Run your fintech more efficiently, precisely, and reliably with Mekari software

Mekari’s integrated software ecosystem automates critical operational and strategic functions, from financial reporting and regulatory compliance to HR management, to boost efficiency and accelerate fintech growth.

99.9% of fintech companies agree that using an integrated business software enhances operational efficiency

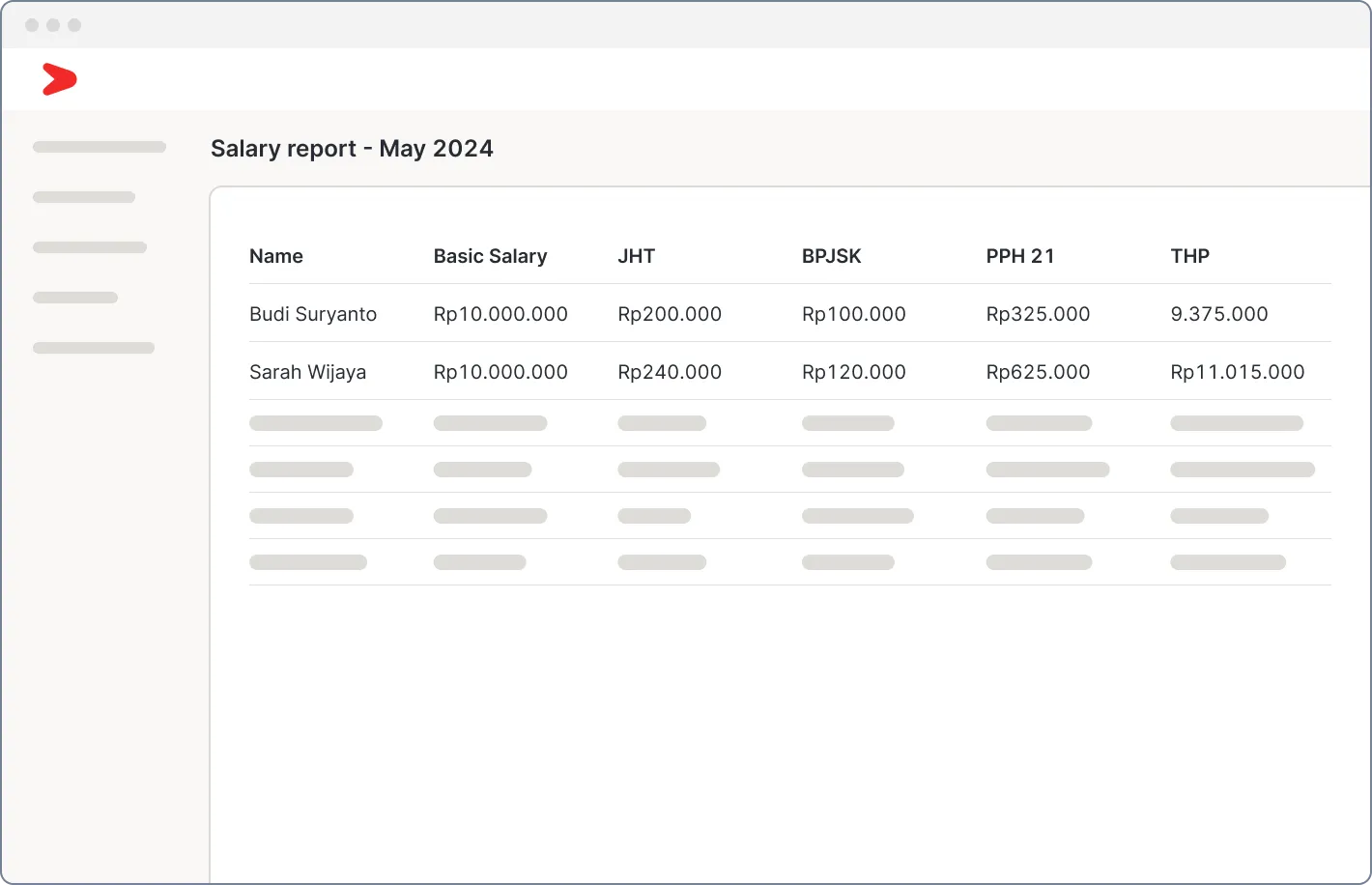

Simplify attendance tracking, process payroll distribution, and automate core HR administration while ensuring full labor law compliance with Mekari Talenta.

