Mekari Insight

- Automating tail spend processes can cut procurement costs by up to 10% through centralized data and streamlined approvals.

- Tail spend management software ensures transparency, enforces policies, and prevents rogue spending and fraud.

- Tail spend management software such as Mekari Expense simplifies procurement, reduces manual tasks, and provides real-time insights for smarter, faster decision-making.

Did you know that tail spend—those small, frequent purchases—could be silently draining your budget? For finance teams, this often-overlooked spending can lead to inefficiencies and missed opportunities.

In this article, discover how automating tail spend management can help you reduce hidden costs by up to 10% and boost your team’s efficiency. Don’t let small purchases add up to big problems!

The hidden cost of tail spend

Tail spend refers to low-value, high-volume purchases outside of strategic sourcing, often including urgent or small high-value transactions.

It causes inefficiencies for procurement, finance, and warehouse teams, and increases the risk of non-compliance and fraud. Examples in Indonesia include office supplies, ad-hoc services, and small maintenance tasks.

While it represents about 20% of the procurement budget, managing tail spend can reduce annual expenses by 5%-10% and prevent inefficiencies.

Types of spending in procurement

Understanding and managing these spending categories, especially indirect and tail spend, is crucial for optimizing procurement efficiency and maximizing cost savings.

1. Direct spend

This is the money spent on goods or services directly related to production. It’s the largest portion of procurement spend and includes vendor management, logistics, and inventory.

Proper management of direct spend involves analyzing purchase orders and leveraging supplier partnerships to improve buying power.

2. Indirect spend

These are operating expenses not directly linked to the end product, like office supplies, marketing, or software. If not properly tracked, indirect spend can lead to tail and maverick spend.

Categorizing all transactions as direct or indirect helps improve spend visibility and uncover savings opportunities.

3. Maverick spend

When purchases are made outside of approved procurement channels, often due to departments bypassing the process, this is known as maverick spend. It leads to lost savings and increased risk of compliance issues.

Managing maverick spend involves educating internal teams and building strong partnerships across departments.

4. Spot buying

This is an emergency purchase made to fulfill an immediate need. While it can’t be avoided entirely, spot buying should be captured and tracked to ensure it aligns with procurement processes.

This minimizes the risk of unnecessary, unplanned spending.

5. Tail spend

Tail spend refers to low-value purchases that, while numerous, represent a small percentage of total spend. Although tail spend can account for a large number of transactions, it only makes up a small portion of the total budget.

By identifying and managing tail spend, businesses can save up to 5%-10% of their annual procurement costs.

Challenges in managing tail spend

Though low in individual value, tail spend add up fast and create major challenges:

1. Manual tracking

Relying on Excel or siloed systems leads to fragmented data, human error, and limited visibility. As the business grows, this becomes unmanageable.

2. Non-PO vendors

Many purchases involve unregistered vendors, increasing risk, missing out on negotiated pricing, and driving inefficiencies in payment processing.

3. Lack of visibility

Without centralized oversight, it’s hard to know who buys what, from where, or at what cost—leading to missed savings, policy violations, and duplicate spending.

4. Fraud and leakage risks

Low-value transactions often escape scrutiny, opening the door to inflated pricing, fictitious vendors, or even personal purchases disguised as business needs.

5. Urgent, off-policy buying

In time-sensitive situations, employees bypass procurement, leading to uncontrolled spend, premium pricing, and poor documentation.

Tail spend management software: The smart solution

Tail spend management software helps companies take control of low-value, high-volume purchases that usually escape standard procurement processes.

How it works

Here’s what tail spend management software enables organizations to do more effectively:

- Centralizes data so all tail spend is visible in one place

- Automates tasks like purchase requests, approvals, POs, and invoice matching

- Enforces compliance with company policies and approval flows

- Identifies savings via supplier consolidation and spend analysis

- Reduces risk by limiting fraud and improving vendor control

Key features

To support those capabilities, tail spend management software typically includes:

- Automation: Smart workflows for requests, approvals, and invoice matching

- Supplier management: Centralized vendor onboarding and tracking

- Custom approvals: Multi-level flows with audit trails and e-signatures

- Analytics: Dashboards and alerts to monitor spend and flag issues

Also, tail spend management software integrates easily with ERP/finance systems via APIs or built-in connectors, enabling:

- Seamless data sync between systems

- Faster, more accurate payments

- Unified reporting across all spend

- Better budget control and compliance

Tail spend automation: Features that solve real problems

Managing tail spend manually often leads to low visibility, compliance risks, and unnecessary costs. Tail spend automation solves these pain points by introducing smarter, more structured processes.

Here’s how each feature makes a real difference:

1. Auto-categorization of spend

This feature automatically sorts purchases into categories like office supplies or marketing.

It replaces the need for manual sorting of transactions across departments, giving companies a clearer view of where money goes. With better categorization, teams can spot patterns, identify overlaps, and track spending more accurately against budgets.

