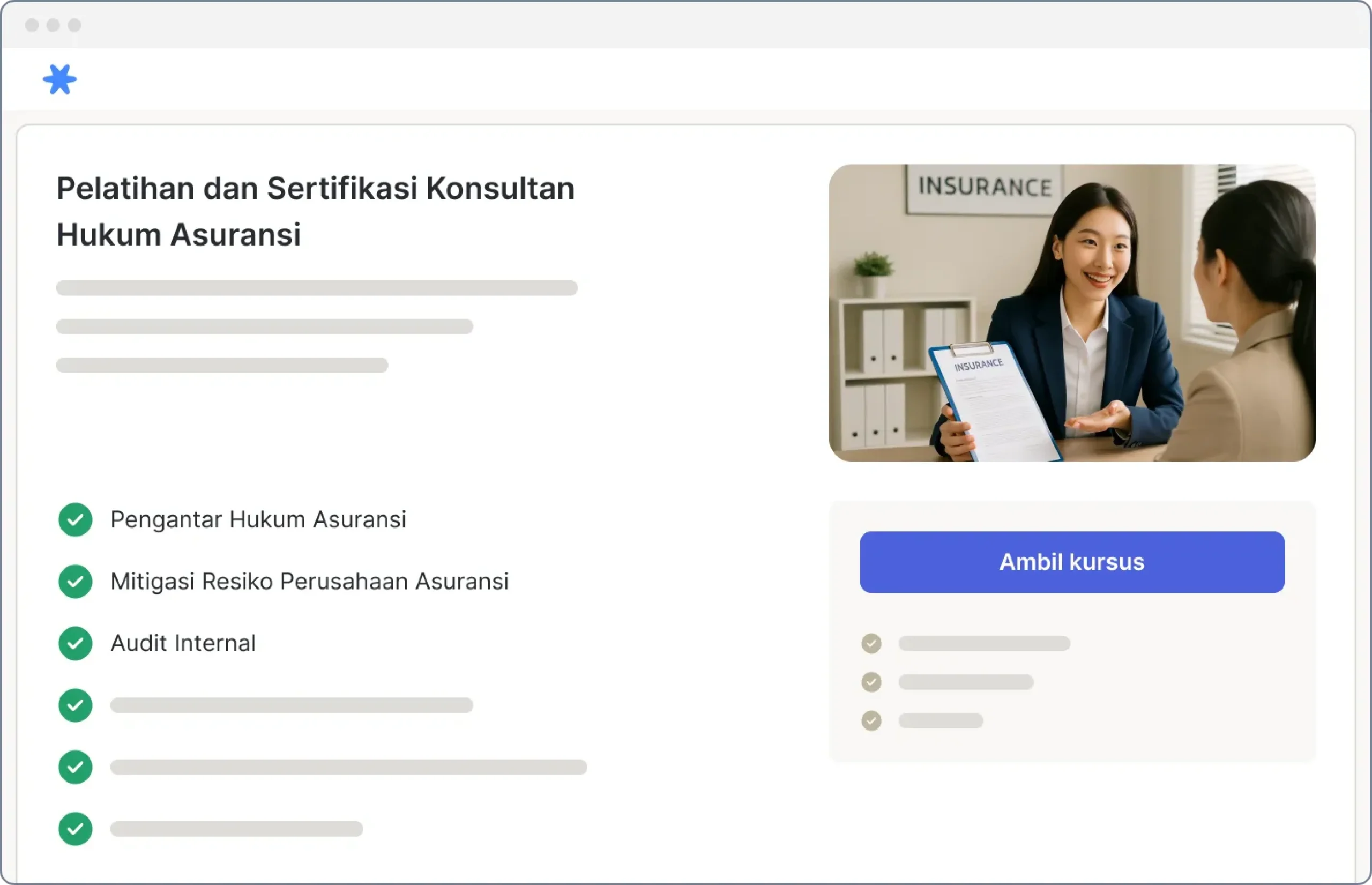

Facilitate the employee with effective online training and certification courses through a flexible and easy-to-monitor LMS platform such as Mekari University.