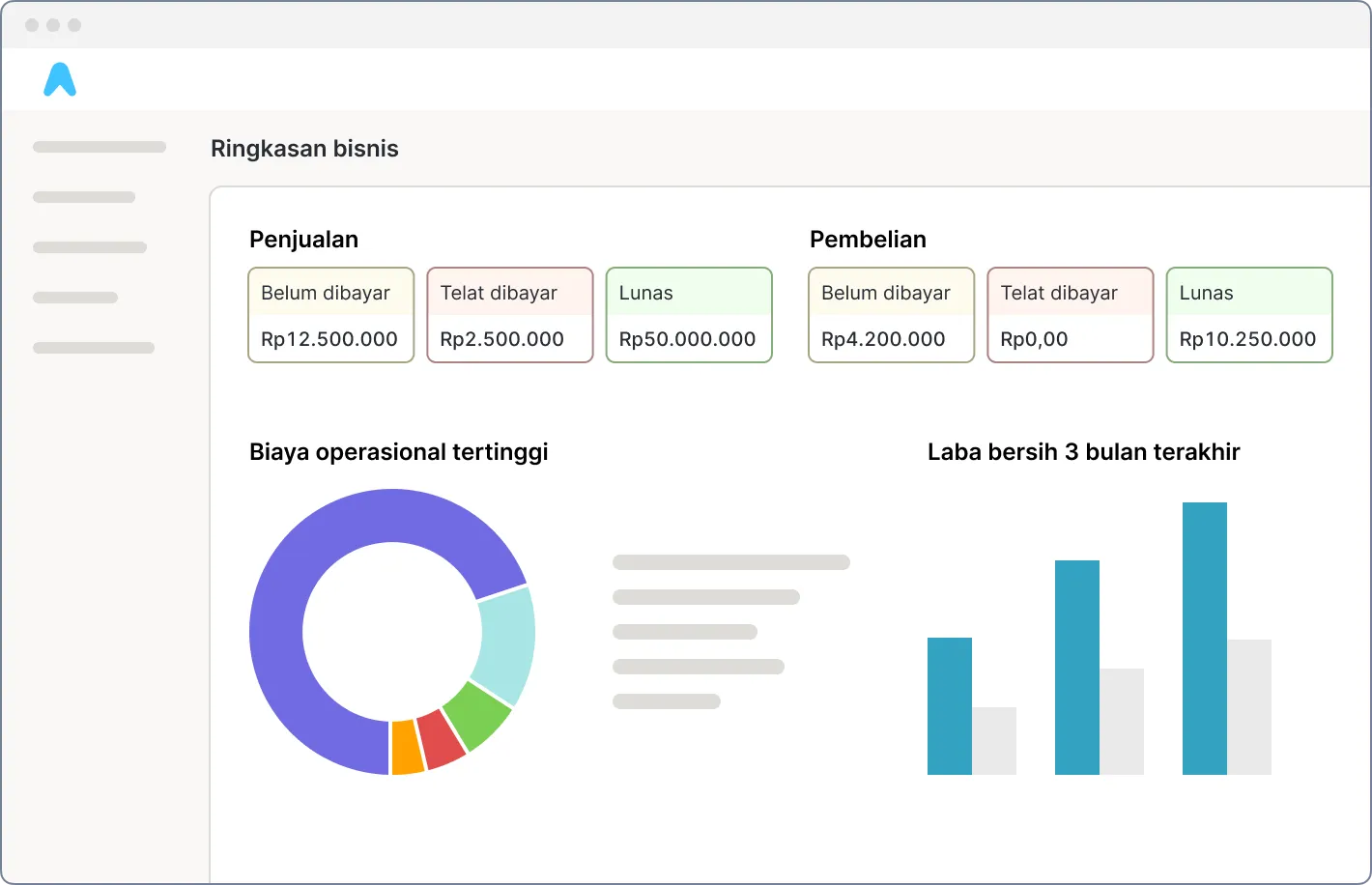

Achieve instant financial reporting compliant with PSAK standards, and automate bank reconciliation for better corporate financial visibility with Mekari Jurnal.