2. Vendor onboarding and compliance

Tail spend often involves ad-hoc or new vendors. Automation makes it easier to onboard them properly—collecting required documentation, running compliance checks, and storing vendor data in one place.

This not only reduces legal and fraud risks but also ensures faster, safer purchasing for non-strategic needs.

3. Smart approval workflows

Approving every small purchase manually is inefficient, but skipping approvals entirely leads to lost control.

Automated workflows solve this by routing requests based on value, department, or category. Small transactions get fast-tracked with built-in rules, while higher-risk purchases still follow proper review steps.

4. Pre-approved vendor catalogs

Rather than letting employees buy from just anywhere, internal catalogs guide them to vetted suppliers with agreed pricing and terms.

This reduces rogue purchases, improves consistency, and accelerates ordering—especially for frequent, small-ticket items like maintenance tools or office materials.

5. Real-time dashboards

Instead of waiting for end-of-month reports, teams get live updates on tail spend activity—by vendor, department, category, or compliance level.

These dashboards highlight unusual activity early, help track savings progress, and provide the visibility needed to make smarter, faster decisions.

Read more: Expense vs. Spend Management: Key Differences and ImpactBenefits of tail spend management software for finance and procurement

Tail spend management software helps finance and procurement teams streamline processes, reduce waste, and gain control over low-value, high-volume purchases that are often overlooked. Here’s how it delivers real value:

1. Saves time by eliminating manual work

Tail spend is often tracked manually through spreadsheets or scattered systems, leading to slow reconciliations and errors.

Tail spend management software centralizes all purchase data, automates PO and invoice matching, and uses digital workflows to speed up approvals and reporting—freeing up both teams from tedious tasks.

2. Reduces costs by curbing maverick spend

Without visibility, small purchases quickly add up. TSM tools guide users to preferred vendors, flag duplicate or unnecessary requests, and provide clear spend data.

Procurement gains leverage to negotiate better deals, while finance can stop uncontrolled purchases before they happen.

3. Enforces policy and ensures compliance

Rogue purchases outside established policies put both teams at risk. Tail spend management software embeds approval flows and spending rules into the system, flags violations instantly, and logs every action.

This promotes consistent governance and prevents policy breaches before they occur.

4. Improves budget control across departments

Tracking tail spend by department is tough without real-time data. With TSM, finance can monitor spend at the unit level, set alerts as budgets near limits, and generate detailed reports.

Procurement can also use these insights to spot demand patterns and optimize sourcing.

5. Keeps audit trails clean and complete

Tail spend often lacks proper documentation, creating audit headaches. Tail spend management software stores all records—requests, approvals, invoices—in one place, with full visibility over every step.

This simplifies audits, strengthens financial reporting, and supports procurement best practices.

Recommended tail spend tools for the Indonesian market

When choosing a tail spend management tool for the Indonesian market, it’s essential to ensure:

- Localization: Offer full support in Bahasa Indonesia, align with local business practices, support Indonesian time zones and currency

- Compliance: Generate e-Faktur as required by DJP, support the creation of POs – updated with Indonesian procurement and tax regulations.

To help choosing the best software, here are some recommendations for Indonesian businesses:

1. Mekari Expense

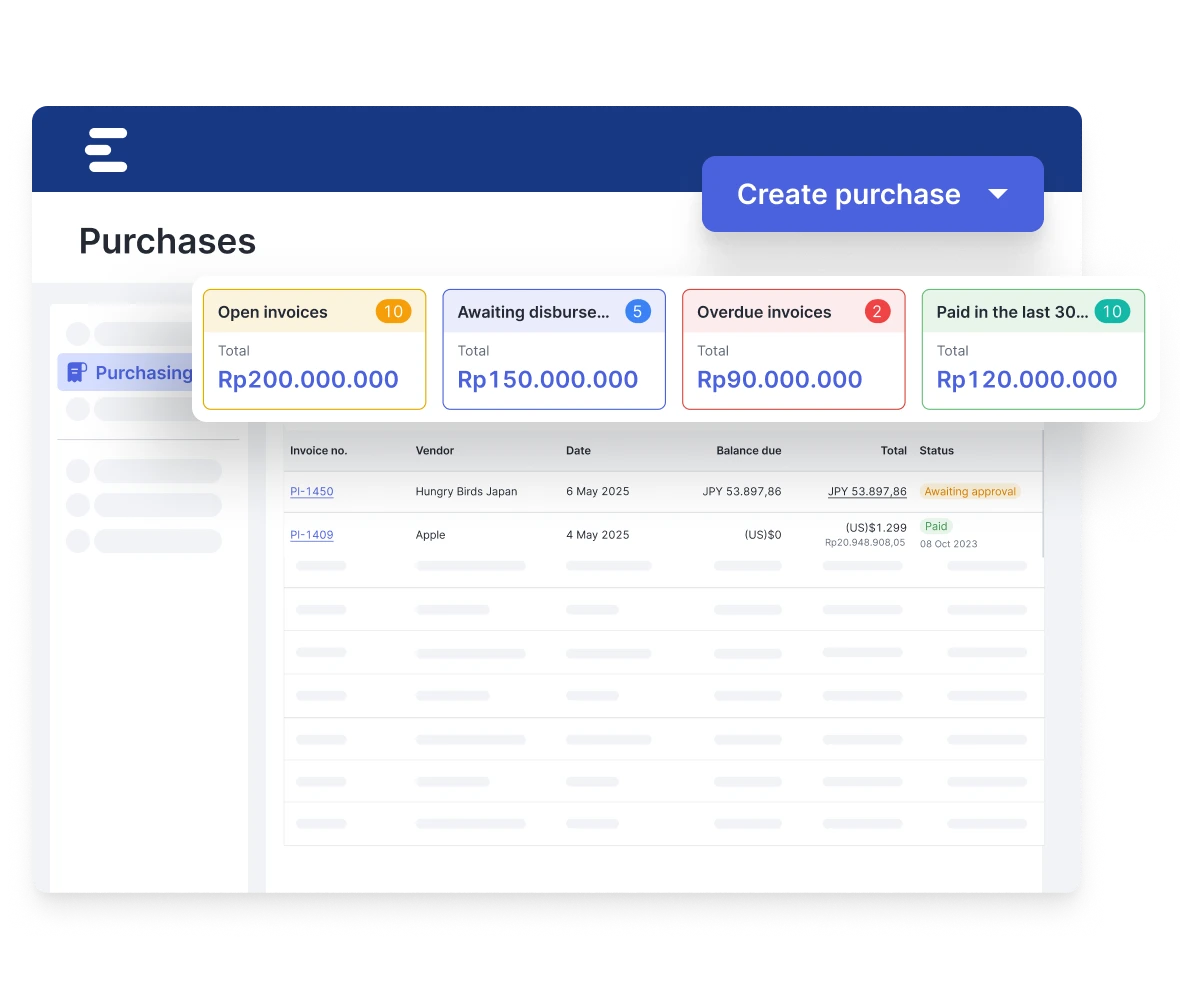

By automating the entire procurement process, Mekari Expense as a spend management software helps speed up the procurement cycle from request to payment, streamline processes, and boost productivity, making it an ideal solution for managing tail spend effectively and efficiently.

Equipped with procurement and purchase features, Mekari Expense could help your business with:

- Centralized data management: Consolidates all tail spend data into one platform, improving visibility and control over low-value, high-frequency purchases.

- Automated purchase requests & approvals: Streamlines the approval process for small, non-PO purchases, ensuring compliance with company policies and reducing manual work.

- Vendor management: Simplifies vendor onboarding, tracking, and compliance checks, reducing risks and ensuring purchases are made from trusted suppliers.

- Spend tracking & reporting: Real-time dashboards provide insights into tail spend patterns, helping identify opportunities for cost savings, consolidation, and better supplier negotiations.

- Customizable purchase orders (POs): Allows for easy creation and management of POs to ensure all purchases follow established procurement processes.

- Budget monitoring: Tracks tail spend against department budgets and provides alerts when limits are close to being exceeded.

2. Coupa

Coupa offers multi-language support and can handle multiple currencies, including IDR. However, the platform’s localization for Indonesian tax requirements, such as generating e-Faktur and adhering to local PO formats, would need to be verified.

For larger organizations, Coupa’s ability to automate AP processes and integrate with ERP systems could still be beneficial, provided it meets local regulatory needs.

3. Ariba (SAP Ariba Buying and Invoicing)

Ariba provides comprehensive localization options and supports various currencies, but confirmation is needed on its compatibility with Indonesian tax invoicing (e-Faktur).

The platform is well-suited for large enterprises and offers powerful tools for automating purchase orders and invoices, though local compliance checks are essential before implementation.

4. SAP Fieldglass

While SAP Fieldglass excels in managing services and external workforce procurement, it may not fully address the needs of organizations looking to optimize their tail spend for goods procurement.

Its focus on service-based transactions and the lack of specific support for Indonesian tax invoicing makes it less suitable for general procurement of goods.

The best tail spend management software: Mekari Expense

In conclusion, spend management software Mekari Expense offers the most efficient solution for managing tail spend, with its Purchase feature at the core of simplifying procurement processes.

By automating everything from purchase requests to payments, it eliminates manual tasks, enhances visibility, and ensures compliance—helping businesses save time and reduce costs.

With centralized data management, streamlined approvals, and seamless vendor management, Mekari Expense makes tail spend easier to track, control, and optimize.

To learn more and start simplifying your tail spend management, visit Mekari Expense Purchase.

References

Ivalua. ‘’Understanding Tail Spend Management: A Complete Guide’’

Simfoni. ‘’Tail Spend Management Handbook’’