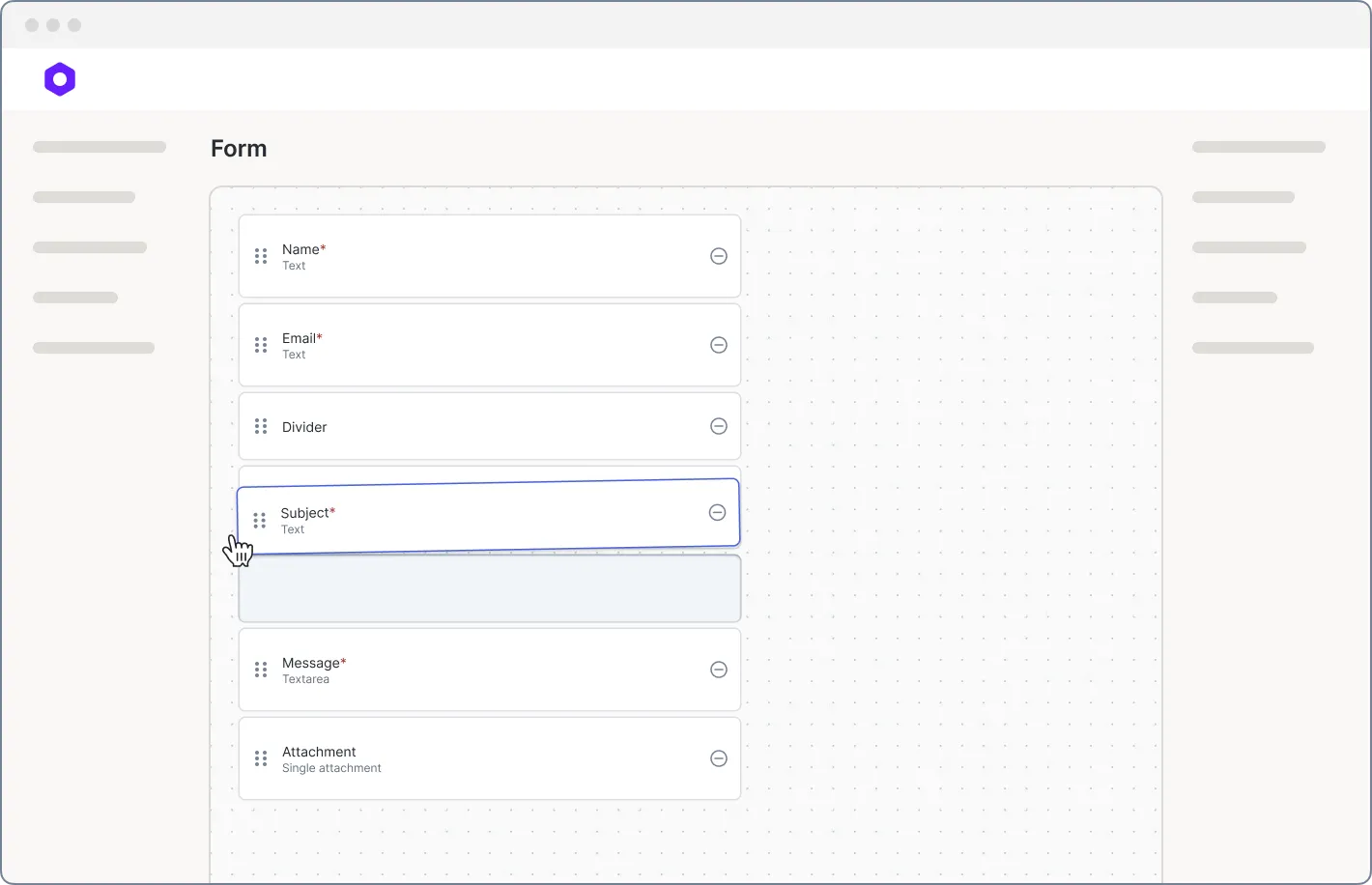

Develop various low-code/no-code-based business apps and systems customized for the insurance industry, such as fraud review platform, with Mekari Officeless.

