Mekari Insight

- Well-defined reimbursement policies boost employee morale and keep financial control in check. By setting clear guidelines, businesses can prevent confusion and ensure timely, compliant reimbursements.

- Streamlining the expense reimbursement process with automated software ensures faster reimbursements, reduces errors, and cuts down on the time spent manually entering data.

- Integrating spend management software such as Mekari Expense into your reimbursement workflow provides real-time analytics and seamless connections with accounting systems, ensuring that both employees and finance teams can manage expenses with ease and transparency.

Handling business expense reimbursements doesn’t have to be a headache for employees or finance teams. Whether you’re submitting receipts or reviewing claims, a streamlined process can make all the difference.

In this guide, we’ll explore practical best practices and solutions that simplify the entire reimbursement process—saving time, reducing errors, and improving accuracy.

For employees, that means faster reimbursements, and for finance teams, clearer tracking and less manual work. Let’s dive into how you can make expense management effortless and efficient.

Expense reimbursement process in business

Business expense reimbursement is the process where companies pay back employees for business-related expenses they’ve personally covered, like travel or office supplies.

It’s essential for all organizations, big or small, to ensure employees aren’t financially burdened by work costs.

To make this process smooth, businesses need clear reimbursement policies. A well-structured policy not only keeps operations efficient but also boosts employee morale by showing their efforts are valued.

When done right, it builds trust and benefits both the company and its employees.

Why business expense reimbursement matters

Business expense reimbursement is more than just a process; it’s a key element in maintaining financial control, compliance, and employee satisfaction.

1. Financial control

Business expense reimbursement allows companies to accurately track and manage spending. By keeping a close eye on business-related expenses like travel or office supplies, businesses can better budget and forecast future costs, preventing overspending.

Read more: Expense vs. Spend Management: Key Differences and Impact2. Compliance

A clear reimbursement policy ensures adherence to tax laws and internal company policies. This reduces the risk of legal and financial issues, like tax breaches or penalties, helping businesses stay compliant with regulations and avoid costly mistakes.

3. Employee satisfaction

Timely and fair reimbursements create trust and boost employee morale. When employees know their out-of-pocket expenses will be reimbursed quickly and fairly, it strengthens their relationship with the company and improves retention.

For example, reimbursing a traveling employee for meals and lodging builds a sense of appreciation.

4. Tax implications

Having a proper reimbursement plan (accountable vs. non-accountable) can prevent reimbursements from being treated as taxable income.

This ensures employees aren’t burdened with unnecessary taxes, while businesses avoid added financial complications, making the reimbursement process smoother for everyone.

Examples of common reimbursable expenses

Business expense reimbursement covers a wide range of costs that employees may incur while performing their jobs. Here’s a breakdown of the most common reimbursable expenses:

1. Travel costs

Business trips often come with significant costs, and companies typically cover flights, hotel stays, transportation, and meals.

It’s not just about convenience – reimbursing these costs ensures employees don’t have to pay out of pocket for work-related travel.

2. Meals and entertainment

Hosting clients or team meetings often requires meals or entertainment, and businesses often reimburse these costs.

Whether it’s a dinner with a client to discuss future projects or catering for an in-house meeting, these expenses are necessary for building relationships and fostering business growth.

3. Supplies and tools

Employees often need specific tools or supplies to do their jobs, and many companies reimburse these costs.

For instance, if an employee buys software, office supplies or equipment to improve their productivity, these expenses can be reimbursed, ensuring they have the right tools to succeed without bearing the financial burden.

4. Professional development

Investing in an employee’s growth is a win-win for both the individual and the company. Costs for attending conferences, pursuing certifications, or enrolling in training courses are often reimbursed to help employees develop their skills and stay competitive.

For example, if an employee attends a coding bootcamp or a leadership seminar, those expenses can often be covered by the company.

5. Other costs

Beyond the obvious, other reimbursable expenses can include communication costs like phone bills for work-related calls, networking events that promote business growth, or health-related reimbursements like gym memberships to keep employees healthy.

Some companies even cover tuition for employees furthering their education, showing a commitment to long-term professional growth.

Business expense reimbursement process

Whether you’re a new hire or managing a team, understanding this process saves time, prevents confusion, and keeps everyone accountable.

