Mekari Insight

- Expense management integration with accounting software eliminates manual data entry, reduces errors, and improves efficiency.

- Real-time syncing ensures accurate reporting, faster month-end closing, and better financial visibility.

- Mekari Expense with Mekari Jurnal integration is the best choice for businesses, offering seamless automation, real-time bookkeeping, and faster closings—all in one platform.

Choosing the right tool for expense management integration with accounting software can save businesses time, reduce errors, and improve financial visibility.

Instead of handling expenses separately, these apps sync directly with trusted accounting software, making reconciliation and reporting seamless.

In this article, we review seven of the best expense management apps that excel in accounting software integration.

Why expense management integration with accounting software matters

Connecting expense management with accounting software is essential for efficient and accurate finance operations. Integration keeps both systems aligned and eliminates gaps between expense tracking and financial reporting.

- Less manual work: Automates data entry, reducing errors and freeing your team’s time.

- Faster, more accurate books: Real-time syncing ensures up-to-date financials and smoother month-end close.

- Better visibility: Get a complete picture of spending, cash flow, and budgets in one place.

- Simpler audits: Every transaction has a digital trail, making audits stress-free.

Here are seven expense management apps, with a focus on their accounting software integration capabilities.

| Software | Key Integration Features | Best Suited For |

|---|---|---|

| Mekari Expense | Real-time synchronization with Mekari Jurnal, automatic reconciliation, faster closings, transaction tracking | Companies of all sizes using Mekari Jurnal, looking for seamless integration and efficiency |

| Expensify | Automated sync with QuickBooks, Xero, NetSuite, Sage; customizable exports; real-time data flow | Businesses of all sizes using popular accounting software needing real-time syncing |

| SAP Concur | Syncs expenses with ERP/financial systems; connects with 200+ systems; ERP-agnostic integration | Mid-to-large global enterprises needing enterprise-level integrations |

| Fyle | Two-way sync with QuickBooks, Xero, NetSuite, Sage; automated data transfer; error alerts | Businesses needing bi-directional syncing and automated expense filing |

| Brex | Automated bookkeeping with QuickBooks, Xero, NetSuite, Sage; pre-built connectors; detailed mapping | Startups and scaling companies using corporate cards and integrated financial tools |

| Ramp | Imports chart of accounts; AI-powered coding rules; transaction splitting; automated reconciliation | Companies prioritizing automation, AI-driven coding, and faster month-end close |

| Dext Prepare | Direct publishing to Xero, QuickBooks, Sage; chart of accounts sync; audit trail storage | Accountants, bookkeepers, and small businesses digitizing financial documents |