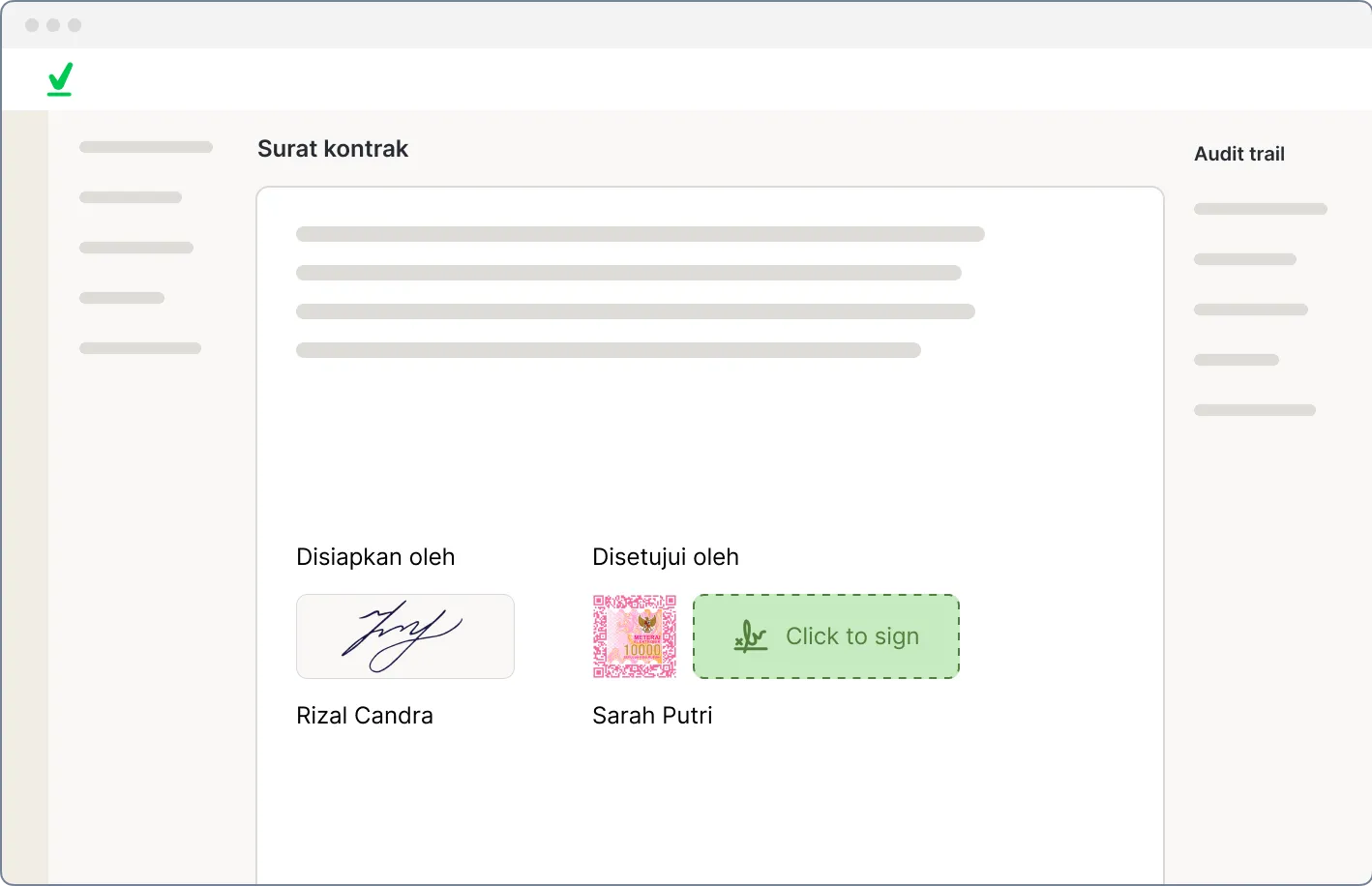

Accelerate the process of verifying and authenticating digital documents including archiving, signing, and electronic stamping processes with a secure and trusted solution from Mekari Sign.

Why choose Mekari ecosystem to meet your insurance business needs

Advantages of using various software within the Mekari ecosystem to meet the needs of the insurance industry.

World-class security

Solutions for insurance business operations that are securely certified with the international standard ISO 27001 and recognized by Gartner.