Submitting on time with clear receipts doesn’t just help you—it helps finance close the books, track budgets, and prevent fraud. The smoother you make it for reviewers, the faster your money comes back.

1. Business expense paid

It all starts when you, the employee, swipe your personal card for something work-related. This could be travel, client entertainment, supplies, or other approved costs.

2. Collecting proof

Right after the purchase, it’s essential to collect proof—such as receipts, invoices, or confirmation emails. It’s best to do this immediately to avoid delays or missing paperwork later.

Read more: Enhancing Efficiency with AP Invoice Automation Software3. Create an expense report

Once documentation is ready, the employee compiles an expense report. This includes:

- A breakdown of each expense

- The date, amount, and category

- A short explanation of its business purpose

Most companies use expense management tools to streamline this process.

Important!

Smart OCR technology from Mekari Expense makes entering expenses practically effortless. It automatically scans, extracts, and categorizes data from your receipts.

Whether you snap a photo, upload a PDF, or forward an email, your expense data gets captured in seconds, keeping everything organized and hassle-free.

4. Submit for review

The completed report, along with all supporting documents, is then submitted—usually to a manager or finance department—for review. Double-checking for policy alignment here helps avoid back-and-forth.

Keep your company’s expense policy handy, especially for tricky items like client gifts or per diem limits.

5. Approval and verification

The finance or admin team reviews your claim. The report is reviewed to ensure all claims meet policy guidelines. This step may involve verifying receipt accuracy, ensuring expenses were necessary, and flagging any exceptions.

6. Reimbursement processed

Once approved, the reimbursement is processed—often through direct deposit or added to your next payroll cycle. Timing depends on your company’s finance schedule, but clear submissions can speed things up significantly.

Accountable vs. non-accountable plans

When it comes to employee reimbursements, understanding the difference between accountable and non-accountable plans can make all the difference.

These plans affect how employees report expenses and, most importantly, whether or not those reimbursements are taxable.

1. Accountable plans

Accountable plans are designed to make life easier for both employers and employees—without creating a headache at tax time. Here’s how they work:

- Business-related expenses only: Employees must spend money on something directly tied to business—like a hotel for a work trip or office supplies. If the expense isn’t business-related, it’s not eligible for reimbursement.

- Timely reporting: Employees need to provide clear proof of the expenses, like receipts or invoices, and submit them within a reasonable time frame (usually within 60 days).

- Return excess money: If an employee gets reimbursed more than the actual cost (like a $50 reimbursement for a $40 meal), they must return the excess amount to the company.

When all of this happens, employees get tax-free reimbursements, and employers can deduct these reimbursements as business expenses.

2. Non-accountable plans

On the other hand, non-accountable plans are much simpler but can be a bit more expensive in the long run, both for the employer and the employee. Here’s the scoop:

- No detailed reporting: Employees don’t need to provide receipts or detailed documentation for the expenses—they just get a set allowance.

- Taxable reimbursements: The reimbursement is treated as taxable income for the employee. That means it’s subject to payroll taxes, and the employee’s taxable income goes up.

- Potential complicated tax deductions: While employees might be able to deduct some expenses on their personal tax returns, this process can be confusing and doesn’t always result in full savings.

Challenges in traditional expense reimbursement

Traditional business expense reimbursement processes, while common, often come with a set of frustrating challenges that can drain time and resources.

1. Manual processes are error-prone and time-consuming

Relying on paper receipts, spreadsheets, and manual data entry creates a perfect storm for errors. Whether it’s a typo, misplaced receipt, or missed deadline, the chances of mistakes are high.

Plus, the back-and-forth between employees and finance teams can take up precious time.

2. Lack of visibility and control over spending

Without a streamlined system, managers and finance teams struggle to see where money is going. They can only react after expenses are submitted, leading to a lack of budget control. It’s hard to spot patterns or catch overspending early.

Insight!

Without real-time tracking, expenses can quickly spiral out of control—especially if the company has multiple departments or frequent travel. An employee’s small meal might seem harmless, but what if unchecked, it leads to larger recurring costs?

3. Delays in approvals and payments frustrate employees

In a manual setup, approval chains can stretch across multiple people, causing delays. An employee might have submitted an expense report weeks ago, but due to sluggish approval processes or missing documents, they still haven’t been reimbursed.