1. Mekari Expense

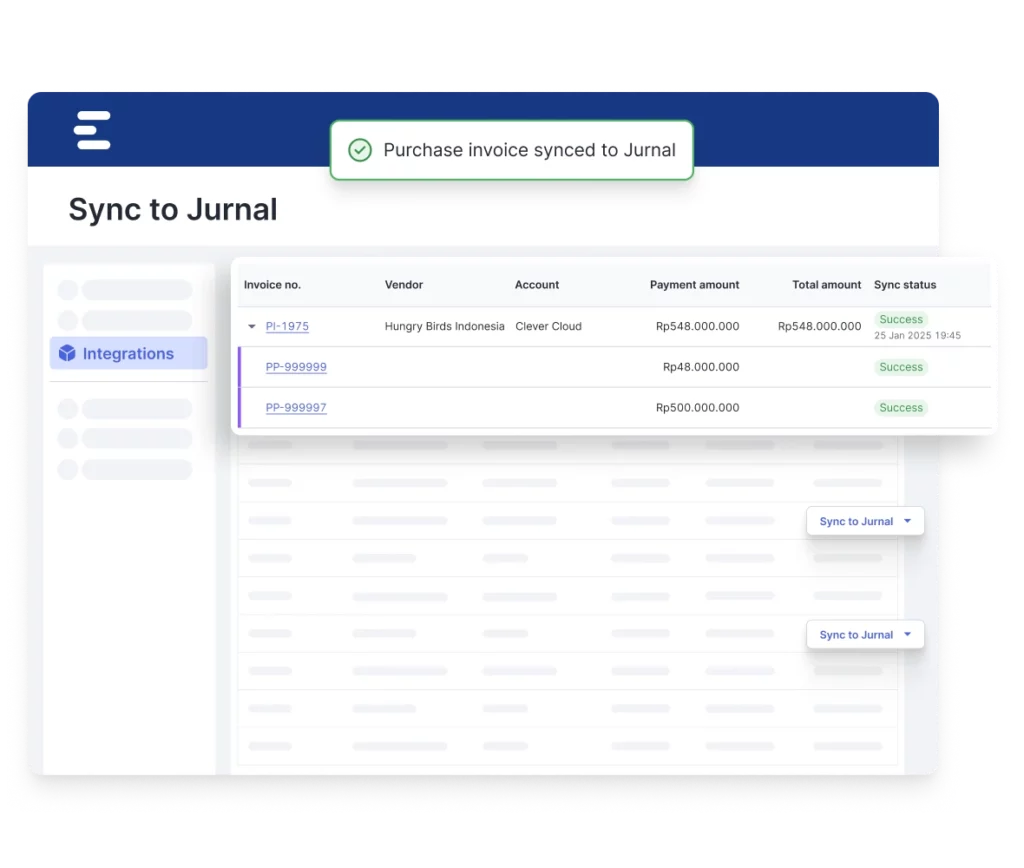

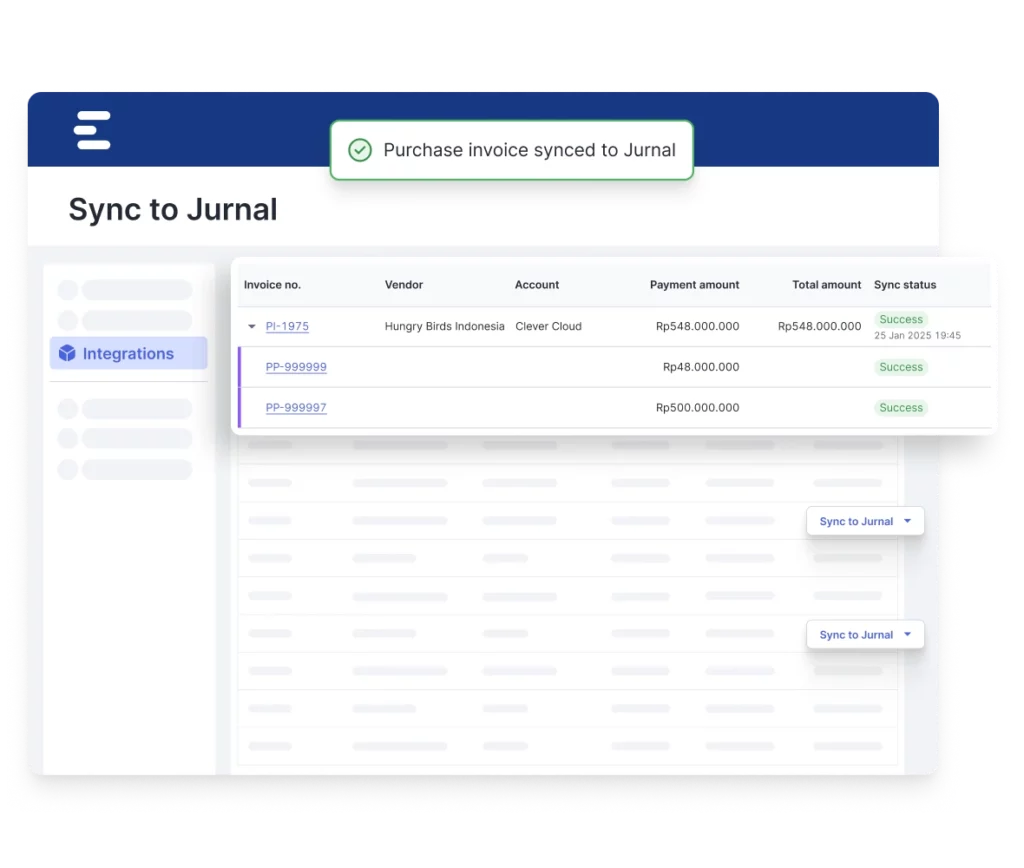

Mekari Expense stands out as one of the best spend management system thanks to its direct integration with Mekari Jurnal, Mekari’s cloud-based accounting software.

With this integration, all expense transactions are automatically synchronized into the accounting system in real time—making financial reporting faster, more accurate, and easier to manage.

Key integration features:

- Automatic synchronization: Every reimbursement, cash advance, or payment made through Mekari Expense is instantly recorded in Mekari Jurnal without manual entry.

- Real-time bookkeeping: Transactions are updated in real time, ensuring accurate, up-to-date financial reports at all times.