Scalable systems

Ready-to-use platforms to meet the operational needs of various business scales from micro, small, medium, to large enterprises.

Flexible integrations

Our software is integrated into one business ecosystem with flexible API support to fulfill various insurance business operations needs.

After-sales services

Customer support for any issues as well as training and empowerment across multiple channels with a clear and transparent SLA.

Customizable solution

Meet various insurance business system development needs with customization support powered by low-code and no-code technology.

Empowerment programs

Join various empowerment program within our ecosystem by networking through events and communities with fellow business people.

What insurance businesses say about Mekari

Numerous businesses in the insurance industry rely on Mekari solutions to simplify their business processes from end-to-end.

FAQs about Mekari as a solution for the insurance industry

Can Mekari support both full-time employees and freelance agents in one HR system?

Yes. Mekari Talenta allows you to manage a mixed workforce—whether full-time, contract-based, or freelance—with different payroll structures, tax treatments, and benefit policies in one centralized system.

Can Mekari help with multi-channel customer communication for claims and renewals?

Absolutely. Mekari Qontak integrates WhatsApp, email, phone calls, and social media into one CRM dashboard, making it easy to track inquiries, automate follow-ups, and manage SLAs.

How does Mekari handle commission and incentive payments for agents?

You can set flexible commission rules within Mekari Talenta and connect them to financial journals in Mekari Jurnal. It ensures accurate disbursement and audit-ready records.

Can I automate tax reporting for insurance operations with Mekari?

Yes. Mekari Klikpajak automates monthly and annual tax submissions—e-Faktur, e-Bupot, and SPT Masa—using synced data from payroll, vendor payments, and income streams.

What if I need a custom internal system—for example, to manage claims audit trails or partner onboarding?

Mekari Officeless lets you build custom apps with drag-and-drop simplicity, so you can digitize any workflow—from branch inspections to claims approval pipelines—without needing a developer.

Do Mekari solutions integrate with each other?

Yes, the entire Mekari ecosystem is designed to work together. HR, finance, CRM, tax, and internal workflows can share data seamlessly for smoother operations.

FAQs about Mekari as a corporation

Is Mekari a stable company? Will it be around in 5 to 10 years?

Mekari is one of Indonesia’s leading SaaS companies and is backed by a strong group of investors and partners including Money Forward, Midplaza Holding, Mandiri Capital, Biznet, East Ventures, Beenext, and Prasetia. These partnerships reflect both long-term support and strategic trust in Mekari’s vision and growth.

How long has Mekari been around?

Mekari has been operating since 2015 and serves thousands of businesses across Indonesia—from startups to enterprise-scale operations.

What industries does Mekari focus on?

Mekari solutions are used across diverse industries including insurance, finance, logistics, retail, manufacturing, healthcare, and professional services.

Can Mekari support enterprise-scale digital transformation?

Yes. Mekari is built to serve businesses of all sizes, with customizable workflows, enterprise-grade features, and integration capabilities that scale with your operations.

Does Mekari offer onboarding or customer success support?

Yes, every Mekari client gets access to onboarding assistance, customer success teams, and product experts who can help configure your solutions based on your unique business needs.

FAQs about access, data, and security

How secure is Mekari in handling employee, customer, and financial data?

Data security is a top priority. Mekari uses end-to-end encryption, role-based access control, and regular penetration testing to ensure your business data is safe and compliant.

Where is our data stored?

All customer data is hosted on ISO 27001-certified cloud infrastructure with data centers located in Indonesia, complying with local data sovereignty regulations.

Can I control who accesses what within my team?

Yes. Mekari provides detailed user access management, so you can set visibility, approval rights, and editing permissions based on role, department, or location.

What happens if there’s a system outage?

Mekari has built-in redundancies and a dedicated support team. Uptime is consistently above 99%, and you’ll always be notified proactively if there are any major disruptions.

Is Mekari compliant with local and international data regulations?

Yes. Mekari complies with Indonesia’s PDP Law (UU PDP) and aligns with global best practices for SaaS security and data protection.

Ready to power your growth?

Transform your insurance operations with the number 1 business acceleration software in Indonesia.

WhatsApp us

WhatsApp us