Mekari Insight

- Custom insurance solutions are designed to evolve with your business, streamlining operations and enhancing customer experiences in ways off-the-shelf products simply can’t.

- Faster service, reduced overheads, and happier customers, all powered by custom insurance software development.

- Custom insurance software development ensures your operations stay at the forefront of industry advancements, keeping your company secure, compliant, and always ready to scale.

According to J.D. Power, 74% of insurers already offer mobile apps for managing policies. Custom insurance software is clearly the way to go for companies wanting to stay ahead of the curve.

Why settle for off-the-shelf solutions when you can have something perfectly tailored to your business? In this guide, we’re diving into how custom insurance software development can transform your operations and future-proof your business.

What is custom insurance software development

Custom insurance software development refers to the process of creating tailor-made software solutions specifically designed for insurance companies.

These solutions are developed to meet the unique needs and operational requirements of the insurance industry, including functions such as underwriting, claims processing, policy management, customer relationship management (CRM), billing, to compliance.

How custom insurance software drive business growth

Custom insurance software is a game-changer for insurance companies, helping them run more efficiently, engage customers better, and drive growth. Here’s how it fuels business success:

1. Faster claims processing

With custom software, claims processing becomes faster and more efficient. It automates the tedious paperwork and approval steps, reducing delays and helping get claims to customers quickly.

This not only enhances customer satisfaction but also reduces the burden on your team.

2. Better customer engagement

Insurance companies can offer a more personalized experience with custom software. Features like self-service portals and AI-driven chatbots allow customers to manage their policies, file claims, and track updates on their own terms, anytime.

This level of convenience boosts customer loyalty and improves overall satisfaction.

3. Data-driven decisions

Custom insurance software equips companies with powerful analytics tools to understand customer behavior, market trends, and business performance.

These insights help insurers fine-tune pricing, identify opportunities for growth, and optimize risk management, all of which contribute to smarter decision-making and increased profitability.

4. Enhanced risk management & fraud detection

AI and machine learning technologies integrated into custom software make it easier to identify and manage risks.

Fraud detection systems analyze patterns and spot unusual activities, ensuring that businesses can mitigate potential risks before they escalate.

5. Scalability for growth

As your business expands, your software should be able to keep pace. Custom software is designed to scale easily, allowing you to add new products, services, and customer segments without major disruptions.

This flexibility ensures that your infrastructure can grow alongside your business, supporting long-term success.

6. Seamless integration with emerging technologies

Custom software seamlessly integrates with technologies like AI, blockchain, and IoT, making your operations more efficient and secure.

These technologies improve everything from underwriting to transaction processing, offering better security and boosting operational efficiency.

7. Regulatory compliance

Insurance companies must navigate complex regulations, and staying compliant can be challenging.

Custom software helps businesses stay updated with changing laws and regulations, ensuring that they meet compliance requirements without extra manual effort.

Benefits of using custom insurance software

In the competitive insurance industry, staying ahead requires more than just good service—it requires innovation. Custom insurance software drives this by automating processes, optimizing data usage, and offering tailored solutions.

Here’s how it benefits insurance companies:

1. Streamlines operations and boosts efficiency

Custom insurance software automates key processes like claims handling and policy management, significantly reducing the need for manual tasks.

This not only speeds up response times but also allows employees to focus on higher-value tasks, leading to improved productivity and smoother workflows. By minimizing manual interventions, it reduces errors and optimizes resource allocation.

Read more: How to Streamline Business Operations: A Step-by-Step Guide2. Enhances customer interactions

Creating a seamless experience for customers is critical in the insurance industry. Custom software ensures clients receive timely updates, reminders, and real-time answers to their inquiries.

This smooth, automated communication fosters better relationships with customers, driving satisfaction and loyalty, while also making interactions more efficient for employees.

3. Ensures compliance with ease

Insurance companies must navigate complex regulations, and keeping up with changing laws is a constant challenge. Custom software helps by automatically tracking updates in regulations and data protection standards.

This ensures your business remains compliant without the risk of manual errors or missing crucial updates, making compliance management much easier.