- Automatic reconciliation: Expenses are mapped directly to the correct Chart of Accounts (CoA), reducing errors in financial reporting.

- Transaction tracking: Each transaction has a clear digital history for accountability, audits, and reporting purposes.

- Faster closing process: Automated recording accelerates monthly and annual closings, saving valuable time for finance teams.

Best suited for: Companies of all sizes that want to integrate expense management with accounting in one platform. Especially valuable for businesses already using Mekari Jurnal and looking to streamline bookkeeping, reduce errors, and close their books faster.

2. Expensify

Expensify is an automated expense management platform that integrates tightly with leading accounting systems to simplify expense reporting and reconciliation.

Key integration features:

- Automated sync: Connects with QuickBooks, Xero, NetSuite, and Sage Intacct to push approved reports and reimbursements automatically.

- Customizable exporting: Configures data export to fit your accounting structure.

- Real-time data flow: Keeps accounting records updated instantly, no manual transfer needed.

- Data mapping: Maps expense categories to the right accounts in your chart of accounts.

Best suited for: Businesses of all sizes using popular accounting systems and needing real-time syncing.

3. SAP Concur

SAP Concur is a comprehensive spend management solution that integrates travel, expense, and invoice data with ERP and accounting platforms.

Key integration features:

- Data synchronization: Automatically creates journal entries and invoices when expenses are approved.

- Broad system support: Connects with 200+ business systems, including pre-built ERP integrations.

- ERP agnostic: Offers connectors and APIs for various ERP systems.

- Import/export capabilities: Imports master data and exports approved reports to financial systems.

Best suited for: Mid-to-large enterprises with global operations requiring enterprise-level integrations.

4. Fyle

Fyle is a real-time expense management platform with two-way integrations that sync data seamlessly with accounting systems.

Key integration features:

- Two-way sync: Works with QuickBooks, Xero, NetSuite, and Sage Intacct to mirror changes in both systems.

- Automated data transfer: Syncs receipts, card transactions, GL codes, and custom fields.

- Field mapping: Maps accounts, projects, and vendors for accurate coding.

- Error management: Alerts finance teams about mapping or export errors.

Best suited for: Businesses that need accurate, bi-directional syncing and automated data entry.

5. Brex

Brex provides corporate cards and integrated spend management, with accounting automation built in.

Key integration features:

- Automated bookkeeping: Syncs with QuickBooks, Xero, NetSuite, and Sage.

- Pre-built integrations: Ready-to-use connectors for ERPs and accounting platforms.

- Detailed mapping: Maps merchants and categories to GL accounts and vendors.

- Transaction status sync: Keeps transaction status aligned across systems.

Best suited for: Startups and scaling companies seeking an integrated financial platform.

6. Ramp

Ramp is an all-in-one finance automation platform with strong accounting integrations to speed up reconciliation.

Key integration features:

- Deep accounting connection: Imports chart of accounts and custom fields from major providers.

- Automated coding rules: Uses AI to auto-code transactions and sync with accounting software.

- Transaction splitting: Splits transactions across accounts for detailed tracking.

- Fast month-end close: Automates reconciliation for quicker financial closes.

Best suited for: Companies prioritizing automation, control, and faster month-end close.

7. Dext Prepare (formerly Receipt Bank)

Dext Prepare captures and digitizes receipts and invoices, sending them directly to accounting software.

Key integration features:

- Direct publishing: Sends documents straight to Xero, QuickBooks, and Sage.

- Chart of accounts sync: Imports chart of accounts for accurate categorization.

- Streamlined reconciliation: Provides categorized data with a strong audit trail.

- Audit trail: Securely stores all documents in the cloud.

Best suited for: Accountants, bookkeepers, and small businesses needing to digitize and organize documents before accounting.

Best software for expense management and accounting integration

When evaluating tools, Mekari Expense stands out as the most complete spend management system solution, especially for businesses already using Mekari Jurnal. Its integration eliminates manual data entry, ensures real-time transaction syncing, and accelerates month-end closing—all while reducing errors.

Why Mekari Expense is the best choice:

- Automatic synchronization: Every reimbursement or payment is instantly recorded in Mekari Jurnal.

- Real-time bookkeeping: Transactions are always up-to-date for accurate reporting.

- Faster financial closing: Automates reconciliation and speeds up monthly or annual reports.

- Clear transaction history: Every record has a digital trail for accountability and audits.

By unifying expense management with accounting, Mekari Expense enables businesses to operate more efficiently, minimize risks, and focus on strategic growth.