4. Risk of fraud and policy abuse without proper controls

Without a digital system in place to track and monitor submissions, there’s a higher risk of policy abuse or fraud. Employees might overstate their expenses, submit fake receipts, or take advantage of a lack of oversight.

For example, without automated checks, someone could submit a meal receipt for a personal dinner and label it as a business expense. Fraud may seem like a small risk, but it can accumulate quickly, costing the business more than it realizes.

Best practices for business expense reimbursement

Expense reimbursement doesn’t have to be complicated. By following a few best practices, businesses can keep the process clear, transparent, and efficient. Here’s how to get it right:

1. Develop and communicate a clear, detailed policy

A well-defined policy is the backbone of any successful expense reimbursement process. When employees know what to expect, it reduces confusion and streamlines approvals. Make sure to clearly outline:

- What’s reimbursable: Business-related meals, travel, office supplies.

- What’s not reimbursable: Personal expenses, luxury meals, or anything unrelated to work.

Having a simple but detailed policy that employees can easily access (like on the company intranet or in an employee handbook) ensures everyone’s on the same page and prevents misunderstandings.

2. Define reimbursable vs. non-reimbursable expenses

It’s crucial to have clear distinctions between what can and can’t be reimbursed. Set specific examples, so there’s no gray area. For example, business meals with clients might be reimbursable, but a personal meal after a late night at the office wouldn’t be.

3. Set per diem rates and spending limits

Travel expenses are among the most common reimbursements, but they can quickly get out of hand without guidelines. Per Diem rates are an excellent solution. These set a fixed daily allowance for meals, accommodation, and transportation—taking the guesswork out of how much to spend.

Most governments set standard rates based on location, but businesses can adjust these figures depending on their needs. For example, if you’re sending an employee to a city where the cost of living is higher, you may increase the per diem rate for that trip.