4. Grows with your business

As your business expands, your software should adapt to new needs. Custom insurance software is designed with scalability in mind, meaning it can easily accommodate new products, services, and customer bases.

Whether you’re launching new offerings or entering new markets, the system can grow alongside your business, ensuring you won’t outgrow your technology.

5. Integrates seamlessly with emerging tech

Custom insurance software integrates smoothly with other systems, such as CRM platforms and third-party APIs — enhances operational efficiency and security.

This integration enables features like automated underwriting and real-time transaction processing, keeping your business on the cutting edge.

6. Safeguards customer data

In the insurance sector, protecting sensitive customer information is critical. Custom software includes advanced security features like encryption, multi-factor authentication, and controlled access, which protect against data breaches.

This ensures customer data remains safe, helping to maintain trust while protecting the company from legal and financial risks.

Types and examples of custom insurance software

Here are seven key types of custom insurance software that drive efficiency, enhance customer experiences, and keep businesses ahead of the curve:

1. Insurance workflow automation

For insurance companies, repetitive tasks such as policy approvals and claims handling can slow down operations. Custom workflow automation software is tailored to automate these tasks according to the specific needs of the business.

By streamlining processes like customer onboarding and internal approvals, this software not only speeds up workflows but also reduces the risk of human error, allowing teams to focus on more important, customer-facing tasks.

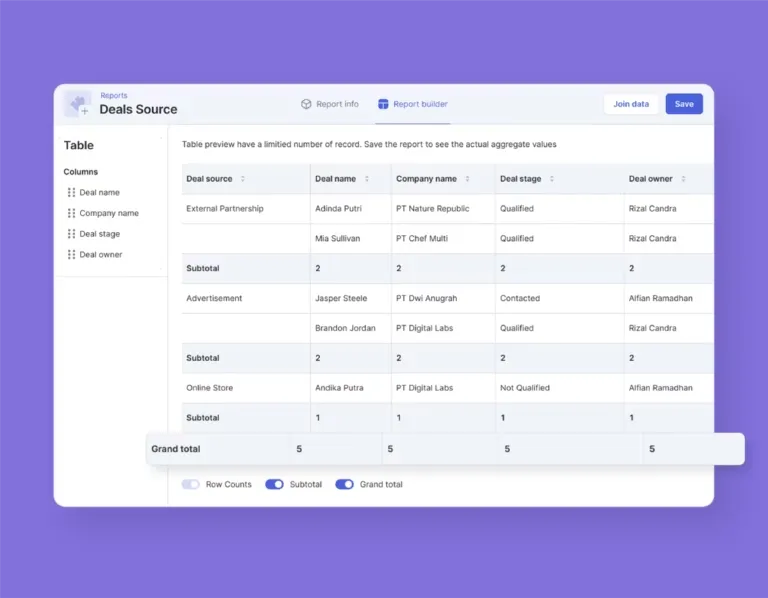

2. CRM & lead management software

Building strong customer relationships is essential, but it requires a personalized approach. Custom CRM and lead management software is designed to integrate seamlessly with a company’s specific sales and service processes.

It gives agents, brokers, and sales teams a holistic view of all customer interactions, enabling them to follow up on leads, renew policies, and provide exceptional service with ease—all while ensuring each client feels like a priority.

3. ERP software

Managing everything from customer data to financial records manually can be chaotic. Custom ERP (Enterprise Resource Planning) software centralizes all key business functions into one system.

This tailored software not only organizes transactions, policy records, and reporting, but also ensures that all departments are aligned.

4. Document management & approval software

In the insurance industry, dealing with large volumes of paperwork is inevitable. Custom document management software can be designed specifically to organize and retrieve policy applications, contracts, and customer records digitally.

By customizing the software to fit the company’s specific needs, insurers can quickly access and update documents, improving both efficiency and accuracy while reducing the administrative burden.

5. Risk assessment with custom underwriting software

Risk assessment is at the core of the insurance business. Custom underwriting software helps insurers accurately evaluate risk by automating the analysis of customer data and providing personalized policy recommendations.

