Mekari Insight

- Pay monthly taxes by the 15th, file by the 20th, and submit your annual return by April 30 to avoid penalties.

- Boost savings through tax holidays, allowances, and deductions—especially if you invest, innovate, or hire.

- Simplify tax tasks with Mekari Klikpajak, fully integrated with Mekari Jurnal for smoother, faster compliance.

Paying taxes is part of running a business—but it doesn’t have to be complicated.

Knowing when and how to meet your corporate income tax obligations in Indonesia helps you stay compliant, avoid penalties, and keep your finances in order.

Here’s a quick guide to Indonesia corporate tax rate and the key deadlines every company should remember.

Read More: 10 Things you Should Know Before Doing Business in IndonesiaFiscal year or tax year in Indonesia

In Indonesia, the most common tax year runs from January 1 to December 31, matching the calendar year. However, companies can choose a different tax year based on their financial year, as stated in their company rules.

Corporate income tax must be paid by the end of the fourth month after the year ends. The tax returns should also be filed by this deadline.

Payments are made at a bank to the State Treasury, and a receipt needs to be included with the tax return. Companies can get an extension of up to two months if they notify the tax office before the deadline.

Indonesia corporate tax rate

In Indonesia, corporate income tax is calculated based on a company’s net income, which is its revenue minus business expenses.

The tax rate of 22% is applied to the net income, and the company pays this amount to the government each year. This tax is a key source of government revenue.

Here’s a summary of related taxes to the Indonesia corporate tax rate

| Related | Last | Previous | Unit | Reference |

|---|---|---|---|---|

| Corporate Tax Rate | 22.00 | 22.00 | percent | Dec 2025 |

| Personal Income Tax Rate | 35.00 | 35.00 | percent | Dec 2025 |

| Sales Tax Rate | 12.00 | 11.00 | percent | Jan 2025 |

| Social Security Rate | 15.74 | 15.74 | percent | Dec 2025 |

| Social Security Rate For Companies | 11.74 | 11.74 | percent | Dec 2025 |

| Social Security Rate For Employees | 4.00 | 4.00 | percent | Dec 2025 |

| Withholding Tax Rate | 20.00 | 20.00 | percent | Dec 2024 |

Tax incentives in Indonesia

To attract investment and support national priorities, the Indonesian government offers a range of tax incentives. These include tax holidays, tax allowances, and additional deductions to encourage business expansion, job creation, and innovation.

Companies that invest in “pioneer industries” can receive corporate income tax exemptions. These industries include:

- Upstream base metal industry

- Oil and gas purification/refining

- Petrochemical industry (based on petroleum, gas, or coal)

- Inorganic and organic chemical industries

- Pharmaceutical raw materials

- Medical and electronic device components

- Industrial engine and robotic components

- Automotive, ship, train, and aircraft parts

- Agriculture, plantation, and forestry

- Infrastructure development

- Digital economy (data processing, hosting, etc.)

Read More: How Corporate Debit Card Can Solve Common Budgeting IssuesTax holiday criteria and duration

The amount of investment determines the level and length of the tax holiday:

| Investment (IDR) | Tax Reduction | Duration |

|---|---|---|

| 100 billion – < 500 billion | 50% | 5 years |

| 500 billion – < 1 trillion | 100% | 5 years |

| 1 trillion – < 5 trillion | 100% | 7 years |

| 5 trillion – < 15 trillion | 100% | 10 years |

| 15 trillion – < 30 trillion | 100% | 15 years |

| 30 trillion or more | 100% | 20 years |

Tax allowances

Companies investing in designated sectors or less-developed regions can benefit from:

- Additional net income reduction of up to 30% of the investment in fixed assets (5% per year for 6 years)

- Accelerated depreciation and amortization

- Loss carry-forward extended up to 10 years

- 10% withholding tax on dividends to foreign shareholders (lower if a tax treaty applies)

Additional incentives

For companies focusing on labor, education, or innovation, the government offers:

- 60% additional cost deduction for new asset purchases in labor-intensive industries not covered by other incentives

- Up to 200% deduction for internship, apprenticeship, or teaching programs aimed at skill development

- Up to 300% deduction for qualifying research and development (R&D) activities conducted in Indonesia

Deductible and non-deductible expenses

Deductible expenses are costs that help a company earn or maintain income. These include:

- Business operations: Salaries, materials, rent, interest, travel, royalties.

- Marketing: Ads, product launches, sponsorships (with proper records).

- Bad debts: Can be written off if recorded in financials, reported to the tax office, and collection efforts are documented.

- Donations: For disaster relief, education, R&D, or sports—if through registered institutions, with documentation, and not exceeding 5% of last year’s profit.

Non-deductible expenses include:

- Employee perks (cars, phones) beyond 50% of costs

- Gifts or unqualified donations

- Income tax and penalties

- Costs linked to final-taxed income

- Partner salaries in partnerships

Keeping accurate records and ensuring compliance is essential for claiming these deductions.

Read More: Expense vs Spend Management: Key Differences and ImpactCorporate income tax deadline

Companies must pay monthly tax installments by the 15th and file returns by the 20th of the following month. The annual tax return and payment are due by April 30 of the next year.

Late submissions may lead to penalties. Overpaid taxes can be refunded or credited, but requesting a refund will trigger a tax audit.

Simplify tax compliance with the right tax management software

Staying compliant with tax deadlines doesn’t have to be stressful. With the right tools, managing your company’s taxes can be faster, easier, and more accurate.

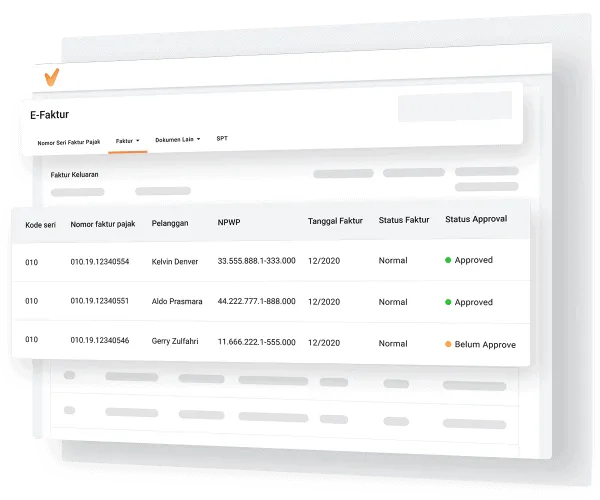

Mekari Klikpajak is a leading tax management solution in Indonesia that helps automate tax calculations, streamline reporting, and ensure timely payments—all fully integrated with Mekari Jurnal for a seamless financial workflow.

To take control of your tax and finance processes, explore how Mekari can support your Finance Division and Legal Division. Or learn more about the features of Mekari Klikpajak and simplify your tax compliance today.

References

Acclime. ‘’Corporate income tax in Indonesia’’

SAS. ‘’A Guide to Corporate Income Tax in 2025’’