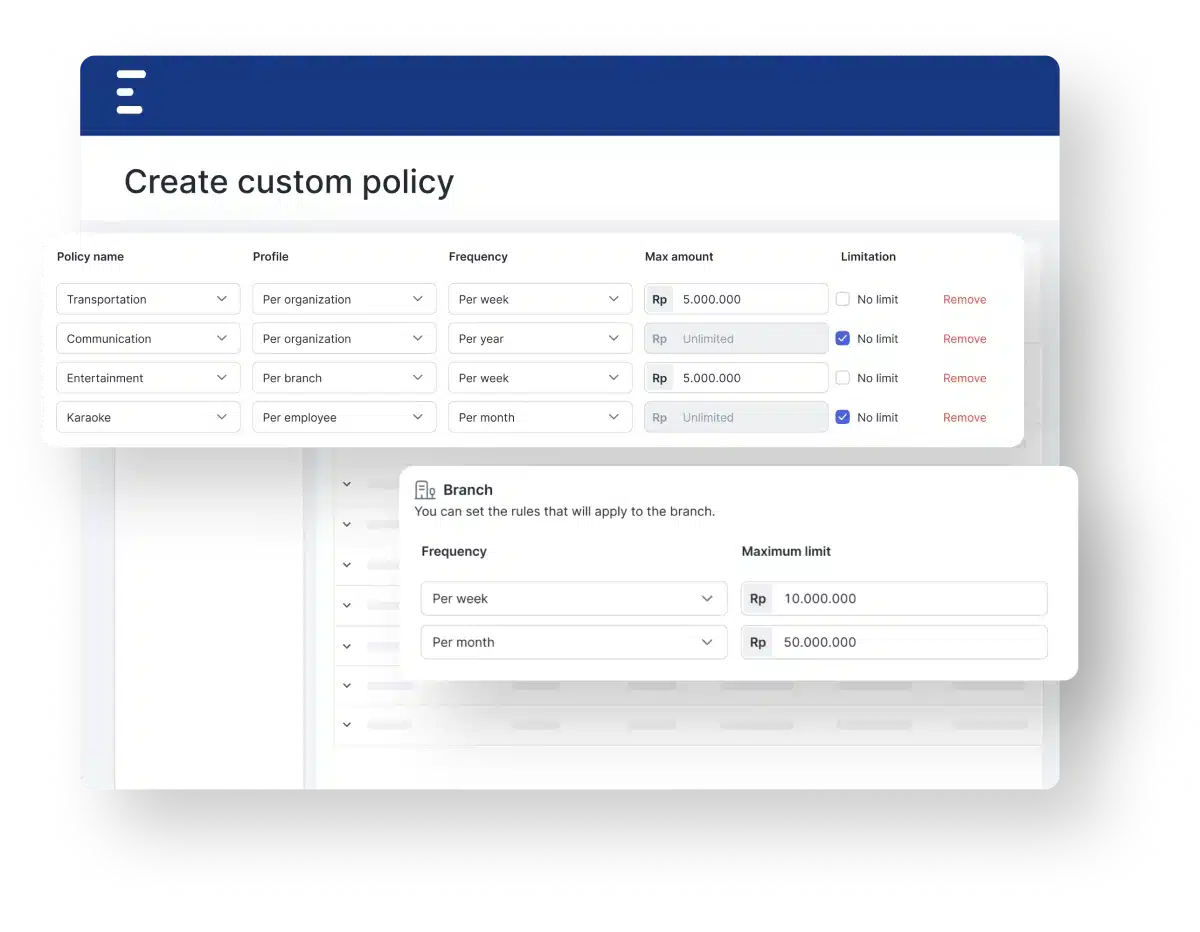

4. Implement internal controls to prevent fraud

Without checks and balances, the door is open for fraud or misuse.

Implementing internal controls like requiring receipts, using expense management software, and setting approval workflows can prevent fraudulent claims and ensure expenses align with the company’s guidelines.

Important!

Using automated expense management systems that flag high-value expenses or unusual claims – such as Mekari Expense, can help catch errors or misuse before they turn into larger issues, saving the company money and frustration.

5. Educate employees on procedures and timelines

It’s not enough to just hand over a policy—employees need to understand it. Educate your team on what’s expected, how to submit expenses, and the timelines for reporting.

Make sure they know how to categorize expenses and when to submit their reports to avoid delays.

6. Regularly review and update policies for compliance and efficiency

Expense reimbursement policies should never be “set it and forget it.” Over time, business needs change, and so do tax laws and compliance regulations. Regularly review and update policies to stay ahead of any changes and ensure they’re as efficient as possible.

For example, you might find that certain categories of expenses, like client meals, are increasing. In this case, you could adjust the policy to either increase the allowance or better define acceptable spending limits.

The role of business expense reimbursement software

As companies continue to evolve, expense reimbursement software is quickly becoming a game-changer. It’s not just about simplifying the process; it’s about making the entire reimbursement cycle more efficient, transparent, and stress-free.

1. Automates data entry, receipt capture, and report submission

Gone are the days of manually entering receipts or hunting down missing paperwork. Expense reimbursement software automates data entry by scanning receipts and extracting key information like amounts, dates, and vendor details.

This means employees no longer need to spend hours inputting numbers, and finance teams don’t need to double-check every report.

2. Streamlines approvals and payment processing

Manual approval chains are not only slow, they’re also prone to bottlenecks. With expense reimbursement software, the approval process is streamlined and much quicker.

Once a report is submitted, it’s automatically routed to the right person for approval. After approval, the payment is processed faster, meaning employees get reimbursed sooner and finance teams spend less time on administrative tasks.