Custom-built to address specific market conditions and risk factors, underwriting software speeds up policy approval and helps ensure fair pricing, reducing the likelihood of errors in the process.

6. Policy management software

Managing insurance policies can be complex, especially when dealing with various policy types and regulations. Custom policy management software simplifies this by automating policy creation, updates, and tracking.

Custom solutions can also handle reinsurance management, streamlining risk transfers and treaties according to the business’s needs, which increases accuracy and efficiency throughout the entire policy lifecycle.

7. Claims management software

Quick and efficient claims processing is key to maintaining customer satisfaction. Custom claims management software automates the entire process from verification to payout, tailored to the specific workflows and requirements of the business.

It ensures faster claims resolution, detects fraudulent claims, and improves accuracy—all while delivering a better experience for both customers and internal teams.

How to choose custom software developer for insurance industry

Choosing the right custom software developer for your insurance business is a big decision, and the right developer can transform your operations.

So, how do you find the best fit for your company? Let’s break it down into practical steps:

1. Look for industry expertise & developer know-how

Building custom insurance software requires deep knowledge of the insurance industry’s regulations, compliance needs, and workflows. When choosing a software development team, make sure they have hands-on experience in the insurance sector.

The best teams know the ins and outs of risk assessment, fraud detection, and regulatory hurdles, so you won’t have to educate them on the basics. They’ll already know what works and what doesn’t, helping you avoid costly mistakes down the road.

2. Prioritize customization & smooth integration

Your insurance company is unique, and your software should be too. A “one-size-fits-all” approach will only get you so far.

Look for a developer who can tailor the software to fit your specific needs while ensuring it integrates seamlessly with your existing systems—whether it’s CRM, ERP, or any third-party tools you already use.

Custom solutions mean you can automate workflows and eliminate manual processes, boosting efficiency and reducing human error.

3. Focus on advanced technology & security

In today’s digital landscape, insurance software needs to be both powerful and secure. Choose a developer who’s well-versed in modern technologies and frameworks—think scalable systems, cloud computing, and cutting-edge performance.

But don’t just stop at performance; prioritize security too. A reliable developer will integrate top-notch security measures, from encryption to compliance with industry standards (like GDPR or HIPAA).

Cyber threats evolve fast, and your software should be built to defend against them.

4. Get clear pricing & realistic timelines

One of the most frustrating things in any development project is unclear pricing and constantly shifting timelines. When you’re choosing a custom insurance software developer, go for transparency.

A good partner will provide clear, upfront pricing, break down project costs, and set realistic timelines. This way, you can avoid surprise fees, delays, and confusion during the development process.

A smooth process from start to finish makes everything easier for your team to plan around.

5. Make sure you have ongoing support & maintenance

Software doesn’t just “go live” and then run on its own. It needs constant maintenance, updates, and security patches. When selecting a developer, ensure they offer robust long-term support.

This should be clearly outlined in a Service Level Agreement (SLA), so you know exactly what you’re getting. Whether it’s fixing bugs, adding new features, or addressing security vulnerabilities, ongoing support is essential to keep your insurance software running smoothly over time.

Best custom insurance software developer

Finding the right custom software solutions is more crucial than ever. Whether you’re looking to streamline operations, enhance customer experience, or ensure compliance, custom software tailored to your needs can help you achieve all of these and more.

The right development partner can help you create a system that not only fits your business today but also grows with you in the future, all while offering cutting-edge technology, security, and seamless integration.

For insurance companies looking for a reliable, proven partner in custom software development, Mekari Officeless is an excellent choice.

Trusted by major players like PT Asuransi Takaful Indonesia and PT Asuransi Perisai Listrik Nasional, Mekari Officeless has a track record of delivering secure, scalable, and tailored solutions that address the unique needs of the insurance industry.

With our expertise, your insurance business will be well-equipped to navigate the future with confidence. Don’t wait, try Mekari Officeless now.

References

Angular Minds. ‘’What is Custom Insurance Software Development in 2025?’’

Decerto. ‘’Custom Insurance Software Development: Tailored Solutions for Insurers’’