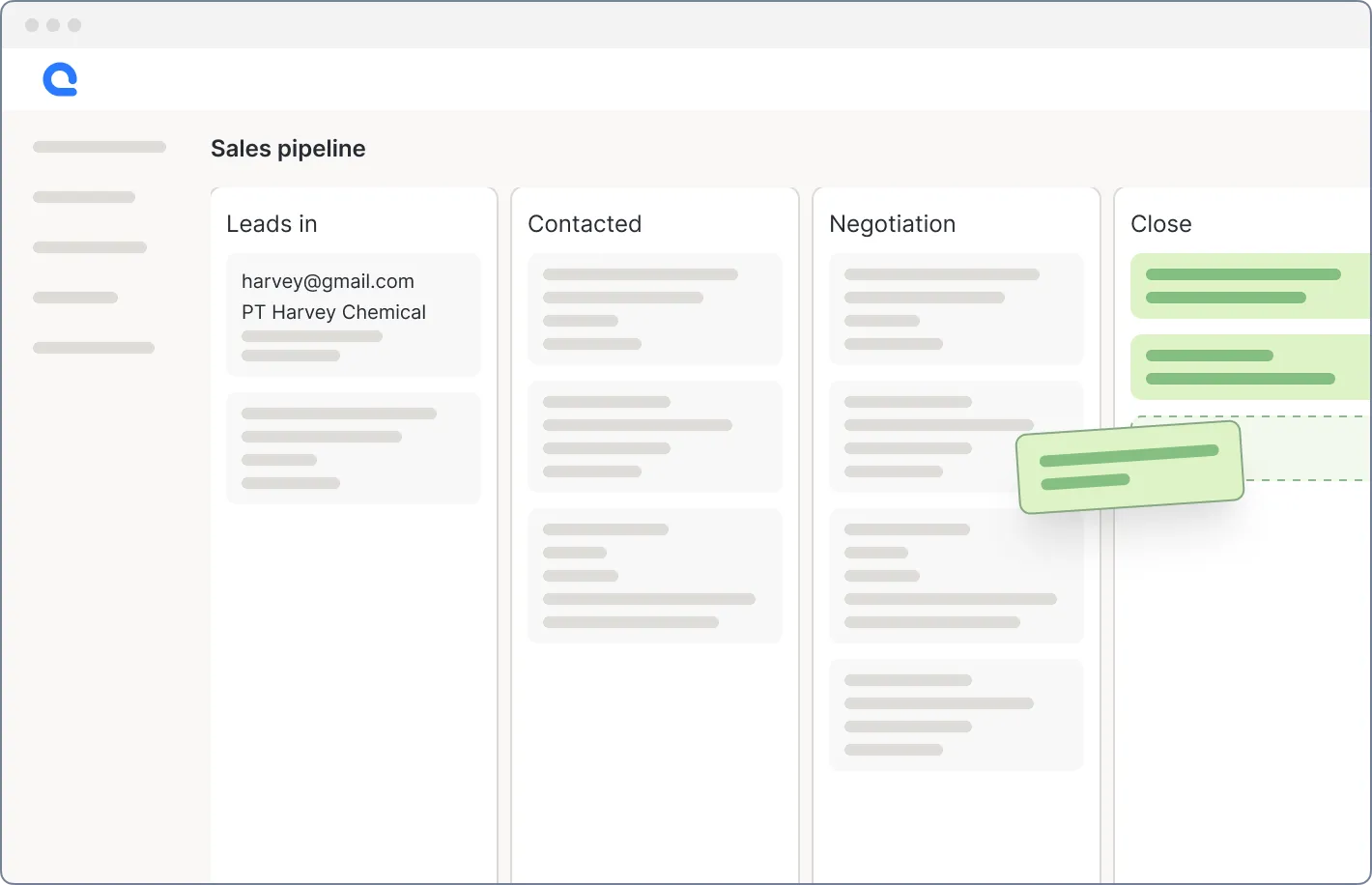

Securely and quickly automate KYC support and payment reminders by centralizing all client and partner communications with Mekari Qontak.

Why choose Mekari ecosystem to meet your fintech company needs

Advantages of using various software within the Mekari ecosystem to meet the needs of fintech companies.