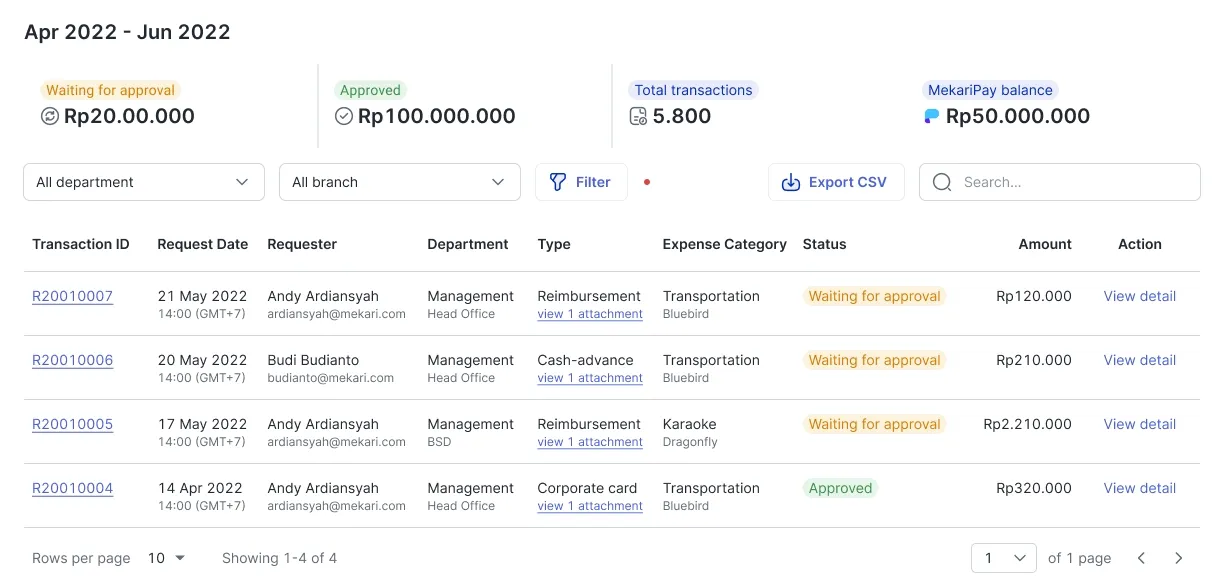

3. Provides real-time visibility and analytics for finance teams

With traditional methods, it’s hard to get a clear view of spending trends across departments. Expense reimbursement software provides real-time analytics that allow finance teams to monitor and analyze spending.

This means you can catch potential overspending early, track trends, and make data-driven decisions for future budgeting.

4. Reduces errors, paperwork, and administrative burden

Manual processes often lead to errors—whether it’s miscategorizing expenses, entering the wrong amounts, or losing receipts. Software reduces this human error by automating the process, ensuring that everything is captured and categorized correctly.

Plus, it cuts down on the paperwork—no more piles of receipts or spreadsheets to sift through.

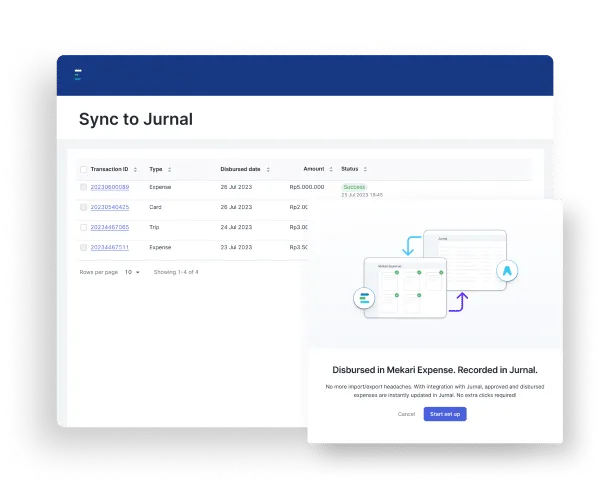

5. Integrates with accounting software for seamless financial management

Another advantage of expense reimbursement software is its ability to integrate seamlessly with accounting platforms.

This integration ensures that all reimbursed expenses are automatically updated in the company’s financial records, keeping everything aligned without additional manual work. No need for your finance team to manually enter the data again—it’s already done.

6. Enhances employee experience with mobile apps and faster reimbursements

Employee satisfaction matters, and expense reimbursement software makes submitting and tracking expenses much easier. With mobile apps, employees can submit receipts on the go, track the status of their reimbursements in real-time, and get paid faster.

The best expense management software

When it comes to simplifying the expense reimbursement process for businesses, Mekari Expense Reimbursement stands out as the best solution.

Mekari Expense is a spend management system designed to not only streamline the entire reimbursement process but also enhance transparency, ensure automated disbursement, and reduce the administrative burden on your team.

With features like automated data capture, real-time tracking, and seamless integration with accounting systems, Mekari Expense makes managing business expenses efficient and hassle-free—ultimately improving employee satisfaction and financial control.

Looking to optimize your expense reimbursement process? Explore Mekari Expense Reimbursement now!

References

Brex. ‘’The employer’s guide to employee expense reimbursement’’

Tipalti. ‘’Expense Reimbursement Guide: Overview and FAQs’’