World-class security

Solutions for fintech companies that are securely certified with the international standard ISO 27001 and have been recognized by Gartner.

Scalable systems

Ready-to-use platforms to meet the operational needs of various business scales from micro, small, medium, to large enterprises.

Flexible integrations

Our software is integrated into one business ecosystem with flexible API support to fulfill various fintech companies’ use cases and needs.

After-sales services

Customer support for any issues as well as training and empowerment across multiple channels with a clear and transparent SLA.

Customizable solution

Meet various fintech company system development needs with customization support powered by low-code and no-code technology.

Empowerment programs

Join various empowerment program within our ecosystem by networking through events and communities with fellow businesspeople.

What fintech companies say about Mekari

Numerous fintech companies rely on Mekari solutions to simplify their business processes from end-to-end.

FAQs about Mekari as a solution for fintech companies

Can Mekari integrate with financial platforms, CRMs, or payment gateways we already use?

Yes. Mekari products can integrate with major accounting systems, fintech CRMs, and payment gateways through APIs. This enables unified data flow between your HR, finance, and client platforms, ensuring transactions, payroll, and compliance stay perfectly synced.

How does Mekari support fintech operations that involve multiple business units or regulated entities?

Mekari Talenta and Mekari Jurnal allow you to manage different subsidiaries or entities within one ecosystem. Each unit can have separate payroll, tax, and financial reporting setups, yet remain consolidated for leadership visibility and compliance readiness.

How does Mekari help with strict financial compliance (OJK, BI, and tax regulations)?

Mekari Klikpajak automates all PPh and e-Faktur processes, ensuring timely filings with complete audit trails. Combined with Mekari Jurnal’s real-time reporting, it helps you stay aligned with OJK and BI reporting requirements, thus reducing compliance risk and manual errors.

What if our workforce includes contractors, sales agents, or freelancers with variable pay?

Mekari Talenta supports flexible payroll setups, including commissions, incentives, and variable pay structures. Combined with Mekari Pay, all disbursements can be processed automatically across multiple payment channels.

How can we improve employee retention and satisfaction in a high-pressure fintech environment?

Mekari Flex provides an accessible salary, allowing employees to access a portion of their earned pay before payday. This improves morale, financial wellbeing, and retention—without affecting your company’s cash flow.

FAQs about Mekari as a corporation

How established is Mekari in Indonesia’s business ecosystem?

Mekari has operated since 2015, supporting thousands of businesses, including financial institutions and startups. Our integrated ecosystem of HR, finance, tax, and productivity tools is trusted by over a million users across Indonesia.

Will Mekari’s ecosystem continue expanding to support digital finance?

Yes. With the acquisition of Desty, Mekari is strengthening its position in digital commerce and financial enablement, bridging fintech and MSME growth in one ecosystem.

Does Mekari provide onboarding and implementation assistance for regulated companies?

Absolutely. Our dedicated implementation team and customer success specialists provide guided onboarding, data migration, and compliance support to ensure a seamless transition without disrupting daily operations.

FAQs about access, data privacy, and security

Is client and transaction data secure within Mekari’s ecosystem?

Yes. Mekari applies enterprise-grade encryption and complies with Indonesia’s data protection laws. All fintech-related data—whether payroll, transaction logs, or client information—is stored securely and monitored 24/7.

Where is the data hosted, and does it comply with Indonesian data localization rules?

All Mekari data is securely hosted in Indonesian data centers, ensuring compliance with local data sovereignty regulations while maintaining high-speed access and redundancy.

Who has access to our company’s financial and customer data?

Only authorized users you assign can access specific datasets. Mekari provides detailed access permissions and audit trails. Our internal team cannot access private data without explicit consent.

What happens to our data if we stop using Mekari?

You can export your data anytime. Upon termination, we permanently delete your records from our servers in accordance with strict data disposal protocols.

Is Mekari certified or aligned with international data security standards?

Yes. Mekari aligns with ISO/IEC 27001 information security standards and follows continuous audits to ensure the safety and integrity of customer data.

Ready to power your growth?

Accelerate fintech companies operations with the number 1 SaaS platform in Indonesia.

WhatsApp us

WhatsApp us